Stock Region Watchlist

Stock Region Watchlist Newsletter – Friday, January 24, 2025.

Stock Region Watchlist Newsletter – Friday, January 24, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The information in this newsletter is for informational purposes only and does not constitute financial advice. Please conduct your own research and due diligence before making any trading decisions.

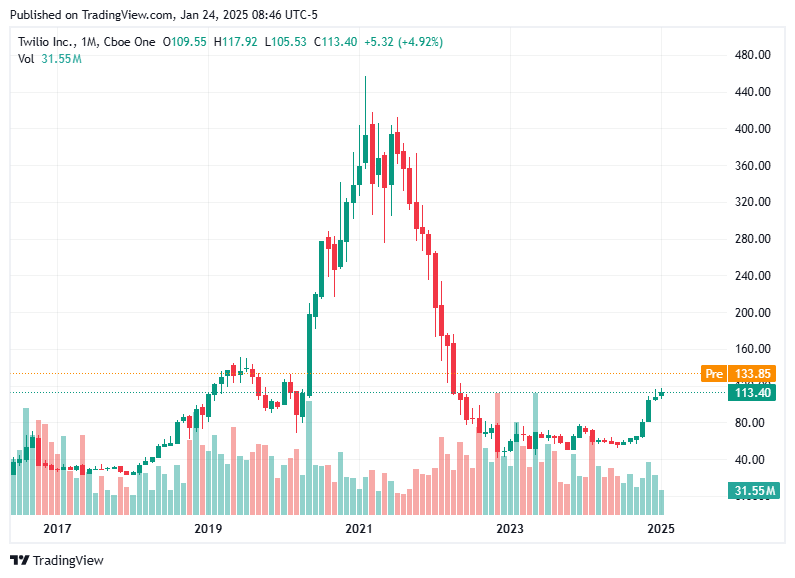

Twilio ($TWLO)

Twilio continues to gain positive momentum, with analysts at Wolfe Research increasing the price target from $140 to $150. Mizuho Securities also reiterated its Buy rating on the stock, reflecting sustained confidence in Twilio’s growth potential.

Key Levels to Watch:

Upside: Above $135.49

Downside: Below $130.75

Traders may find these levels pivotal in assessing Twilio's near-term movement amidst optimism in the tech sector.

Boeing ($BA)

Boeing pre-announced a larger-than-expected quarterly loss, forecasting a $4 billion deficit that exceeded analysts' expectations. Interestingly, despite the gloomy outlook, the stock saw modest gains, potentially influenced by preliminary fourth-quarter results that were better received.

Key Levels to Watch:

Upside: Above $176.55

Downside: Below $174.89

Observers should keep an eye on market reactions as more reports unfold regarding Boeing's performance and industry challenges.

Novo Nordisk ($NVO)

Shares of Novo Nordisk surged by 10% after reporting early-stage success for a new weight-loss drug, Amycretin. This breakthrough could significantly impact the medical and pharmaceutical markets, drawing increasing interest from investors.

Key Levels to Watch:

Upside: Above $92.97

Downside: Below $90.17

Investors may want to continue following developments around Amycretin, as this news could act as a catalyst for further price movement.

CSX ($CSX)

CSX reported mixed fourth-quarter results, with revenue slightly missing expectations. However, the total quarterly volume increased by 1% year-over-year, suggesting underlying growth in certain operations.

Key Levels to Watch:

Upside: Above $32.65

Downside: Below $32.24

CSX remains a stock to monitor, as the volume growth might signal resilience despite the revenue miss.

Please note that all the stocks listed come with their own risks and potential rewards. Make sure to base trading decisions on research and a clear understanding of your financial goals.

Disclaimer: This newsletter does not constitute financial advice. Always perform your due diligence before making any trades or investments.