Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Wednesday, February 20, 2025.

Stock Region Market Briefing Newsletter - Wednesday, February 20, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. All investments carry risk, and past performance is not indicative of future results. Please consult with a financial advisor before making any investment decisions.

Market Recap and Key Headlines

Nikola Files for Chapter 11 Bankruptcy

Electric vehicle (EV) maker Nikola Corporation (NKLA) has filed for Chapter 11 bankruptcy after failing to secure additional funding or find a buyer. Once valued at over $30 billion in 2020, the company rapidly rose to prominence by focusing on all-electric and hydrogen fuel cell semitrucks. Its valuation even briefly surpassed legacy automaker Ford Motor Company (F) at its peak. However, credibility issues and financial instability overshadowed its early success, forcing Nikola to make this dramatic move.

Growth Stocks to Watch

Though Nikola’s bankruptcy paints a bleak picture for certain EV startups, the broader EV industry still offers strong players. Consider focusing on industry leaders like Tesla (TSLA), which has a diversified EV lineup and an optimistic production outlook, and Rivian Automotive (RIVN), a company expanding its fleet and commercial partnerships. Both hold promise in the transition to clean energy transportation.

Tesla Cybertruck Achieves Mixed Milestone

Tesla (TSLA) has secured a 5-star safety rating for its highly anticipated Cybertruck. The results follow rigorous crash tests by the National Highway Traffic Safety Administration (NHTSA). However, some areas, such as rollover risk (12.4%) and pedestrian safety concerns, remain under scrutiny. Tesla has received strong demand for the Cybertruck, and this milestone could strengthen market confidence despite skepticism raised by these tests. Recall activity and consumer feedback on Cybertruck performance will remain key to watch moving forward.

Growth Stocks to Watch

Beyond Tesla, investors may consider Lucid Motors (LCID) as it advances in the luxury EV market or BYD Company (BYDDY), a significant player in China’s clean vehicle industry. Both companies are pushing technological innovation and gaining international traction.

Apple Unveils iPhone 16E with AI-Powered Features

Apple Inc. (AAPL) has introduced the iPhone 16E, reshaping the SE lineage with advanced features like the A18 chip, a 6.1-inch OLED display, and AI tools powered by Apple Intelligence. Priced at $599, the phone ditches Touch ID, replacing it with Face ID and USB-C charging, aligning with consumer demand for modern functionality and regulatory requirements. Apple’s strategic design decisions reflect its adaptability in maintaining dominance in the tech industry.

Key Stats

Current Market Cap (AAPL): $4.2 trillion

1-Year Stock Performance: +18.5%

Latest Dividend Yield: 0.6%

Growth Stocks to Watch

Investors may also consider companies contributing to the broader semiconductor and AI landscape, such as NVIDIA (NVDA) and Advanced Micro Devices (AMD), which benefit from the rising demand for advanced computing systems.

Microsoft Unveils Majorana 1 Quantum Chip

Microsoft (MSFT) unveiled the “Majorana 1” quantum chip, marking a groundbreaking moment in computing. This innovation is said to significantly accelerate the timeline for practical quantum computing. Analysts believe the chip could transform industries like healthcare, material sciences, and cybersecurity, offering MSFT a pioneering edge in this rapidly evolving sector.

Key Stats

Current Market Cap (MSFT): $2.8 trillion

Dividend Yield: 0.84%

P/E Ratio: 27.2

Growth Stocks to Watch

Look at other leaders in the quantum space such as IBM (IBM), which focuses on superconducting quantum systems, and Google parent Alphabet (GOOGL), deeply invested in quantum AI applications.

Forever 21 Faces Uncertainty Amid Liquidation Talks

Fast fashion retailer Forever 21 might be heading toward a second bankruptcy, with liquidator talks signaling a troubling fate. The rise of competitors like Shein and Temu, with their aggressive pricing models, has eroded Forever 21’s market share significantly. Investors are concerned about the retail sector's evolution as companies struggle to adapt to changing consumer preferences.

Growth Stocks to Watch

Online players like Shopify (SHOP) and Amazon (AMZN) are reshaping retail with innovative solutions like omnichannel strategies and fast delivery. These stocks remain at the forefront of e-commerce transformation.

Market Forecast

The stock market remains in a mixed sentiment zone this month, with ongoing macroeconomic uncertainties and sector-specific headwinds keeping investors cautious. Tech stocks, driven by innovative launches from giants like Apple and Microsoft, continue to provide resilience in an otherwise tepid environment.

Here’s an outlook by sector for the upcoming month:

Technology: Bullish, due to AI and quantum computing advancements driving significant momentum.

Energy: Neutral, as oil prices stabilize and green energy picks up subsidy support.

Consumer Discretionary: Bearish; challenges in the retail and travel industries are expected to weigh on earnings.

Healthcare: Neutral, as policy shifts and R&D investments balance out.

The Federal Reserve’s monetary stance remains key to shaping investor confidence. Traders should monitor inflation numbers and potential interest rate decisions to anticipate broader movements in the market. Diversification and a focus on quality growth stocks remain paramount.

Thank you for reading this week’s Stock Region Market Briefing. Stay informed, stay ahead!

Market Recap and Key Earnings Updates

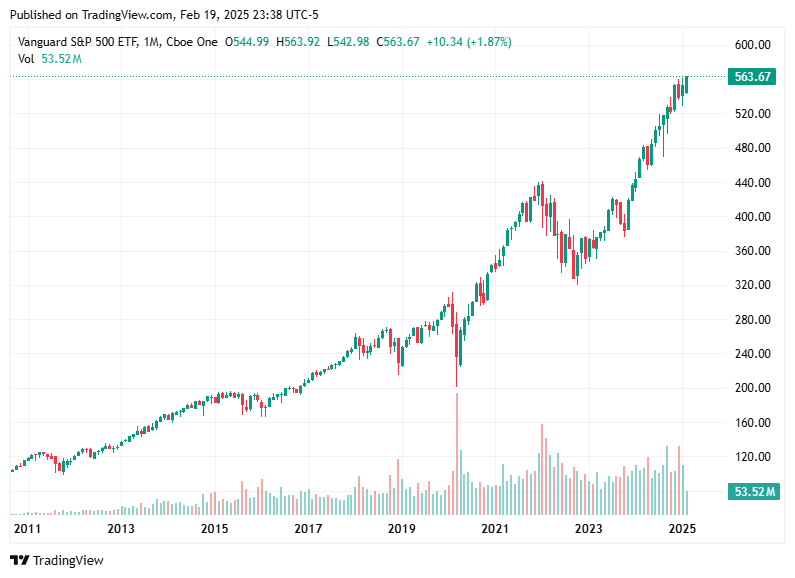

The stock market closed with the S&P 500 reaching a new record high, reflecting resilience among mega-cap and semiconductor stocks. The Dow gained 0.4%, the Nasdaq climbed 0.6%, and the S&P 500 added 0.5% in a session of muted early action but strong end-of-day momentum. Semiconductor and energy stocks provided notable strength, while disappointing earnings caused some outsized moves.

Here are the highlights from key earnings updates and corporate developments.

B2Gold Earnings Miss Amid Output Challenges

B2Gold Corporation (BTG) reported Q4 earnings of $0.01 per share, missing analyst expectations by $0.05. Revenue declined 2.4% year-over-year to $499.79 million. The company’s gold production totaled 186,001 ounces, with underperformance at the Fekola mine offsetting stronger production at Otjikoto and Masbate.

Growth Stocks to Watch

Gold investors could consider Newmont (NEM) or Barrick Gold (GOLD) for exposure to stronger balance sheets and operational output.

Pulmonx Corporation Posts Record Results

Pulmonx Corporation (LUNG) reported record quarterly revenue for Q4, driven by increased adoption of its minimally invasive lung disease treatments. Although the update was accompanied by profit-taking (-5.0% during the session), Pulmonx shows promise as a med-tech leader within its niche.

Growth Stocks to Watch

Innovators like DexCom (DXCM) and Intuitive Surgical (ISRG) remain well-positioned for long-term growth in medical device technologies.

Cheesecake Factory Offers Strong FY25 Guidance

The Cheesecake Factory (CAKE) outpaced Q4 earnings expectations by $0.12, reporting EPS of $1.04 on revenue of $920.96 million (+5.0% YoY). The company issued upside revenue guidance for FY25, citing strong sales momentum.

Key Stats

Current Market Cap (CAKE): $2.74 billion

2025 Revenue Guidance (Projected): $3.8 billion

Growth Stocks to Watch

While CAKE remains a solid name in consumer discretionary, consider following Chipotle Mexican Grill (CMG) and Domino’s Pizza (DPZ) for exposure to high-performing restaurant chains with strong expansion opportunities.

American Electric Power Settles Large Load Tariff Issues

American Electric Power (AEP) has received regulatory approval from the Indiana Utility Regulatory Commission for its large load tariff settlements. Shares closed higher (+0.87%), reflecting optimism about the company’s ability to serve data centers and other high-energy-demand customers.

Key Stats

1-Year Stock Performance (AEP): +2.1%

Dividend Yield: 3.29%

Growth Stocks to Watch

For exposure to renewable energy trends, consider NextEra Energy (NEE) and Enphase Energy (ENPH), both leaders in clean energy technology.

Nutrien Boosts Dividend Despite Miss

Nutrien Ltd. (NTR) reported Q4 earnings of $0.31 per share, missing expectations by $0.02. Revenues fell 10.3% year-over-year to $5.08 billion. The company increased its quarterly dividend to $0.545 per share, citing progress in its operational efficiency efforts.

Key Stats

Revenue Growth Target (2026): Mid-single digits

Dividend Yield (Post-Increase): 4.15%

Growth Stocks to Watch

CF Industries (CF) and Mosaic (MOS) are noteworthy competitors in the agricultural input industry.

Index Change Impacts Small-Cap Market

SanDisk (soon to spin off from Western Digital, WDC) will join the S&P SmallCap 600, replacing Leslie’s Pool Supplies (LESL). Investors in small-cap-focused strategies may see fund adjustments linked to this index change.

Growth Stocks to Watch

Western Digital (WDC) benefits from high demand for storage solutions. Another notable small-cap tech entrant worth monitoring is Alpha and Omega Semiconductor (AOSL).

Wall Street’s Sector Snapshot

Here’s a focused look at sector trends shaping broader market sentiment today.

Technology: Semiconductor stocks led by the PHLX Semiconductor Index (+1.2%) continue to drive optimism. Top movers included Applied Materials (AMAT), introducing breakthroughs in defect review technology.

Energy: Resource names like Occidental Petroleum (OXY, +4.4%) benefited from rising production and oil price stability. Devon Energy (DVN) gained 7.7% on the session.

Consumer Discretionary: Cheesecake Factory’s guidance lifted sentiment (+FY revenue), though concerns linger in retailers like Forever 21 facing competitive stress in e-commerce.

Market Tone

The bullish tone persists overall, led by innovation across technology and strength in energy markets. However, challenges remain in certain consumer and housing sectors.

Here’s the short-term outlook by sector moving forward into week’s end and beyond.

Technology: Optimistic. Upside momentum remains with leading names like Microsoft (MSFT) and Apple (AAPL) reporting product advancements and strong guidance.

Energy: Positive. Supply discipline among oil producers continues supporting commodity-linked gains. Green energy projects also gain tailwinds from policy announcements.

Consumer Discretionary: Mixed. Restaurant chains outperform retail. Housing headwinds, reflected in declines in building starts, limit upside in durable-related industries.

Investors should keep a close watch on FOMC meeting minutes or inflationary updates that might influence Federal Reserve rate decisions. Diversified portfolios, balancing tech’s growth with energy or utility defensiveness, may be better positioned for uncertainty.

Disclaimer: The content provided is based on reported events and publicly available information, and is intended solely for educational purposes. Always conduct your own research or consult with a financial advisor before making investment decisions. Stock Region does not guarantee the accuracy or completeness of this information.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net