Stock Region Watchlist

Stock Region Watchlist - Today’s Stock Insights (Wednesday, May 21, 2025).

Stock Region Watchlist - Today’s Stock Insights (Wednesday, May 21, 2025)

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The information below is for educational purposes only and does not constitute financial advice. Always consult with a professional before making investment decisions.

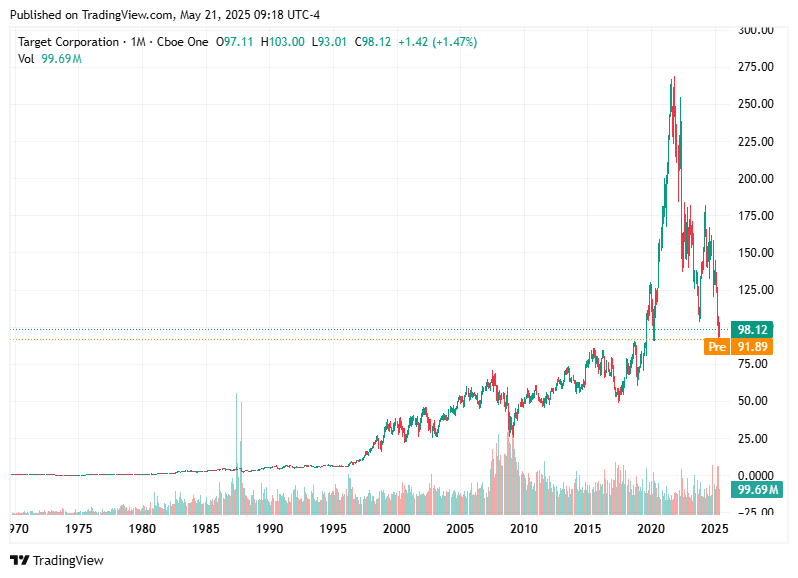

Target ($TGT)

Earnings Report: GAAP EPS rose to $2.27 from $2.03 last year, but adjusted EPS missed expectations at $1.30.

Digital Growth: E-commerce shone with 4.7% sales growth, and same-day delivery surged by 36%.

Challenges: Comparable sales declined 3.8%, and net sales dropped 2.8% year-over-year.

Strategic Moves: Target unveiled an “acceleration office” to promote quicker growth.

Key Levels: Watch for upside above $98.15 or downside below $88.76.

👉 Monitor Target’s performance and assess if its digital growth outweighs broader challenges.

Palo Alto Networks ($PANW)

Strong Earnings: Adjusted EPS hit $0.80, with revenue climbing 15% year-over-year to $2.29 billion.

Guidance: Optimistic Q4 forecast with EPS expected between $0.87 and $0.89.

Market Reaction: Despite the strong results, shares dipped 4% due to a slight gross margin miss.

Key Levels: Upside above $187.70 or downside below $185.28.

👉 Stay informed on cybersecurity trends and evaluate long-term buying opportunities.

Lowe’s ($LOW)

Earnings Insight: EPS dipped to $2.92 from $3.06 last year. Sales also felt a 1.7% decline, partly due to weather impacts.

Customer Loyalty: Ranked #1 in home improvement satisfaction by J.D. Power.

Full-Year Outlook: The 2025 sales forecast remains strong at $83.5–$84.5 billion.

Key Levels: Upside above $239.00 or downside below $231.11.

👉 Consider Lowe’s pullback as a potential value opportunity amid solid customer satisfaction and reaffirmed guidance.

UnitedHealth ($UNH)

Stock Hit: Shares fell 7% amid allegations of secret payments to nursing homes and a criminal probe into Medicare fraud.

Analyst Downgrade: HSBC downgraded the stock to “reduce” with a $270 price target.

Leadership Shakeup: CEO Andrew Witty’s sudden departure further adds uncertainty.

Key Levels: Upside above $317.12 or downside below $296.00.

👉 Assess risks as legal and leadership challenges shake investor confidence.

Thank you for trusting Stock Region with your market insights!

Disclaimer: The information provided in this newsletter is for educational purposes only. It is not a recommendation to buy or sell any securities. Always conduct your own research or seek advice from a certified financial advisor before making investment decisions.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net