Stock Region's Watchlist

Here Are THe Top 4 Stocks To Watch Today! Stock Region Weekly Newsletter

Watchlist: Friday, August 16th, 2024

Disclaimer: The information provided in this newsletter is for informational purposes only and should not be considered as financial advice. Please consult with a financial advisor before making investment decisions.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net

Real-time information is available daily at https://stockregion.net

Welcome to this week's edition of the Stock Region newsletter. In today's volatile market, staying informed can make all the difference. Our focus this week includes a diverse range of companies, each showing unique growth potential and strategic developments.

H&R Block ($HRB):

H&R Block has recently impressed investors with robust fourth-quarter earnings, posting an EPS of $1.89, surpassing market expectations. The company further strengthened investor confidence by announcing a 17% dividend increase and a substantial $1.5 billion share buyback. These moves have generated a positive buzz among investors. For those tracking stock movements, keep an eye on the short-term levels: an upside above $62.80 and a downside below $62.00.

Applied Materials ($AMAT):

Applied Materials continues to demonstrate strong financial health with record-breaking third-quarter revenues of $6.78 billion, a 5% increase year-over-year. The company's beat-and-raise earnings report has further solidified confidence in its growth trajectory. Investors should monitor the stock's short-term movements, with an upside potential above $207.69, while downside risks fall below $204.75.

Microchip Technology ($MCHP):

As Microchip Technology gears up for its annual shareholder meeting, expectations are high for strategic insights that could influence market perceptions. The semiconductor industry remains a hotbed of activity, and Microchip's stock has been closely watched amid recent market fluctuations. Key levels to watch in the short term are an upside above $83.37 and a downside below $81.30.

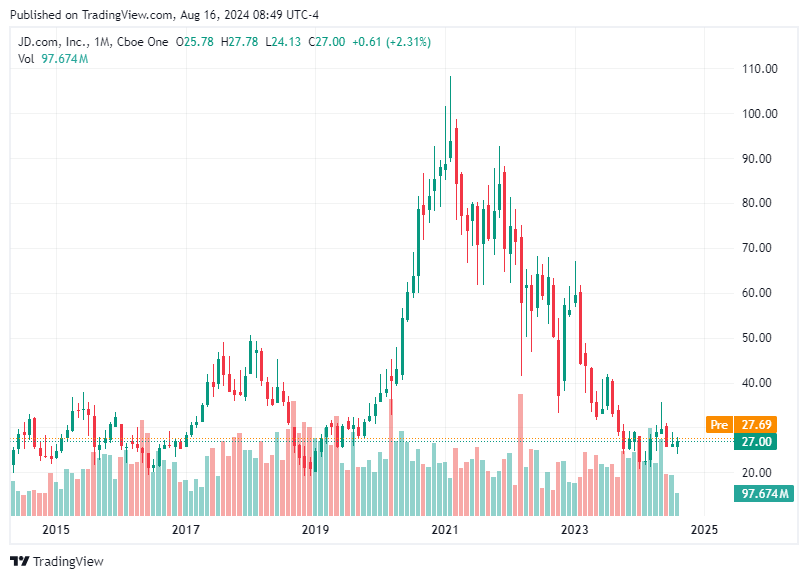

JD.com ($JD):

JD.com has caught the market's attention with a 6.5% expected rise in shares following a strong second-quarter earnings report. The company's operating margin for JD Retail has shown improvement over the previous year, underscoring its solid operational performance amidst challenging market conditions. Investors should pay attention to short-term levels: an upside above $27.90 and a downside below $27.00.

As always, these insights are designed to provide you with a snapshot of current market dynamics. We hope this information assists in making informed investment decisions. Stay tuned for more updates and insights in the next edition of the Stock Region newsletter.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net

Disclaimer: Investments are subject to market risks. Please conduct your own research or consult a financial advisor before making any investment decisions.