Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Monday, April 28, 2025

Stock Region Market Briefing Newsletter - Monday, April 28, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Please conduct your research and consult with a financial advisor before making investment decisions.

Market Snapshot: A Choppy Yet Resilient Day

The stock market displayed mixed momentum today, closing with fractional gains in two major indices while the Nasdaq Composite lagged slightly. Here's how the benchmarks performed:

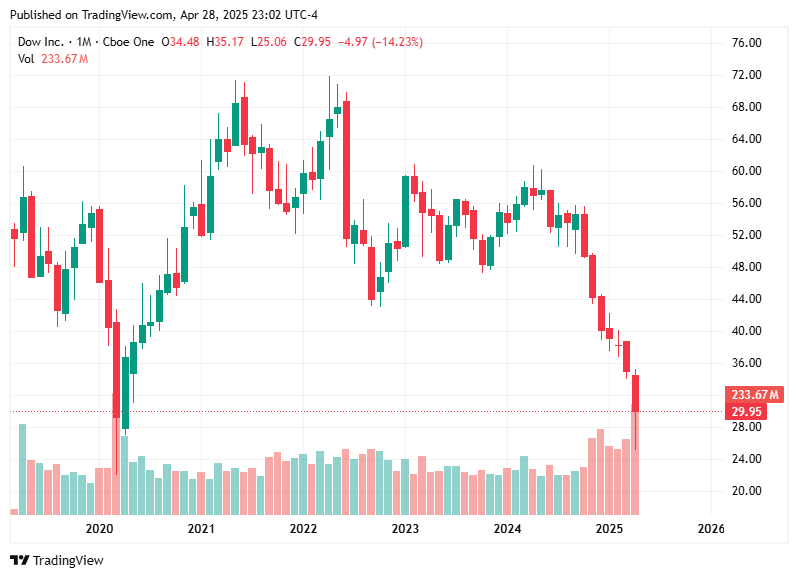

Dow Jones Industrial Average: +100 points (+0.3%), now -5.5% YTD

S&P 500: Fractional rise, now -6.0% YTD

Nasdaq Composite: Ended lower, down -10.1% YTD

Rate-sensitive sectors like Utilities (+0.7%) and Real Estate (+0.7%) led the gains, while Technology (-0.3%) trailed, reflecting caution around mega caps like Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN).

The bond market also exhibited strength, with the 10-year Treasury yield easing to 4.22%, and the 2-year yield closing lower at 3.68%.

With a busy week ahead, including reports from over 160 S&P 500 companies, investors embraced a “wait-and-see” attitude.

Key Company Highlights

Riot Platforms (RIOT)

Price: $7.63 (-$0.14)

Big Move: Acquired Rhodium Assets at the Rockdale Facility, adding 125 MW to its power capacity. This move terminates unprofitable legacy contracts and expands Riot’s fully owned operations at the site.

Reason to Watch: Riot continues to strengthen its position in the cryptocurrency mining space amid ongoing sector volatility.

Evolv Technology (EVLV)

Price: $4.17 (+$0.28)

Update: Completed a financial restatement alongside releasing Q3, Q4, and FY 2024 results. The stability post-restatement improves investor confidence in its long-term prospects within security technology.

Uptrend: Solid 7.2% increase today, signaling optimism.

CVR Energy (CVI)

Price: $18.71 (+$0.30)

Financial Highlights:

EPS beat by $0.31 at -$0.58/share.

Revenue totaled $1.65 billion (-11.6% YoY), outperforming FactSet estimates.

Insights: Despite forgoing dividends, the long-term outlook stabilizes with continued cost discipline and asset distributions from CVR Partners.

Waste Management (WM)

Price: $229.08 (+$0.36)

Results:

EPS rose to $1.67/share, beating expectations by $0.08.

Revenue climbed +16.7% YoY to $6.02 billion.

Growth Potential: A resilient business model, coupled with strong Q1 results, positions WM to meet its 2025 guidance confidently.

Atomera (ATOM)

Price: $4.14 (-$0.12)

Development:

Announced a strategic agreement with a global chip-fabrication leader for next-gen technology applications, including AI and 5G. This partnership could address semiconductor industry inefficiencies.

Nucor (NUE)

Price: $116.53 (+$0.79)

Details:

Q1 EPS exceeded estimates by $0.06 at $0.77/share.

Revenues reached $7.83 billion (+3.8%).

Why It Matters: Nucor’s solid revenue from steel mill operations highlights its strength in a volatile industrials market.

Microsoft (MSFT)

Price: $391.16 (-$0.69)

News:

Partnered with Clearway Energy (CWEN) to acquire carbon-neutral power for its initiatives, setting trends in corporate sustainability.Upcoming Earnings: Analysts eagerly await its report this week for insights on AI growth and cloud services expansion.

Growth Stocks to Watch

Riot Platforms (RIOT)

Riot is aggressively positioning itself within cryptocurrency mining. With its acquisition boosting operational efficiency, it’s worth monitoring if Bitcoin trends upward again.

Atomera (ATOM)

The company's MST technology, targeting AI, 5G, and advanced semiconductors, disrupts traditional markets with scalable innovation. Assigning its strategic partnership higher valuation potential.

Nucor (NUE)

Investors should focus on its steel manufacturing segment, which offers stability and projected earnings growth for Q2.

Evolv Technology (EVLV)

Security tech remains essential in public spaces, and with Evolv regaining financial credibility, strides in detection technology could yield strong demand.

Clearway Energy (CWEN)

Rich with renewable energy projects, CWEN continues green energy ventures, especially given its high-profile PPA with MSFT.

Other notable mentions include Cellectis (CLLS) for pioneering gene therapy and Protalix BioTherapeutics (PLX) for biotech advancements.

Overall Market Forecast

The upcoming wave of earnings reports and key economic data like Q1 GDP and April's Jobs Report will test market sentiment further. Investors should expect volatility, particularly as the technology and industrial sectors report earnings. The Fed’s monetary policy direction will also play a crucial role, with inflation-adjusted spending gaining attention.

Tech Companies like Microsoft (MSFT) and Apple (AAPL) are expected to focus on AI-driven revenue expansions.

Energy remains unpredictable with geopolitical factors but offers selective opportunities for gains in renewables and traditional fuel sectors.

Market risks include rising interest rates, geopolitical frictions, and shifting spending patterns amid macroeconomic slowdowns.

Our outlook tilts cautiously optimistic for 2025, provided corporate earnings stabilize. Growth stocks in tech and industrials stand poised for a rebound once broader markets regain equilibrium.

Today’s choppy session underscores the fragile balance between optimism and uncertainty in the markets. Volatility could persist, but diversified portfolios centered on high-quality stocks may provide resilience.

Market Highlights

Russia Signals Openness to Peace Talks with Ukraine

Russia's willingness to engage in negotiations without preconditions could mark a pivotal moment in the ongoing conflict with Ukraine. While the long-term economic impact remains uncertain, global markets are watching closely for any indications of regional stability, which could positively affect energy stocks. Companies with exposure to Eastern Europe, such as ExxonMobil (XOM) and Chevron (CVX), may experience shifts depending on further developments.

Growth Stock to Watch: Enphase Energy (ENPH), a leader in renewable energy technologies, could gain attention if European nations accelerate their renewable projects to reduce dependency on Russian energy.

India Secures $20 Billion Rafale Jet Deal with France

India's finalized agreement to acquire 26 Rafale fighter jets from Dassault Aviation bolsters defense ties with France while modernizing its military hardware. Dassault Aviation (EPA: AM) shares may see positive momentum as this deal underlines its global defense reputation. Simultaneously, India's reliance on diversified defense suppliers could encourage investments in defense tech companies like Lockheed Martin (LMT) and Northrop Grumman (NOC).

Growth Stock to Watch: Raytheon Technologies (RTX), a key player in defense innovation, is well-positioned for continued global demand for advanced military equipment.

DHL Resumes High-Value Shipments to the U.S.

DHL's announcement regarding high-value shipments over $800 resuming to the U.S. follows adjusted customs regulations. This operational pivot may ease tensions in global commerce, benefiting logistics giants like FedEx (FDX) and UPS (UPS). Investors may also see increased consumption in luxury goods, favoring companies such as LVMH (MC.PA).

Growth Stock to Watch: ZIM Integrated Shipping Services (ZIM), a global container shipping company, as logistics and trade normalization drive demand.

Putin Declares Ukraine Ceasefire for Victory Day

President Vladimir Putin's proposed three-day ceasefire in Ukraine raises hopes for reduced tensions temporarily. Markets are likely to remain volatile, but this development could provide short-term relief as negotiations evolve. Stability in the region could favor commodity stocks like Freeport-McMoRan (FCX) and steel producers reliant on Eastern European metals.

Growth Stock to Watch: Nucor Corporation (NUE), a steel manufacturing leader, stands to benefit from infrastructure developments if global geopolitical tensions ease.

Trump Advocates U.S. Expansion

Donald Trump's controversial "annexation agenda" has raised eyebrows among international leaders and markets. Strategic posturing aside, this rhetoric may indirectly attract attention to defense and infrastructure companies that could play a role in hypothetical developments.

Growth Stock to Watch: Caterpillar Inc. (CAT), a heavy equipment manufacturer, which could benefit if infrastructure discussions heat up.

IBM's $150 Billion U.S. Tech Investment

IBM's (IBM) ambitious five-year, $150 billion U.S. investment plan positions the company as a major player in technology innovation, particularly in mainframe and quantum computing. With over $30 billion allocated to these cutting-edge technologies, IBM is doubling down on its efforts to lead in AI, cloud computing, and IT infrastructures.

Growth Stock to Watch: NVIDIA (NVDA), which dominates the AI chipset market, is expected to grow as demand for AI and computing accelerates.

BMW to Integrate AI from Chinese DeepSeek into Cars

BMW (BMW.DE) is venturing into AI with China-based DeepSeek. While this partnership highlights technological innovation, concerns over data privacy and government influence loom. The integration of AI in vehicles signals a broader trend of automakers adopting next-gen tech.

Growth Stock to Watch: Tesla (TSLA), with its first-mover advantage in AI-driven electric vehicles, maintains its position as a key player in smart car technology.

Amazon (AMZN) Launches Kuiper Satellites

Amazon has officially entered the satellite internet race by launching the first batch of Project Kuiper satellites. With an ambitious FCC deadline requiring 1,618 satellites by mid-2026, Amazon seeks to rival SpaceX’s Starlink. CEO Andy Jassy believes this venture will not only profit but also transform global internet infrastructure.

Growth Stock to Watch: Iridium Communications (IRDM), which specializes in satellite-based communication solutions, stands to gain from increased focus on space technologies.

The stock market remains cautiously optimistic as geopolitical tensions surrounding Ukraine show slight improvement and major corporations continue investing in innovation. Industries poised for growth include renewable energy, defense, and technology. Should global tensions ease, commodity-dependent sectors such as energy and materials may experience steady growth.

Key threats to this positive outlook include potential escalation in geopolitical conflicts, erratic regulatory developments, and inflationary pressures. Investors should keep a diversified portfolio and focus on companies with strong fundamentals and growth potential across these sectors.

Thank you for reading Stock Region Market Briefing! Stay tuned for updates, and here’s to informed investing!

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Always conduct your own research or consult a financial advisor before making investment decisions.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net