Stock Region Watchlist

Watchlist: Analysis and Insights for October 2, 2024

Watchlist: Analysis and Insights for October 2, 2024

Disclaimer: The information contained in this article is intended for informational purposes only and should not be considered as financial advice. Readers are advised to conduct their own research or consult with a professional financial advisor before making any investment decisions.

In today's dynamic financial landscape, the performance of individual stocks can be influenced by a myriad of factors, ranging from company-specific developments to broader economic trends. This article analyzes three prominent companies—Humana, Nike, and JD.com—each facing unique challenges and opportunities. As we explore these stocks, we'll consider recent performance metrics, potential impacts of external factors, and specific price levels to monitor for short-term movements.

Humana ($HUM): Navigating Challenges in Healthcare

Performance and Challenges:

Humana, a leader in the healthcare industry, has recently faced significant headwinds, marked by a decline in Medicare Advantage enrollment. This downturn can be attributed to increasing competition and changing regulations, which have impacted the company's market share and financial stability. Compounding these challenges is a decrease in Medicare Star Ratings, which are crucial for evaluating the quality of service and patient care.

The star rating system is pivotal as it not only influences consumer choice but also the funding received from Medicare. A lower rating can lead to reduced bonuses and reimbursements, putting further financial strain on the company.

Opportunities and Strategic Considerations:

Despite these setbacks, there might be a silver lining for Humana. Investors with a long-term perspective may see this as a potential buying opportunity, particularly if they believe in the company's ability to enhance its ratings and regain its competitive edge. Strategic initiatives aimed at improving service quality, expanding healthcare offerings, and leveraging technological advancements could help in reversing the current trends.

Stock Levels to Watch:

Investors should keep an eye on key price levels for Humana's stock. In the short term, an upside is noted above $237.48, which could signal a recovery phase, whereas a downside below $216.50 might indicate continued challenges and warrant caution.

Nike ($NKE): Transition and Market Dynamics

Performance and Leadership Transition:

Nike's stock performance has been under pressure lately, primarily due to a notable drop in revenue. This decline has prompted the company to withdraw its full-year financial outlook, coinciding with a forthcoming CEO transition. Leadership changes in large corporations can generate uncertainty as strategic priorities and operational tactics might shift.

The global economic environment, including fluctuating consumer spending and supply chain disruptions, has also played a role in Nike's recent challenges. These factors have affected both sales volumes and profit margins, demanding a reassessment of market strategies.

Potential Pathways and Market Response:

As Nike navigates this transitional phase, the incoming leadership will play a crucial role in steering the company back to growth. Focus areas may include innovation in product lines, expansion in emerging markets, and sustainable practices, aligning with evolving consumer preferences.

For investors, monitoring the impact of these strategies on financial performance will be key. The ability of new leadership to execute a cohesive vision could restore confidence and potentially enhance stock value.

Stock Levels to Watch:

Nike's stock levels suggest closely watching movements above $84.82, indicating potential recovery and investor optimism, or below $82.64, which might prompt further scrutiny of the company's strategic direction.

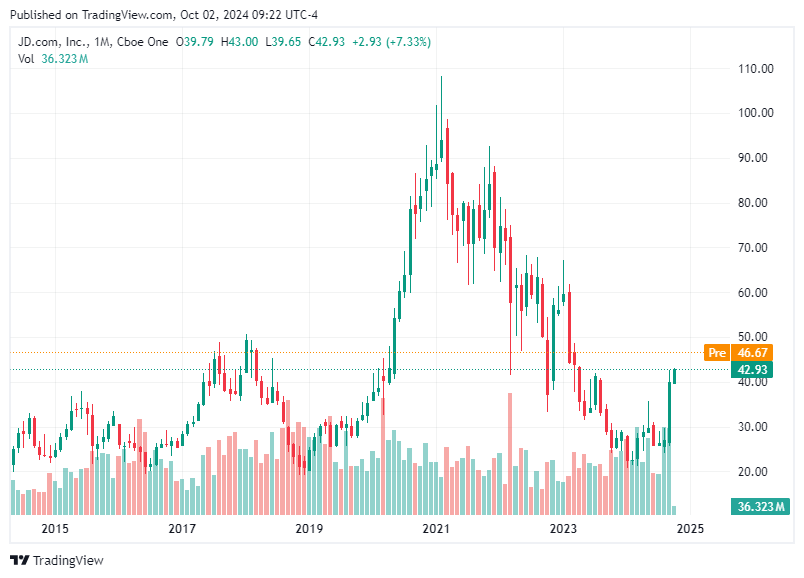

JD.com ($JD): Riding the Waves of Economic Trends

Performance and Economic Influences:

JD.com, a major player in the e-commerce sector, remains largely influenced by broader economic trends within China. While there is no specific news driving recent stock performance, the company's fortunes are closely tied to the health of the Chinese economy and consumer sentiment.

Factors such as government policies, shifts in consumer behavior, and technological advancements in the e-commerce landscape are critical determinants of JD.com's growth trajectory. A robust domestic economy can enhance consumer purchasing power, benefiting e-commerce giants like JD.com.

Strategic Focus and Growth Potential:

JD.com's strategic initiatives focus on enhancing logistics capabilities, expanding product offerings, and integrating cutting-edge technology to improve customer experience. These efforts are designed to not only capture market share but also ensure resilience against external economic fluctuations.

Investors should consider how effectively JD.com adapts to changing economic conditions and capitalizes on growth opportunities in both domestic and international markets.

Stock Levels to Watch:

For JD.com, key levels to monitor include an upside above $48.16, which could reflect positive economic signals and strong operational performance, or a downside below $46.68, suggesting potential vulnerabilities or economic slowdowns.

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. The reader is encouraged to perform independent research and consult a financial advisor before making any investment decisions.

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.