Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Thursday, January 16, 2025.

Stock Region Market Briefing Newsletter - Thursday, January 16, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The following newsletter is for informational purposes only and should not be considered financial advice. Investors should perform due diligence and seek advice from licensed financial advisors before making any investment decisions.

Market Snapshot

Recent developments across industries, geopolitical events, and economic trends are shaping the investment landscape. Here's a breakdown of the latest headlines and key updates to keep investors informed.

Major Headlines & Highlights

Amazon Strengthens Financial Services with Axio Acquisition (AMZN)

Amazon ($AMZN) has acquired Indian fintech startup Axio for over $150 million, targeting India’s growing demand for buy-now, pay-later services. With a $260 million loan book serving over 10 million customers, this acquisition underscores Amazon's $10 billion investment in India, aiming to deepen its foothold in financial services.

Growth Stock to Watch: Paytm ($PAYTM.NS) – India's leading digital payments company harnessing opportunities in the financial services sector.

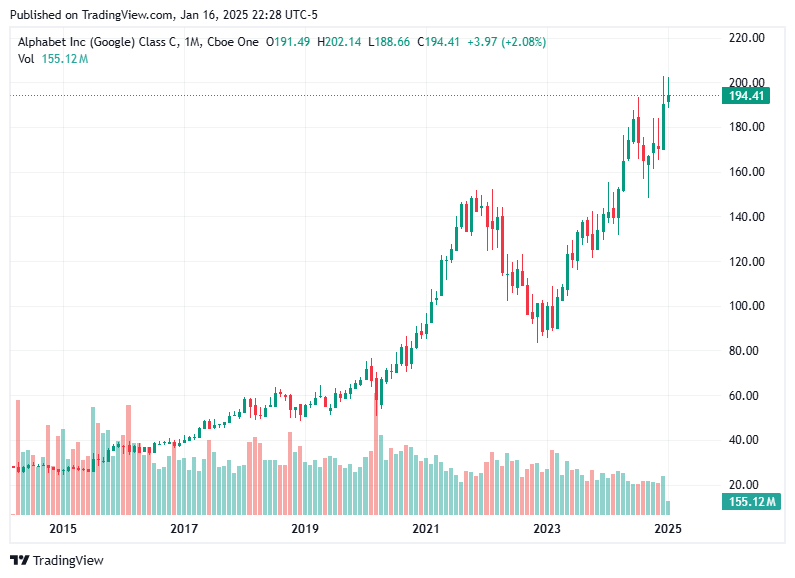

Google’s Landmark Biochar Deal with Varaha (GOOGL)

Google ($GOOGL) inked a revolutionary deal with Indian startup Varaha, purchasing 100,000 tons of carbon removal credits by 2030. The initiative reinforces Google's commitment to net-zero emissions and scalable carbon mitigation technologies.

Growth Stock to Watch: Aker Carbon Capture ($AKCCF) – Positioned in the growing carbon removal and biochar-based technologies market.

Blue Origin’s New Glenn Rocket Reaches Orbit

Blue Origin, under Jeff Bezos, launched its flagship New Glenn rocket. Although a booster malfunction occurred, plans for future launches aim to disrupt the satellite deployment arena and rival SpaceX.

Growth Stock to Watch: Lockheed Martin ($LMT) – Leading aerospace and satellite technologies player.

Bank of America Posts Strong Results (BAC)

Bank of America ($BAC) topped analyst expectations with a 47% YoY profit increase in Q4, boosted by investment banking revenues and net interest income. Shares rose 2.1% post-announcement.

Competitor Corner: Goldman Sachs ($GS) – Potential outperformance fueled by recovering M&A activity.

BP Plans to Slash Jobs and Cut Costs (BP)

BP ($BP) will reduce its workforce by 4,700 roles to streamline operations. This follows a challenging year where its performance trailed competitors like Shell ($SHEL), representing a pragmatic strategy for competitiveness.UK Inflation Eases to 2.5%

The UK’s inflation rate surprised economists by dropping to 2.5%, alleviating pressures on policymakers. Potential rate stabilization may create opportunities in consumer-focused equities.

Growth Stock to Watch: Tesco ($TSCO.L) – Poised to capture demand as inflation eases.

Symbotic and Walmart Broaden Robotics Partnership

Symbotic ($SYM) signed a $550 million deal with Walmart ($WMT) to enhance their automation ecosystem. The collaboration solidifies Symbotic’s dominance, mirroring Amazon's ($AMZN) Kiva Systems acquisition and reshaping Walmart's distribution efficiency.eToro Confidentially Files for $5B IPO

eToro, targeting a U.S. IPO, expects a valuation exceeding $5 billion. The fintech company’s expansion highlights rising investor interest in trading platforms.

Competitor Spotlight: Robinhood ($HOOD) – Continues scaling its user base despite market fluctuations.

Nvidia’s Advances in AI Safety Tools (NVDA)

Nvidia ($NVDA) launched enterprise-grade AI control features to address security concerns. Despite slower initial adoption, these innovations may unlock a growth wave in enterprise AI.Mortgage Rates Climb Beyond 7%

The rate hike creates headwinds for potential homebuyers, further limiting housing affordability. This trend benefits real estate investment trusts (REITs) focused on rental properties.

Growth Stock to Watch: AvalonBay Communities ($AVB) – REIT enjoying strong rental growth amid declining homeownership.

SpaceX Struggles with Starship Test but Scores Booster Catch Success

SpaceX achieved a major technical milestone in booster recovery while addressing issues with its Starship system. This dual narrative highlights ongoing innovation challenges.

Related Growth Stock: Maxar Technologies ($MAXR) – A satellite-focused player aligned with Mars and lunar missions.

China’s 5% GDP Growth in 2024

China exceeded expectations in 2024, buoyed by factory output and retail sales. However, lagging fixed-asset investments underscore structural challenges.

Growth Stock to Watch: Alibaba ($BABA) – Positioned to benefit from renewed consumer demand domestically.

Noteworthy Regulatory Updates & Global Outlook

American Express Faces $230M Fine (AXP)

American Express ($AXP) grapples with reputational fallout following regulatory sanctions for deceptive practices. Investors will watch closely for long-term profit margin stability.FTC Imposes Data Sale Ban on GM (GM)

General Motors’ ($GM) unauthorized data sales led to regulatory restrictions. Panasonic ($PCRFY) and other mobility technology partners may benefit indirectly from stricter data handling compliance requirements.Gold Prices Steady on Fed Rate Speculation

Gold prices ($XAU) remain stable as Fed signals potential rate reductions. Investors regard gold as a safe-haven asset to diversify portfolios.

Growth Stock: Newmont Corporation ($NEM) – A mining leader likely to benefit from sustained gold demand.

Broader Market Forecast

The first quarter of 2025 is expected to bring mixed trends. Global inflation cooling, combined with Fed expectations to cut rates, could provide a boost. However, persistently high mortgage rates and geopolitical headwinds may weigh on equities:

Technology Sector (Bullish): With innovations in AI and carbon removal, companies like Alphabet ($GOOGL) and Nvidia ($NVDA) are poised for gains.

Energy Sector (Mixed): Supply disruptions could bolster oil ($WTI) prices, but stricter energy regulations present challenges for traditional players like BP ($BP).

Financials (Positive): Banks like Bank of America ($BAC) are capitalizing on strong rate conditions, supported by a buoyant M&A environment.

Consumer Discretionary (Cautiously Optimistic): Inflation relief offers opportunities for retail players like Walmart ($WMT) and Amazon ($AMZN).

Short-term volatility will likely persist, but growth opportunities remain compelling for disciplined investors. Strategic positioning in renewable energies, AI, and consumer categories could yield advantages.

Market Close Recap

The stock market closed on a mixed note today, reflecting investor caution amid significant earnings reports and economic data. While the Dow Jones Industrial Average (-0.2%) and S&P 500 (-0.2%) remained relatively unchanged, the Nasdaq Composite dragged lower by 0.9%, hampered by losses in key technology stocks like Apple ($AAPL), NVIDIA ($NVDA), and Tesla ($TSLA). Interestingly, the Russell 2000 eked out a small gain of 0.2%, underscoring some resilience in smaller-cap stocks.

Treasury yields declined following comments from Federal Reserve Governor Christopher Waller hinting at potential rate cuts later this year. The 10-year yield settled at 4.61% (down five basis points), while the 2-year yield dropped to 4.24%. The overall market sentiment struggled to find direction, with influential sectors like technology and consumer discretionary underperforming.

Key Performance Highlights for Major Indices:

S&P 500: +1.0% Year-to-Date (YTD)

Nasdaq Composite: +0.1% YTD

Dow Jones Industrial Average: +1.4% YTD

Russell 2000: +1.6% YTD

S&P Midcap 400: +3.4% YTD

Earnings Reports & Corporate Announcements

WaFd, Inc. ($WAFD)

WaFd missed earnings and revenue expectations, reporting Q1 earnings of $0.54 per share (FactSet Consensus: $0.65). Revenues rose 2.8% year-over-year to $171.13 million, falling short of the $187.37 million consensus.Western Digital ($WDC)

The company updated preliminary Q2 guidance, projecting revenues to reach the midpoint of its $4.20 billion–$4.40 billion range. However, earnings per share are likely to hit the lower end due to challenges in flash pricing.Bank OZK ($OZK)

The bank exceeded expectations, delivering Q4 EPS of $1.56 (FactSet Consensus: $1.44) and revenue growth of 1.2% YoY, reaching $412.34 million.Rivian Automotive ($RIVN)

Rivian secured a historic $6.6 billion loan from the U.S. Department of Energy for its Stanton Springs North manufacturing plant. These funds will support EV production, creating an estimated 7,500 jobs by 2028.

Sector Watch: Look for upward momentum in EV-related stocks like Tesla ($TSLA) and Lucid Motors ($LCID) as federal support for clean energy grows.

Plug Power ($PLUG)

Plug Power closed a $1.66 billion loan guarantee, aiding hydrogen plant construction. This aligns with the U.S. government's push for hydrogen energy.Telix Pharmaceuticals ($TLX)

Telix gained regulatory approval for Illuccix, its prostate cancer imaging agent, in Europe. The company is transitioning to facilitate commercial launches across EU nations.General Electric ($GEO)

GEO faced a legal setback as the Ninth Circuit upheld a ruling regarding its work programs. The company plans to pursue further appeals.Con Edison ($ED)

Announced an increase in its quarterly dividend to $0.85 per share, reflecting confidence in stable cash flows.Valero Energy ($VLO)

Valero increased its quarterly dividend payout to $1.13, up from $1.07, signaling robust confidence in profitability amidst rising oil prices.National Vision ($EYE)

Issued upbeat Q4 revenue guidance, projecting $437 million (FactSet Consensus: $432.83M). CFO Melissa Rasmussen announced her departure, effective February 26.Otis Worldwide ($OTIS)

The company authorized a $2 billion share repurchase program, reflecting its strategy to return value to shareholders.Qiagen ($QGEN)

Advanced its $300 million synthetic share repurchase plan as part of its strategy to return $1 billion to shareholders by 2028.BlackSky Technology ($BKSY)

Selected as one of the vendors for a $200 million National Geospatial-Intelligence Agency contract. This development reinforces BlackSky's role in GEOINT-driven AI capabilities.

Economic Data Highlights

Retail Sales (December): Rose 0.4%, reflecting moderated consumer spending compared to prior adjustments (+0.8%). Consumer demand remains resilient.

Weekly Jobless Claims: Initial jobs data at 217K, steady compared to prior trends, signaling continued labor market strength.

January Philly Fed Index: Surged to 44.3 from -16.4, significantly above consensus (-6.0). Manufacturers reported robust activity.

Treasury Yields Decline: Driven by Fed rate cut expectations, the yield curves are likely to influence sectors sensitive to rate movements (e.g., financials and REITs).

Sector Trends & Market Insights

Technology and AI

The Nasdaq’s underperformance reflects profit-taking in high-valuation technology stocks. Despite challenges, advancements in AI safety, including Nvidia's ($NVDA) NeMo Guardrails, point to long-term opportunities.

Energy Sector

Energy stocks retained their momentum on dividend announcements by companies like Valero ($VLO) and regulatory incentives for clean energy projects like Plug Power’s ($PLUG) hydrogen plants.

Electric Vehicles

EV investments, such as Rivian's factory funding, demonstrate sustained government and investor interest. Rivian ($RIVN) remains a growth focus amid its new SUV and crossover launches.

Real Estate

Rising mortgage rates above 7% have dampened housing affordability, which may bode well for rental-focused REITs such as AvalonBay ($AVB) and Equity Residential ($EQR).

Financials

Performance reflected mixed outcomes, with Bank OZK ($OZK) outshining peers like WaFd ($WAFD). Expectations of rate cuts could shape the sector outlook for 2025.

Market Outlook for January 17, 2025

Market participants will pay close attention to data releases tomorrow, including housing starts (expected at 1.318M) and industrial production (consensus at a 0.3% increase). These indicators will help shape market sentiment around economic growth and Federal Reserve policy decisions.

While the S&P 500 struggles to regain technical support at its 50-day moving average, there are pockets of resilience in utilities (+2.6%) and small-cap stocks. Investors should focus on sectors poised for growth in an evolving economic environment, such as renewable energy, AI, and EV manufacturing.

Prepared by Stock Region Editorial Team

Happy Investing,

Stock Region Editorial Team

Disclaimer: Investing in equities involves risks, including possible loss of principal investment. Past performance does not guarantee future returns. This briefing is for educational purposes and should not substitute professional guidance. Always consult a licensed financial expert before investing.