Stock Region Watchlist

Stock Region Watchlist Newsletter - Monday, February 3, 2025.

Stock Region Watchlist Newsletter - Monday, February 3, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The information in this newsletter is for educational purposes only and does not constitute financial advice. Always consult with a financial professional before making investment decisions.

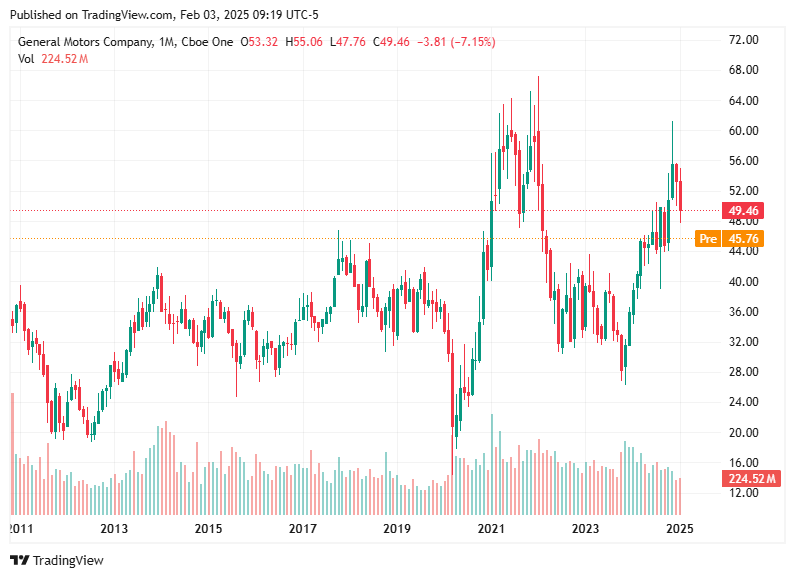

General Motors ($GM)

Strong Financial Performance: GM's Q4 2024 results impressed with revenues up 9% year-over-year to $187 billion and record earnings of $10.60 per share. Analysts have raised their earnings estimates for 2025.

EV Growth: Electric vehicle sales surged 50% in 2024, and GM aims to ramp up production to 300,000 units in 2025. The EV segment turned "variable profit positive" last quarter.

Valuation and Share Buybacks: Trading at a forward P/E ratio of 4.36, GM stands out for value investors. The company also completed a $10 billion share buyback program.

Institutional Confidence: Caprock Group LLC increased holdings by 26% in Q4 2024, signaling strong confidence.

Key Levels to Watch: Upside potential above $47.54; downside support at $45.41.

Constellation Brands ($STZ)

Dividend Announcement: The company declared a $1.01 per share dividend, payable on February 21, 2025, reflecting its dedication to shareholder value.

Tariff Headwinds: A 25% tariff on Mexican imports poses challenges, yet analysts highlight STZ's long-term resilience and strategic outlook.

Analyst Sentiment: Mixed views persist; Piper Sandler downgraded to "Neutral" with a $200 price target due to tariff risks, but optimism from other analysts balances the outlook.

Key Levels to Watch: Potential breakout above $174.00; support at $168.73.

Tyson Foods ($TSN)

Q1 2025 Strength: Revenue rose 2.3% to $13.62 billion, surpassing expectations. Adjusted EPS came in at $1.14, well above consensus estimates of $0.90.

Chicken Segment Success: The company's standout segment saw operating margins rise to 9.1%, marking the highest profit in two years.

Raised Guidance: Tyson upped its fiscal 2025 sales outlook, projecting flat to 1% growth versus previous guidance of flat to a slight decline. Operating income guidance also increased to $1.9–$2.3 billion.

Market Reaction: Shares climbed 4% premarket after the earnings beat and improved guidance.

Cost Efficiency: Lower feed costs and operational streamlining boosted profitability.

Key Levels to Watch: Support holds at $56.00.

Stay tuned for more updates next week as we continue to track market trends and insights!

Disclaimer: All investments carry risk. This newsletter does not endorse any specific investment or strategy. Readers are encouraged to perform their own research or consult with a licensed financial advisor.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net