Stock Region Watchlist

Stock Region Watchlist Newsletter - Tuesday, February 18, 2025.

Stock Region Watchlist Newsletter - Tuesday, February 18, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice, investment recommendations, or an offer to buy or sell any securities. Please consult your financial advisor or conduct your own research before making investment decisions.

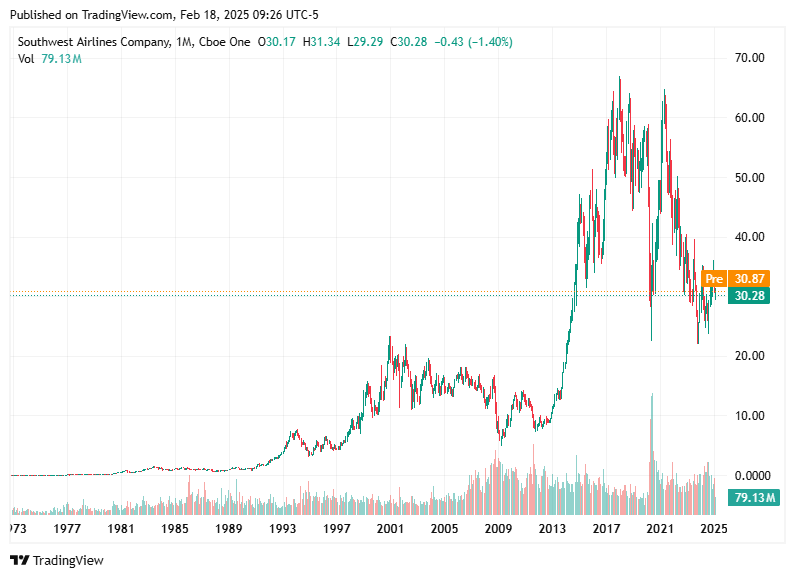

Southwest Airlines ($LUV)

Cost-Cutting Measures: Southwest Airlines has announced its first-ever mass layoff plan, reducing 15% of its corporate workforce, equivalent to 1,750 jobs. This move is part of a "transformational plan" aimed at boosting revenue, reducing costs, and increasing operational efficiency.

Investor Reaction: Following the announcement, shares of Southwest gained over 2% in premarket trading. The layoffs are viewed positively by investors as they aim to enhance profitability.

Future Savings: The layoffs are projected to save the company $210 million in 2025 and $300 million in 2026. However, the company will incur a one-time charge of $60–$80 million in Q1 2025.

Key Levels to Watch:

Upside: Above $31.00

Downside: Below $30.70

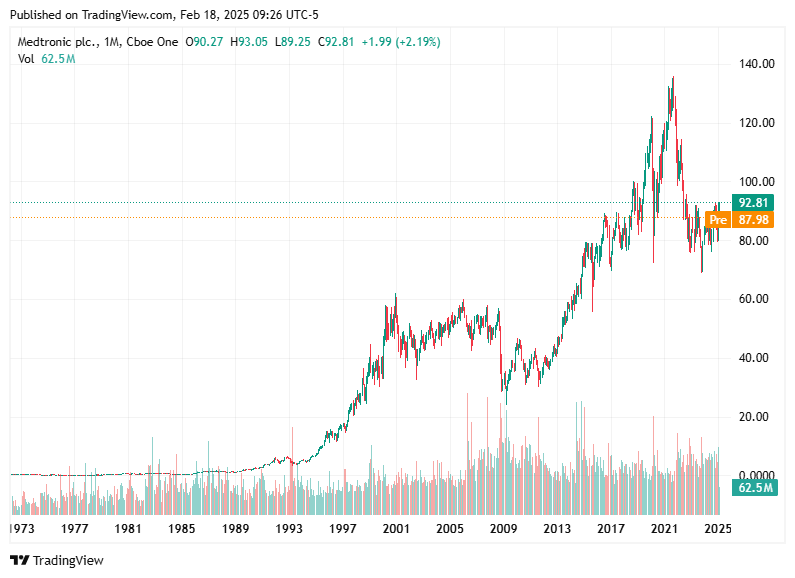

Medtronic ($MDT)

Strong Financial Outlook: Medtronic reaffirmed its fiscal 2025 guidance, with adjusted earnings projected between $5.44 and $5.50 per share. It also expects revenue growth in the range of 3.4% to 3.8%, with organic growth at 4.75% to 5.0%.

Analyst Confidence: Analysts remain confident that Medtronic will meet its targets, highlighting the company's financial stability.

Growth Acceleration: The company predicts high single-digit adjusted EPS growth in the second half of fiscal 2025, signaling strong momentum ahead.

Key Levels to Watch:

Upside: Above $92.81

Downside: Below $88.25

Snowflake ($SNOW)

Analyst Upgrade: Wolfe Research recently upgraded Snowflake to "Outperform," setting a price target of $235. This reflects optimism around improving core consumption trends and growing product momentum.

AI Growth Potential: Snowflake's investment in AI-based infrastructure has driven customer adoption of its solutions, potentially doubling its total addressable market to $342 billion by 2028.

Revenue Growth: The company's remaining performance obligations (RPO) rose 55% year-over-year, pointing to strong future revenue streams.

Key Levels to Watch:

Upside: Above $194.50

Downside: Below $190.57

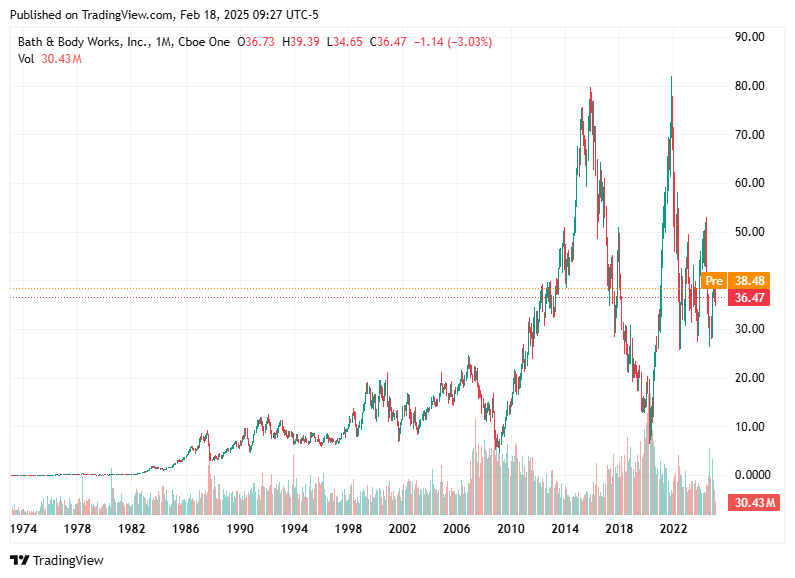

Bath & Body Works ($BBWI)

Upcoming Earnings Report: The company is set to release its Q4 and fiscal 2024 earnings results on February 27, 2025. These figures will shed light on its recent performance and future strategy.

Analyst Upgrade: JPMorgan upgraded Bath & Body Works to "Overweight" with a price target of $47. The move highlights growing optimism about the company’s growth trajectory.

Strong Brand Positioning: Bath & Body Works continues to dominate in personal care and home fragrance, driven by an agile and innovative supply chain that reinforces its competitive edge.

Key Levels to Watch:

Upside: Above $38.77

Downside: Below $36.24

Thank you for subscribing to Stock Region. Stay informed, stay savvy. See you next time!

Disclaimer: The content in this newsletter is based on publicly available information and is subject to change. Stock Region and its authors are not responsible for any financial losses. Always perform your due diligence before trading or investing.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net