Stock Region Watchlist

🚨 Stock Region Watchlist - Thursday, May 22, 2025.

🚨 Stock Region Watchlist - Thursday, May 22, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The content provided here is for informational purposes only and should not be considered financial advice. Always conduct your own research before making investment decisions.

Advance Auto Parts ($AAP)

Q1 2025 Results: The company exceeded expectations with $2.6 billion in net sales and adjusted losses of $0.22 per share.

Sales Growth: Eight weeks of U.S. Pro comparable sales growth and a completed store optimization plan reflect progress.

Stock Performance: Shares, despite being down 34% YTD, surged 20% in premarket trading.

Guidance Reaffirmed: Full-year projections of $8.4–$8.6 billion suggest stable growth potential.

Why Watch? Operational improvements and cost efficiencies position $AAP as a possible turnaround story. Keep an eye on levels at $42.42 (upside) and $31.50 (downside) in the short term.

Snowflake ($SNOW)

Impressive Q1 Results: $0.24 EPS beat estimates, with a 26% YoY revenue increase reaching $1 billion.

Growth Outlook: Product revenue guidance was raised to $4.325 billion, driven by strong demand.

AI Partnerships: Collaborations with OpenAI and Anthropic are deepening its influence in data analytics.

Stock Movement: Year-to-date shares are up 18%, with an 8% pop after Q1 results.

Why Watch? Snowflake’s advancements in AI-driven analytics and a growing customer base underline its leadership in the data economy. Watch levels of $197.90 (upside) and $191.50 (downside) closely.

Humana ($HUM)

Strong Q1 Performance: Robust revenue and net income growth, particularly in healthcare and Medicare services.

Revised Guidance: While the FY earnings projection is more cautious, ongoing investments in AI-driven healthcare show promise.

Stock Outlook: Flat YTD but analysts predict a potential rise of ~15.5% to $307.01.

Why Watch? Innovation in healthcare paired with consistent performance make $HUM worth watching. Key levels include $238.00 (upside) and $229.70 (downside).

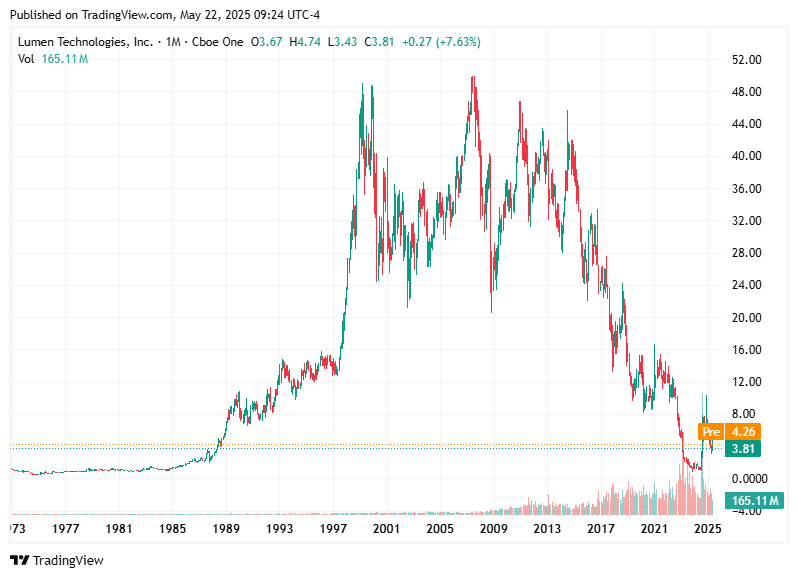

Lumen Technologies ($LUMN)

Strategic Shift: Selling its Mass Markets fiber-to-the-home unit for $5.75 billion to AT&T.

Debt Reduction: The $4.8 billion debt cut and annual interest savings of $300 million are key highlights.

Enterprise Focus: Investment in AI-driven infrastructure and multi-cloud solutions strengthens its position.

Stock Reaction: Shares jumped 14%, reclaiming some ground after this year’s earlier slump.

Why Watch? Lumen’s refinements in operations align with long-term enterprise growth strategies. Watch short-term levels at $4.31 (upside) and $4.15 (downside).

Summary

$AAP: Recovery potential amid operational improvements.

$SNOW: Continued growth with AI-driven analytics.

$HUM: Resilience in healthcare and steady growth projections.

$LUMN: Streamlined focus on enterprise services post-divestiture.

Stay vigilant and follow these stocks for potential opportunities!

Thank you for being part of Stock Region!

Disclaimer: The information in this newsletter is not a recommendation to buy, sell, or hold any security. Please consult a licensed financial advisor for tailored advice.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net