Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Sunday, April 6, 2025.

Stock Region Market Briefing Newsletter - Sunday, April 6, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The information in this newsletter is for informational purposes only and should not be construed as financial advice. Please conduct your own research or consult with a qualified financial advisor before making any investment decisions.

Market Overview

The stock market closed with significant losses this week, as escalating trade tensions and global slowdown fears spooked investors. The Nasdaq Composite dropped 5.8% this week, officially entering bear market territory, while the S&P 500 and Dow Jones Industrial Average fell by 6.0% and over 2,000 points, respectively.

Year-to-date performances remain grim across the board:

Dow Jones Industrial Average: -9.9%

S&P 500: -13.7%

Nasdaq Composite: -19.3%

Russell 2000: -18.1%

A fresh wave of retaliatory trade tariffs from China, including a 34% import duty, intensified the ongoing trade war, further dampening investor sentiment. Oil prices also slid by 7.5%, Treasury yields declined, and the VIX volatility index surged past 45. Despite March's nonfarm payrolls showing an increase of 228,000 jobs, the Fed did not signal any immediate policy changes, opting instead to monitor economic conditions.

Economic uncertainty overshadowed positive pockets of data, leaving the market vulnerable to continued volatility.

Sector Performance

Top Percentage Gainers (Week Ending April 5, 2025):

Healthcare:

CORT (+34.71%), BLUE (+21.32%), MOH (+8.13%)

CORT’s notable recovery in trial results boosted its valuation, while BLUE capitalized on biotech optimism.

Industrials:

RUN (+13.59%)

Residential solar adoption tailwinds lifted RUN significantly this week.

Consumer Discretionary:

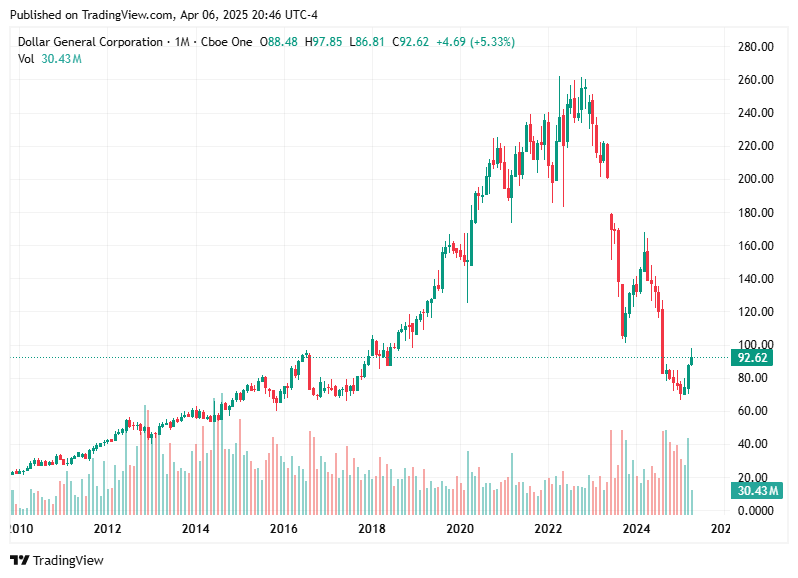

GT (+10.92%), DG (+8.81%), GME (+8.70%)

Consumer-focused stocks rebounded on value-focused shopping trends.

Energy:

TUSK (+8.53%)

TUSK’s operational efficiency improvements drove gains.

Financials:

SQQQ (+27.22%), COOP (+26.57%), HMST (+21.94%)

COOP surged after strong mortgage servicing portfolio growth.

Top Percentage Losers (Week Ending April 5, 2025):

Energy:

RIG (-33.75%), KOS (-32.66%), and NBR (-30.76%) led losses amid declining oil prices.

Consumer Discretionary:

RH (-37.42%)

RH sank sharply following weaker-than-expected earnings guidance.

Information Technology:

AAOI (-34.25%), COMM (-32.59%)

High-growth tech names were punished as risk-off sentiment took hold.

Energy was the worst-performing sector this week, declining by 8.7%, followed by financials (-7.4%) and technology (-6.3%). Healthcare stocks provided some relief, with select biotechs showing positive momentum.

Company Highlights

Grupo Aeroportuario Del Pacífico (PAC, -12.56%)

March passenger traffic saw a 7% year-over-year increase across GAP's 12 Mexican airports. Key hubs like Guadalajara and Tijuana experienced robust growth of 10.4% and 5.6%, respectively. However, Montego Bay recorded a 7.7% decline in traffic, reflecting mixed performance across GAP's portfolio.

Hut 8 Mining Corp (HUT, -0.52%)

Hut 8 Mining announced progress in its strategic fleet upgrades. It has more than doubled its deployed hashrate to 9.3 EH/s while improving efficiency. The company is positioning itself for stronger cryptocurrency market conditions.

UFP Technologies (UFPT, -3.35%)

UFP Technologies secured two exclusive supply agreements with Stryker (SYK) through its AJR Enterprises subsidiary. These agreements extend for 42 and 63 months, guaranteeing a significant portion of Stryker-related manufacturing business for UFP, bolstering its long-term revenue visibility.

Cipher Mining (CIFR, -0.21%)

Cipher mined 210 bitcoin in March and made notable progress on its Black Pearl infrastructure project. This underlines its focus on consistent production and strategic growth in the cryptocurrency space.

Growth Stocks to Watch

Based on recent news and sector trends, here are some growth stocks worth paying attention to this quarter:

Corcept Therapeutics (CORT): With a strong rally driven by clinical success, CORT is one to watch in the biotech space. Investors are showing increased interest in stocks with novel treatments.

Hut 8 Mining (HUT): As Hut 8 successfully scales its fleet efficiency and increases operational capacity, it remains a key player in the cryptocurrency mining landscape.

RUN: The residential solar market continues to grow and support renewable energy adoption. Sunrun's strong performance signals its potential in the clean energy transition.

DigitalOcean (DOCN): Despite recent losses, DigitalOcean reaffirmed its revenue guidance for FY25. Its focus on competitive cloud computing services makes it a strong candidate in the cloud sector.

UFP Technologies (UFPT): Strategic agreements with Stryker highlight potential revenue growth, making this stock attractive for investors interested in the healthcare supply chain.

Stock Market Forecast

Ongoing geopolitical tensions and the Federal Reserve’s patient stance will likely keep markets volatile. The escalated tariff situation with China increases the risk of prolonged trade disruptions, which could further pressure corporate earnings and economic growth.

However, there are reasons for optimism. Robust nonfarm payroll data for March suggests the labor market remains resilient, which could offer some support to consumer spending. Additionally, with inflation easing modestly, the Fed may avoid aggressive tightening, creating some breathing room for the markets.

Investors should remain cautious but vigilant, focusing on sectors like healthcare, renewable energy, and select technology stocks with strong fundamentals and long-term growth potential. A resolution of trade tensions or improved global economic conditions could help stabilize markets in the near term.

Markets are in the red as escalating trade tensions, rising tariffs, political instability, and tech disruptions contribute to heightened uncertainty. The Dow Jones Industrial Average (DJIA) dropped precipitously this week, with futures down over 1,200 points (-3%). The S&P 500 extended its losses to a 15% decline from its recent peak, while the Nasdaq Composite has entered bear market territory, having dropped 21% from its December high. Tech giants, financial institutions, and multinational exporters have been hit the hardest.

Synchronously, Treasury yields are signaling flight-to-safety behavior, with the 10-year yield falling to 3.882% amid recession fears. Investors need to tread with caution, weigh risks, and monitor further developments.

Key Market Events

1. Trade War Heats Up Between the U.S. and China

President Trump has imposed new tariffs, including a 34% levy on Chinese imports, sparking retaliation from China with equivalent tariffs. The trade war has disrupted global supply chains and driven steep declines in companies with significant China exposure.

Apple Inc. (AAPL) fell 3% in the wake of the battle, as China remains a critical market and manufacturing hub.

Tesla Inc. (TSLA) dropped 6%, with its Shanghai Gigafactory at risk of higher costs due to tariffs.

Nvidia Corporation (NVDA) slid 5%, as semiconductor makers face uncertainty surrounding rare earth mineral exports restricted by China.

Growth Stock to Watch: Advanced Micro Devices (AMD) - Although currently under pressure, AMD continues to innovate in AI and GPU technology, making it a long-term growth candidate as geopolitical risks stabilize.

2. Tariffs Expand Beyond China

A 46% tariff has now been imposed on Vietnam, further straining U.S. relations with the region. Nike (NKE) initially suffered losses due to its reliance on Vietnam for 25% of its production but rebounded by 5% in trading after reports of potential negotiations.

A 26% tariff targeting Indian imports is likely to impact industries heavily reliant on goods from India, including pharmaceuticals and technology.

Growth Stock to Watch: Pfizer Inc. (PFE), which could benefit if the tariff accelerates the reshoring of pharmaceutical supply chains.

3. Political and Leadership Shifts Add to Uncertainty

The firing of NSA Director Timothy Haugh and Deputy Wendy Noble has raised alarms in Washington over cybersecurity vulnerabilities. Additionally, South Korea’s impeachment of President Yoon has added political tensions in Asia, and international markets are watching for potential ripple effects.

Growth Stock to Watch: CrowdStrike Holdings (CRWD) - With cybersecurity concerns rising, CrowdStrike's innovations in endpoint protection could provide a defensive growth opportunity.

4. Tech Disruption

Microsoft Corporation (MSFT) celebrated its 50th anniversary this week but faced protests over the alleged use of AI in military operations. Meanwhile, OpenAI announced the delayed launch of GPT-5 but accelerated releases of its o3 and o4-mini reasoning models, hinting at potential AI advancements.

Microsoft (MSFT) shares stayed relatively stable, as the company's cloud and AI initiatives provide long-term growth opportunities despite short-term controversies.

AI competitors like Alphabet Inc. (GOOGL) and Palantir Technologies (PLTR) should remain on investors' radars as innovation in artificial intelligence accelerates.

5. Economic Data Mixed Amid Recession Fears

Despite the tumultuous environment, U.S. nonfarm payrolls rose by 228,000 in March, far exceeding the estimate of 140,000. However, the unemployment rate ticked up slightly to 4.2%, and Federal Reserve Chair Jerome Powell has warned that recent tariffs could push inflation higher.

Growth Stock to Watch: Visa Inc. (V) - As consumer spending continues to hold steady, companies like Visa stand to benefit from prolonged economic resilience, despite volatility in global equity markets.

The stock market is braced for further declines in the near term as trade tensions intensify, interest rate policy hangs in balance, and geopolitical issues remain unresolved. Current recession odds are estimated at 60%, according to recent reports. However, strong corporate earnings from companies in resilient industries (e.g., health care, artificial intelligence, and renewable energy) could partially offset broader market weaknesses.

Investors should prepare for more volatility and look for opportunities in defensive sectors, such as utilities and healthcare, while keeping an eye on high-growth tech and AI stocks for long-term potential. Treasury bonds and other safe-haven assets will likely continue to attract inflows during periods of heightened uncertainty.

Growth Stocks Roundup

Nvidia (NVDA): A leader in AI chips with strong long-term prospects despite near-term supply chain worries.

The Trade Desk (TTD): Positioned well to capitalize on digital advertising, especially as privacy changes disrupt competitors.

Moderna (MRNA): A strong player in mRNA technology, particularly as medical innovation persists despite economic headwinds.

Markets are facing turbulent times driven by policy shocks, geopolitical tensions, and recession fears. While volatility remains a key theme, strategic investments in growth industries such as technology, healthcare, and clean energy could help investors ride out the storm. Remember to stay informed, diversify your portfolio, and remain vigilant of ongoing events.

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Stock Region and its affiliates are not liable for any losses incurred from investment decisions based on this content. Please consult a certified financial advisor for personalized investment advice.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net