Biopharmaceutical Company Secures $55 Million Licensing Deal For New Era Cancer Treatment

ABVC BioPharma's Historic Licensing Deal Signals a New Era in Cancer Treatment.

As an investor it's important to stay updated with major news. Get real-time stock market alerts, news, and research by creating an account here.

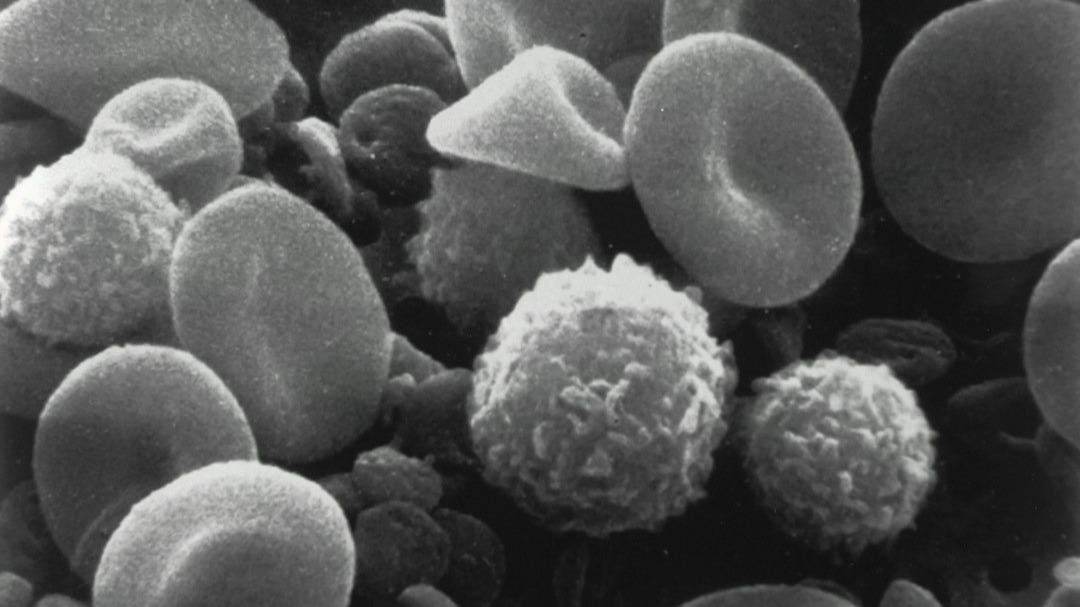

In an unprecedented move that marks a significant milestone in the fight against cancer, ABVC BioPharma has announced a global licensing agreement that is set to revolutionize oncology and hematology treatment landscapes. The company has entered into a term sheet with OncoX BioPharma, leveraging its innovative oncology/hematology products. This partnership not only forecasts a substantial financial windfall for ABVC BioPharma, with expectations of $55 million in licensing income plus up to $50 million in potential royalties but also signifies a leap forward in cancer therapeutics' accessibility and development.

What sets this deal apart is not just the financial boon it represents for ABVC BioPharma but the collaborative framework it establishes. OncoX BioPharma brings to the table its expertise in marketing dietary supplements, which it plans to leverage in the development and commercialization of the licensed products. This synergy between ABVC's innovative drug development and OncoX's commercial acumen promises to accelerate the availability of groundbreaking cancer treatments to patients worldwide. This partnership is a testament to the power of collaboration in driving scientific innovation, especially in fields as complex and challenging as oncology. ABVC BioPharma's decision to license its oncology/hematology products to OncoX BioPharma is not merely a business transaction; it is a strategic move towards creating a more robust, efficient, and accessible pathway for bringing new cancer therapies to market.

The significance of this deal cannot be overstated. It represents a beacon of hope for millions of cancer patients globally, promising access to the next generation of cancer treatments. Moreover, it underscores the importance of strategic partnerships in overcoming the barriers to drug development and commercialization, setting a precedent for future endeavors in the pharmaceutical industry. For stakeholders and observers alike, this licensing agreement is a clear indicator of ABVC BioPharma's commitment to innovation, growth, and, most importantly, patient care. As the company continues to navigate the complexities of drug development and commercialization, its partnership with OncoX BioPharma stands as a pivotal moment in its journey—a journey that could very well change the landscape of cancer treatment forever.

A global licensing deal is an agreement between two entities, where one (the licensor) grants the other (the licensee) the rights to market, sell, and distribute the licensor's products or technologies on a global scale. These deals are pivotal in industries like pharmaceuticals, where the development, approval, and commercialization of new treatments involve significant time, resources, and expertise. For ABVC BioPharma, securing such a deal for its oncology/hematology products represents a major strategic accomplishment with far-reaching implications.

The Impact

Financial Boost: The immediate financial implication of this deal for ABVC BioPharma is substantial, with $55 million expected in licensing income and the potential for up to $50 million in royalties. This influx of capital can significantly enhance the company's financial stability and fuel further research and development activities.

Strategic Growth: Beyond the financial aspect, the deal marks a strategic expansion of ABVC BioPharma's global footprint. It allows the company to leverage the licensee's distribution networks, regulatory expertise, and marketing capabilities, facilitating quicker access to international markets without the corresponding increase in operational complexities and costs.

Stock Performance: News of a successful global licensing deal often leads to positive investor sentiment, potentially boosting the stock price of the company involved. For $ABVC, the announcement could attract increased attention from investors, buoyed by the prospects of enhanced revenue streams and the company's strengthened position in the oncology/hematology market.

Investor Confidence: Investors are likely to view this deal as a vote of confidence in ABVC BioPharma's product pipeline and its management's ability to execute high-value strategic agreements. The anticipated financial gains and the potential for accelerated growth could make $ABVC a more attractive investment opportunity.

Enhanced Access to Treatments: Perhaps the most significant impact of this deal will be on patients suffering from cancer. The global licensing agreement means that ABVC BioPharma's oncology/hematology products could become available to a wider patient population around the world, potentially offering new, effective treatment options for those in need.

Speed to Market: Licensing deals can streamline the regulatory approval process in various jurisdictions, meaning that promising treatments can reach patients faster than if ABVC BioPharma were to undertake this process independently.

The global licensing deal secured by ABVC BioPharma for its cancer treatments is a multifaceted triumph. Financially, it promises a substantial boost to the company's revenue, supporting its continued innovation and development efforts. For investors, it could signal a promising opportunity, potentially enhancing stock value and confidence in the company's strategic direction. Most importantly, for patients battling cancer, this deal represents hope—faster access to potentially life-saving treatments across the globe. As we move through 2024, the effects of this deal will likely resonate across the pharmaceutical industry, setting a precedent for how innovative therapies can be brought to market efficiently and effectively.

For more information on this groundbreaking partnership, please visit Yahoo Finance's detailed report here. Note: All information presented is accurate and factual, based on the latest available data. The content provided aims to inform and engage readers, maintaining a neutral perspective while avoiding personal bias or unsupported claims.