Stock Region Watchlist

Stock Region Newsletter - Thursday, December 5, 2024.

Stock Region Watchlist Newsletter - Thursday, December 5, 2024

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only. It is not financial advice and should not be treated as such. Always consult with a financial professional before making investment decisions. Stock prices are subject to market risks, and past performance does not guarantee future results.

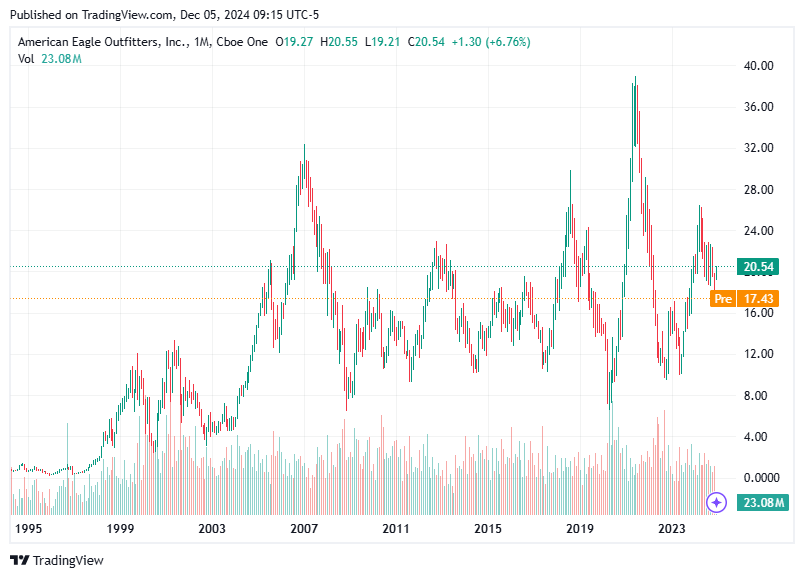

American Eagle Outfitters ($AEO)

Recent Developments: American Eagle has adjusted its annual sales growth forecast downward, which might weigh on investor sentiment. However, a silver lining comes from UBS Group, which has issued a "buy" rating for the stock. This indicates potential long-term growth despite the current revised outlook.

Key Levels to Watch (Short-Term):

Upside Target: $18.18

Downside Risk: $17.10

Five Below ($FIVE)

Positive Outlook: The discount retailer has delivered promising updates by raising its FY24 adjusted EPS and revenue outlook. These revisions signal strong financial health and could boost investor confidence. Five Below’s ability to stay on track with its expansion strategy makes it a stock worth keeping on your radar.

Key Levels to Watch (Short-Term):

Upside Target: $120.90

Downside Risk: $118.90

MicroStrategy ($MSTR)

Crypto Influence: MicroStrategy’s stock is in the spotlight following Bitcoin’s groundbreaking rise past $100,000. With over $41 billion in Bitcoin holdings, the company’s performance is heavily tied to crypto market trends. Investors are closely eyeing this crypto-driven stock for growth opportunities.

Key Levels to Watch (Short-Term):

Upside Target: $453.00

Downside Risk: $426.40

Disclaimer: The information provided herein reflects analysis based on publicly available data as of December 5, 2024. Stock Region does not endorse or guarantee the performance of any security discussed. Always perform your due diligence before making investment decisions.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net