Publishing Company's Stock Surges In Market Debut

Springer Nature's Market Debut: A Detailed Analysis.

Disclaimer: This article is intended for informational purposes only and does not contain any commercial or promotional content. The views expressed are based on publicly available information and are not intended to serve as financial advice.

The world of academic publishing experienced a noteworthy event with the market debut of Springer Nature on the Frankfurt Stock Exchange. As a renowned name in the publishing industry, Springer Nature's initial public offering (IPO) not only marked a pivotal moment for the company but also sent ripples across global equity markets.

The Role of Springer Nature in Publishing

Springer Nature stands as a giant in the academic and professional publishing arena. Known for its extensive portfolio that includes high-impact journals like "Nature" and "Scientific American," the publisher is integral to the dissemination of scientific knowledge worldwide. With its roots tracing back to 1842, Springer Nature has cultivated a reputation for advancing research and education across numerous disciplines.

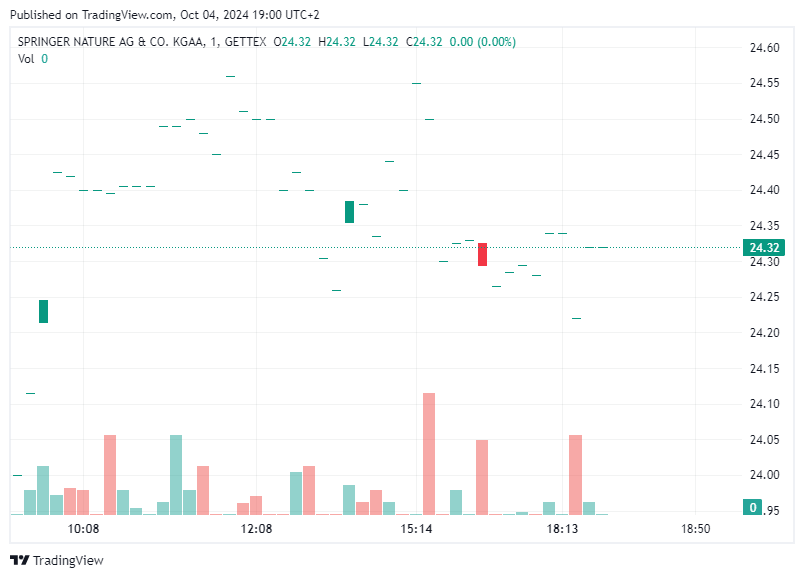

The company operates under the ownership of Holtzbrinck Publishing Group and BC Partners, holding 53% and 47%, respectively. This ownership structure has been crucial in steering the company's plans and operational decisions, including the recent move to go public. Springer Nature's IPO was a notable milestone, marking Europe's first major public offering since the summer. Priced at €22.50 per share, the IPO saw the company's shares rise by 8.2% on the first day of trading, closing at €24.24. This uptick valued the company at approximately €4.8 billion. The IPO involved the sale of €600 million in shares, providing the company with substantial capital to further its aims.

The decision by Holtzbrinck not to sell any of its shares during the IPO highlights its confidence in the long-term growth prospects of Springer Nature. This move also reflects a broader trend among major stakeholders to retain significant stakes in companies, particularly those with promising future trajectories.

Comparison with Recent European IPOs and Market Trends

Springer Nature's successful debut contrasts sharply with some other notable European IPOs earlier in the year. For instance, Spanish fashion company Puig Brands and beauty retailer Douglas experienced significant declines post-IPO, with shares falling by 18.3% and 24%, respectively. These cases highlight the volatile nature of the IPO market and the challenges companies face in maintaining investor confidence.

The broader IPO market has shown signs of recovery, buoyed by falling interest rates and a renewed investor appetite. The backlog of companies waiting to go public, due to market disruptions over the past two years, is indicative of the pent-up demand and optimism prevailing in equity markets. The successful IPO of Springer Nature has had a positive impact on market sentiment. It has reinforced confidence in the European IPO landscape, indicating that investor interest remains strong for companies with solid fundamentals and growth potential. The robust performance of Springer Nature's shares on debut day suggests that the market values its established presence and track record in the publishing industry.

This IPO has also set a precedent for other companies considering public offerings, particularly in sectors that have shown resilience despite economic uncertainties. The publishing industry, with its critical role in information dissemination, stands out as a sector that can attract substantial investor interest.

Repercussions for the Publishing Industry and Equity Markets

Springer Nature's journey to going public has not been without its hurdles. The company had initially planned an IPO in 2020 but postponed it due to the uncertainties brought about by the Covid-19 pandemic. This delay reflects the broader challenges companies faced during the pandemic, as market volatility and economic downturns forced many to reassess their strategies.

The decision to finally proceed with the IPO in 2023 aligns with a broader trend of companies capitalizing on improved market conditions and investor confidence. The timing also coincides with a resurgence in the IPO market, as businesses seek to leverage the favorable interest rate environment. The IPO of Springer Nature holds broader repercussions for the publishing industry. It highlights the value of established publishing houses that have successfully navigated the digital transformation and continued to expand their reach. In an era where digital content consumption is rapidly increasing, companies like Springer Nature are well-positioned to capitalize on these trends and drive innovation in content delivery.

For equity markets, the successful IPO signals a positive outlook for sectors that have adapted to changing market dynamics. It reflects the resilience of industries that have managed to maintain growth despite global challenges. This success could encourage more companies in similar sectors to explore public offerings as a means of raising capital and expanding their operations. The market debut of Springer Nature on the Frankfurt Stock Exchange is a testament to the company's robust market position and forward-thinking foresight. With a rich history and a strong portfolio of publications, Springer Nature is well-equipped to navigate the challenges and opportunities that lie ahead. The IPO not only enhances its financial standing but also positions it for future growth and expansion.

The successful IPO is likely to serve as a catalyst for further developments in the publishing sector, encouraging innovation and investment. As Springer Nature continues to build on its legacy, it remains a key player in shaping the future of academic publishing.

Disclaimer: The content of this article is for informational purposes only and should not be construed as financial advice. The article reflects publicly available information and does not include any commercial or promotional content.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net