Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Thursday, August 14, 2025 | Time: 8:00 PM ET.

Stock Region Market Briefing Newsletter - Thursday, August 14, 2025 | Time: 8:00 PM ET

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making investment decisions. Stock markets are inherently volatile, and past performance is not indicative of future results.

Market Recap: A Day of Resilience Amid Mixed Signals

The stock market showed remarkable resilience today, despite a rocky start following the release of the July Producer Price Index (PPI). The S&P 500 eked out a slight gain of 0.03%, closing at a record high of 6,468.54. However, the Russell 2000 and S&P Mid Cap 400 took a hit, each down 1.2%, as investors reassessed their positions in light of rising market rates and a tempered policy outlook.

The Federal Reserve's September rate cut remains highly likely, with a 92.6% probability of a 25 basis-point cut. However, the PPI report has thrown cold water on hopes for a more aggressive 50 basis-point cut. The bond market reacted accordingly, with the 10-year Treasury yield climbing to 4.29%.

Earnings Highlights: Winners and Losers

Winners:

KULR Technology Group (NYSE American: KULR): Up 15.9% after reporting strong Q2 results. The company continues to innovate in high-performance energy systems and AI robotics.

Blaize Holdings (NASDAQ: BZAI): Up 7.4%, marking a pivotal shift from technology validation to execution in edge AI computing.

Losers:

Applied Materials (NASDAQ: AMAT): Down 12% after issuing disappointing Q4 guidance. The semiconductor giant cited macroeconomic uncertainty and challenges in its China business.

Gambling.com Group (NASDAQ: GAMB): Down 10.4% despite beating revenue expectations, as investors reacted cautiously to its acquisition of Spotlight.Vegas.

Corporate Updates: Key Developments to Watch

TMC The Metals Company (NASDAQ: TMC): Reported Q2 results, highlighting its progress in developing critical metals for energy and infrastructure. With shares at $5.41 (-0.03), TMC remains a speculative play for those bullish on the green energy transition.

Hesai Group (NASDAQ: HSAI): Announced a lidar design win with Toyota (NYSE: TM) for its new energy model, set for mass production in 2026. Shares closed at $23.32 (+0.02).

Nu Holdings (NYSE: NU): Reported Q2 results, with shares dipping to $12.01 (-0.37). As one of the largest digital financial platforms, Nu's growth trajectory in Latin America remains a long-term story.

Growth Stocks to Watch

Hesai Group (HSAI): With its lidar technology gaining traction in the automotive sector, Hesai is a compelling growth story in the EV and autonomous vehicle space.

KULR Technology Group (KULR): A leader in energy systems and AI robotics, KULR is well-positioned to capitalize on the growing demand for high-performance technologies.

Blaize Holdings (BZAI): As edge AI computing becomes increasingly critical, Blaize's focus on energy-efficient solutions makes it a stock to watch.

Array Technologies (NASDAQ: ARRY): The recent acquisition of APA Solar strengthens its position in renewable energy infrastructure.

Sector Spotlight: Semiconductors Under Pressure

The semiconductor sector faced headwinds today, with Applied Materials (AMAT), KLA Corporation (KLAC), and Lam Research (LRCX) all posting significant losses. Despite short-term challenges, the long-term growth potential of the semiconductor industry remains intact, driven by advancements in AI, 5G, and IoT.

The stock market is navigating a delicate balance between optimism over a potential rate cut and concerns about inflationary pressures. While the S&P 500 continues to hit record highs, the broader market's performance suggests caution. Investors should brace for increased volatility as we approach the Federal Reserve's September meeting.

Today’s market action underscores the importance of staying informed and adaptable. While growth stocks like Hesai and KULR offer exciting opportunities, the broader market's mixed signals call for a balanced approach. Keep an eye on macroeconomic indicators and sector-specific trends to navigate these uncertain times.

Market Highlights: Tesla's Call Options Surge and Geopolitical Tensions

Tesla's Call Options Skyrocket 120%

Tesla ($TSLA) continues to electrify the market, with Stock Region's trading alert reporting a jaw-dropping 120% surge in call options. This remarkable performance underscores Tesla's dominance in the EV space and its ability to capture investor enthusiasm. With a market cap of $1.2 trillion and a P/E ratio of 75, Tesla remains a growth stock to watch. The company's recent advancements in battery technology and expansion into new markets are fueling optimism.

Growth Stocks to Watch:

Rivian ($RIVN): Tesla's younger competitor, Rivian, is gaining traction with its innovative electric trucks and SUVs.

ChargePoint ($CHPT): As EV adoption grows, charging infrastructure companies like ChargePoint are poised for long-term growth.

Geopolitical Developments: Russia-Ukraine Conflict and the Putin-Trump Summit

The Russia-Ukraine conflict continues to dominate headlines, with Russian forces advancing near Dobropillia. The upcoming Putin-Trump summit is expected to be a high-stakes event, with discussions likely to impact global markets. President Trump's cryptic comments about "ocean-front property" have raised concerns about potential territorial concessions.

Market Impact:

Geopolitical tensions often lead to market volatility. Defense stocks like Lockheed Martin ($LMT) and Raytheon Technologies ($RTX) could see increased interest as nations bolster their military capabilities.

Economic Update: Wholesale Prices Surge in July

The producer price index (PPI) rose 0.9% in July, far exceeding the 0.2% consensus estimate. This unexpected surge in wholesale prices could signal inflationary pressures, potentially influencing Federal Reserve policy.

Opinion:

While inflation remains a concern, it also presents opportunities in sectors like commodities and energy. Companies like ExxonMobil ($XOM) and Freeport-McMoRan ($FCX) could benefit from rising prices.

Tech and Innovation: AI, Space, and Beyond

NASA & Google Test AI "Space Doctor"

NASA and Google have unveiled CMO-DA, an AI-powered "space doctor" designed to provide medical assistance to astronauts in deep space. This groundbreaking technology could revolutionize healthcare both off-planet and on Earth.

Growth Stocks to Watch:

Alphabet ($GOOGL): Google's Vertex AI is at the forefront of this innovation, showcasing the company's leadership in AI.

Intuitive Surgical ($ISRG): A leader in robotic surgery, Intuitive Surgical could benefit from advancements in AI-driven healthcare.

Meta AI Controversy

Meta's ($META) leaked AI guidelines have sparked ethical debates, but the company's focus on AI innovation remains a key growth driver. With a market cap of $850 billion, Meta's investments in the metaverse and AI could pay off in the long run.

Breaking News: Business and Market Updates

Bitcoin Hits Record High: Bitcoin ($BTC) has surged past $124,000, reflecting growing investor confidence in digital assets.

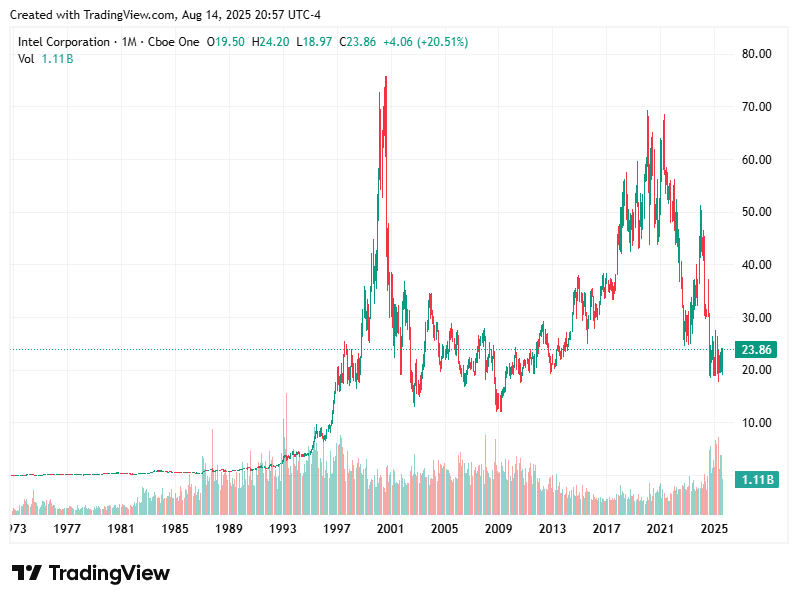

Intel Stock Surges: Intel ($INTC) shares jumped on reports of potential U.S. government investment in domestic semiconductor production.

Berkshire Hathaway's Moves: Warren Buffett's Berkshire Hathaway ($BRK.A) revealed new stakes in UnitedHealth ($UNH), D.R. Horton ($DHI), and Lennar ($LEN), while trimming positions in Apple ($AAPL) and Bank of America ($BAC).

Opinion:

Buffett's moves highlight a shift toward healthcare and housing, sectors that could offer stability amid market uncertainty.

Overall Stock Market Forecast

The stock market is navigating a complex landscape of geopolitical tensions, inflationary pressures, and technological advancements. While volatility is expected to persist, growth opportunities abound in sectors like EVs, AI, and healthcare.

Bullish Sectors:

Technology: Companies like Nvidia ($NVDA) and AMD ($AMD) are leading the AI revolution.

Healthcare: With an aging population, healthcare stocks like UnitedHealth ($UNH) and Johnson & Johnson ($JNJ) remain strong bets.

Renewable Energy: The transition to clean energy is accelerating, benefiting stocks like NextEra Energy ($NEE) and Enphase Energy ($ENPH).

Bearish Sectors:

Retail: Rising inflation could dampen consumer spending, impacting companies like Macy's ($M) and Kohl's ($KSS).

Travel: Geopolitical tensions and economic uncertainty may weigh on travel stocks like Delta Air Lines ($DAL) and Carnival ($CCL).

Stay Informed, Stay Ahead

Thank you for reading this edition of the Stock Region Market Briefing Newsletter. Have questions or want to share your thoughts? Reply to this email or join the conversation on our platform.

Until next time, happy trading!

Disclaimer: This newsletter is not a recommendation to buy or sell any securities. Stock Region and its affiliates are not responsible for any investment decisions made based on this information. Always conduct your own research or consult a financial advisor.