Stock Region Watchlist

Stock Region Weekly Watchlist - Friday, April 11, 2025.

Stock Region Weekly Watchlist - Friday, April 11, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The information in this newsletter is for informational purposes only and should not be considered as financial advice. All investment decisions involve risk, and past performance does not guarantee future results. Please consult with a financial professional before making any investment decisions.

JPMorgan Chase (JPM)

Key Updates:

Record Trading Revenue: JPMorgan reported a 48% increase in stock trading revenue for Q1 2025, reaching a record $3.81 billion. This was largely driven by heightened market volatility.

Strong Earnings: The bank announced a 9% rise in quarterly profits, totaling $14.6 billion ($5.07 per share). These results exceeded analyst expectations, highlighting the company’s operational resilience.

Investment Banking Growth: Optimism surrounding pro-growth policies sparked a 12% increase in investment banking fees.

Dividend Increase: Reflecting its financial strength, JPMorgan has raised its common stock dividend, a move that may appeal to income-focused investors.

Levels to Watch:

Upside potential if prices move above $234.34

Downside risk if prices dip below $227.11

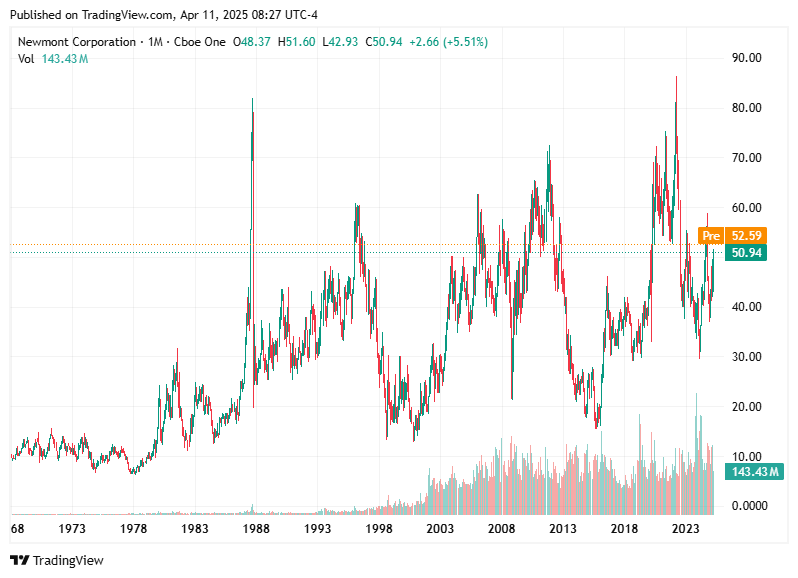

Newmont Corporation (NEM)

Key Updates:

Stock Price Surge: Newmont's stock increased by 4.59% this week, spurred by positive exploration results and strategic expansions.

Analyst Upgrades: Several analysts boosted their price targets for Newmont, citing robust trends in the gold market as a key factor.

Strategic Acquisitions: The company acquired options in Argentina to expand its gold and silver asset portfolio, strengthening its long-term growth prospects.

Favorable Market Conditions: Rising gold prices and geopolitical uncertainties have added to investor confidence in Newmont’s outlook.

Levels to Watch:

Upside potential if prices move above $52.91

Downside risk if prices fall below $51.40

Wells Fargo (WFC)

Key Updates:

No significant updates were reported for Wells Fargo. That said, the bank's performance often tracks broader financial sector trends, including interest rate shifts and overall economic conditions. Investors may want to stay tuned for upcoming earnings reports or strategic announcements.

Levels to Watch:

Upside potential if prices move above $64.69

Downside risk if prices drop below $62.52

Thank you for reading Stock Region’s Weekly Watchlist! Stay informed, stay confident, and happy investing.

Disclaimer: Stock Region is not responsible for any investment losses arising from the use of the information contained in this newsletter. Always conduct thorough research or consult a financial advisor before taking any action.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net