Stock Region Watchlist

Stock Region Watchlist Newsletter - Thursday, March 13, 2025.

Stock Region Watchlist Newsletter - Thursday, March 13, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Stock performance and financial market updates are subject to change. Readers are encouraged to conduct their own research or consult with a licensed financial advisor before making investment decisions.

Welcome to today’s Stock Region Watchlist! Here’s a roundup of the most recent developments and key insights on Intel ($INTC), Adobe ($ADBE), and American Eagle Outfitters ($AEO). Keep reading for updates on market movements and levels to watch.

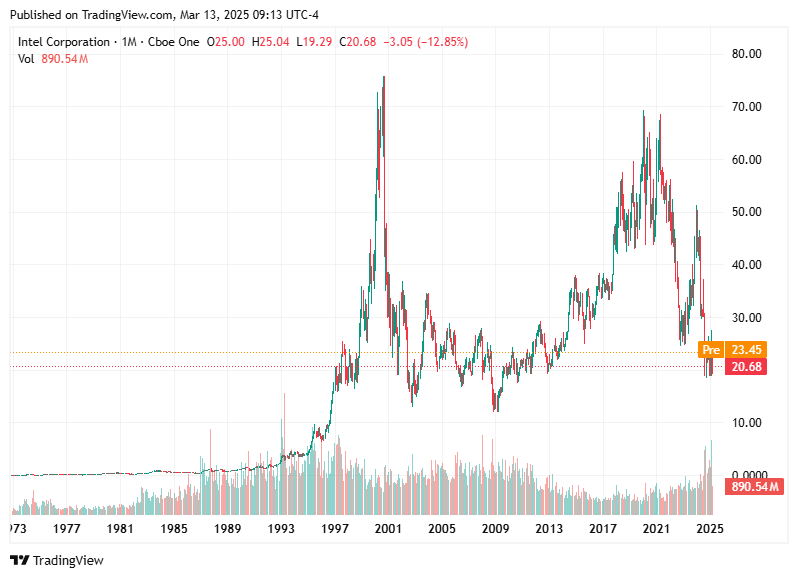

Intel ($INTC)

Key Updates:

New CEO Appointment: Intel has introduced Lip-Bu Tan as its new CEO. Known for his extensive experience in the industry, this leadership change has sparked discussions of potential strategic shifts. A reevaluation of the company’s foundry spinoff plans may be on the horizon.

Stock Performance: The market responded positively, with Intel's stock jumping by 12% in recent pre-market trading. Investors are showing optimism about the company’s new direction, particularly in the rapidly evolving AI sector.

Strategic Partnerships: Talks of joint ventures with industry giants like Nvidia and Broadcom are ongoing. Such partnerships could be instrumental in strengthening Intel's position in the competitive semiconductor sector.

Levels to Watch:

Upside Level: $23.22

Downside Level: $22.40

Intel’s leadership transition and collaborative potential make it one to watch closely in the short term.

Adobe ($ADBE)

Key Updates:

Strong Q1 Results: Adobe posted record revenues of $5.71 billion for Q1 2025, exceeding expectations. The company’s adjusted EPS was equally impressive at $5.08, further showcasing its strong financial performance.

AI Integration: Adobe continues to innovate with its AI-driven solutions, such as the Firefly models. This innovation has contributed $125 million in annualized recurring revenue, reinforcing Adobe's commitment to staying ahead in the digital creative space.

Mixed Outlook: Despite strong quarterly results, Adobe issued softer forward guidance, which led to a 5% drop in stock price. For long-term investors, this pullback may present an opportunity.

Levels to Watch:

Upside Level: $420.90

Downside Level: $405.92

Adobe's steady performance in AI-driven growth areas makes it an interesting option for patient investors looking for long-term value.

American Eagle Outfitters ($AEO)

Key Updates:

Earnings Beat: American Eagle beat Q1 EPS expectations, reporting $0.54 per share versus the forecasted $0.51. Revenue came in at $1.6 billion, matching analyst projections.

Dividend Yield: The stock stands out for its higher-than-average dividend yield of 4.37%, backed by 22 years of consistent dividend payments. This reliability adds to its appeal for income-focused portfolios.

Challenges and Opportunities: A 5% drop in stock price followed cautious forward guidance. However, investments in digital platforms and store remodels signal a focus on driving future growth.

Levels to Watch:

Upside Level: $10.90

Downside Level: $10.20

With its commitment to innovation and shareholder returns, AEO remains a valuable contender with growth potential.

Thank you for staying informed with Stock Region. We’ll be back with more updates to help you stay on top of market trends!

Disclaimer: The information provided here reflects the latest updates as of this newsletter's publishing date. The stock market carries risks, and past performance is not indicative of future results. Always make investment decisions based on thorough research and professional guidance.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net