Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Tuesday, July 8, 2025 | Time: 5:00 PM ET

Stock Region Market Briefing Newsletter - Tuesday, July 8, 2025 | Time: 5:00 PM ET

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making investment decisions. Stock markets are inherently volatile, and past performance is not indicative of future results.

Market Recap: A Day of Balancing Acts

Today’s market session was a tug-of-war between small- and mid-cap outperformance and mega-cap underperformance, leaving the major indices relatively flat. The S&P 500 dipped slightly (-0.1%), while the Nasdaq (-0.2%) and Dow Jones Industrial Average (-0.1%) followed suit. However, the Russell 2000 (+0.7%) and S&P Midcap 400 (+0.5%) shone brightly, showcasing the strength of smaller players in the market.

The breadth of the market was encouraging, with advancers outpacing decliners nearly 2:1 on both the NYSE and Nasdaq. This suggests that while the big names struggled, the broader market is alive and kicking.

Key Developments Driving the Market

Trade Tensions and Tariffs

President Trump’s executive order postponing the July 9 trade deadline to August 1 created ripples across sectors. While the broader market remained unfazed, sector-specific impacts were notable:

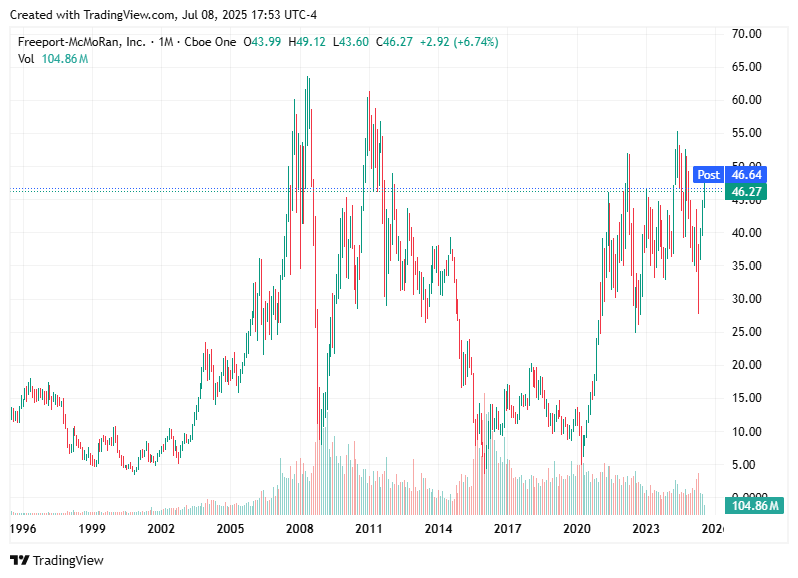

Copper Surge: A 50% tariff on copper, effective August 1, sent copper futures soaring by 11.2% to $5.58/lb. Freeport-McMoRan (FCX, $46.29, +2.57%) was a standout, riding the wave of this announcement.

Energy Sector Boom: The energy sector (+2.7%) was the day’s top performer, fueled by an executive order eliminating subsidies for renewable energy. Oil giants like ConocoPhillips (COP, $95.65, +3.35%), Chevron (CVX, $152.93, +3.75%), and Exxon Mobil (XOM, $114.14, +2.73%) saw significant gains.

Mega-Cap Struggles

Mega-cap stocks faced headwinds, with the Vanguard Mega Cap ETF (-0.15%) underperforming. Financial heavyweights like JPMorgan Chase (JPM, $282.66, -3.2%), Bank of America (BAC, $47.14, -3.1%), and Goldman Sachs (GS, $697.04, -2.0%) dragged the financials sector (-0.9%) lower after a downgrade from HSBC.

Meanwhile, Amazon (AMZN, $219.33, -1.9%) struggled with disappointing Prime Day sales, down 14% year-over-year. Apple (AAPL, $210.01, +0.0%) and Microsoft (MSFT, $496.62, -0.2%) also failed to inspire, despite a strong showing from semiconductor stocks (+1.8%).

Economic Data

Small Business Optimism: The NFIB Small Business Optimism Index held steady at 98.6, reflecting resilience among small businesses.

Consumer Credit: May consumer credit rose by $5.1 billion, driven by nonrevolving credit (+$8.6 billion).

Growth Stocks to Watch

Freeport-McMoRan (FCX)

With copper prices surging, FCX is well-positioned to benefit from the new tariffs. Its 2.57% gain today could be just the beginning if demand for copper remains strong.Mobileye Global (MBLY, $18.64, +1.25%)

The company issued upside Q2 revenue guidance, projecting $502-$506 million, well above consensus. With autonomous driving gaining traction, MBLY is a growth stock to keep on your radar.Kura Sushi USA (KRUS, $86.78, +4.9%)

This tech-enabled Japanese restaurant concept reported strong fiscal Q3 results, showcasing its ability to blend innovation with tradition.Tesla (TSLA, $297.81, +1.32%)

After rebounding from yesterday’s unfavorable press, Tesla remains a growth darling, especially as it continues to expand its EV and energy storage businesses.Granite Construction (GVA, $92.65, -1.06%)

Despite a slight dip today, Granite’s $111 million contract win for a major infrastructure project in Salt Lake City highlights its growth potential in the construction sector.

Stock Market Forecast

The market is in a holding pattern, waiting for clarity on trade negotiations and the release of FOMC minutes tomorrow. While the S&P 500 and Nasdaq are up 5.9% and 5.7% year-to-date, respectively, the Russell 2000 (-0.1% YTD) underscores the challenges faced by small caps.

Looking ahead, we expect:

Volatility: Trade tensions and tariff announcements could lead to short-term swings.

Opportunities in Small Caps: With small- and mid-cap stocks outperforming today, this trend could continue as investors seek value outside of mega-caps.

Sector Rotation: Energy and materials sectors are gaining momentum, while financials and consumer discretionary may face near-term pressure.

Today’s market action was a reminder that even in a flat market, there are pockets of opportunity. Whether it’s the copper surge, energy sector boom, or small-cap resilience, savvy investors can find ways to capitalize on the shifting landscape.

As always, stay informed, stay diversified, and stay the course.

Market Overview: A Day of High Stakes and Bold Moves

The stock market today was a whirlwind of political drama, global economic shifts, and corporate shake-ups. From President Trump's bold tariff announcements to Meta's aggressive AI talent acquisition, the day was packed with developments that could shape the market's trajectory in the coming months.

Trump Defends Bolsonaro and Receives Nobel Nomination

President Trump’s defense of former Brazilian President Jair Bolsonaro and his Nobel Peace Prize nomination by Israeli Prime Minister Benjamin Netanyahu added a layer of political intrigue. While this news doesn’t directly impact the markets, it underscores the global political dynamics that investors should monitor closely.

Global Challenges: Defense, Economy, and Trade

Defense Shortages: The U.S. faces a critical shortage of Patriot missile interceptors, holding only 25% of the required stockpile. This could impact defense contractors like Raytheon Technologies (RTX) and Lockheed Martin (LMT), which may see increased demand for missile systems.

Steel Tariffs: The UK’s efforts to avoid a 50% U.S. steel tariff could influence steel producers like Nucor Corporation (NUE) and United States Steel Corporation (X).

Chinese Bank Rally: Hong Kong shares of Chinese banks surged as investors sought yield. Keep an eye on Industrial and Commercial Bank of China (1398.HK) and China Construction Bank (0939.HK).

Samsung’s Struggles: Samsung’s profit slump due to U.S. chip controls and AI memory issues highlights challenges in the semiconductor sector. This could benefit U.S. chipmakers like NVIDIA (NVDA) and Advanced Micro Devices (AMD).

Trump Boosts Ukraine Aid Amid Global Tensions

The announcement of additional defensive weapons for Ukraine could further strain U.S.-Russia relations. Defense stocks like Northrop Grumman (NOC) and General Dynamics (GD) may benefit from increased military spending.

Powell Stresses Patience on Rates, Meta Poaches Apple AI Talent

Federal Reserve Chair Jerome Powell’s cautious stance on interest rates provides some relief to growth stocks, while Meta’s recruitment of Apple’s AI head signals a heated talent war in tech. Watch Meta Platforms (META) and Apple (AAPL) for potential shifts in AI innovation.

Trump Confirms Tariff Payment Deadline of August 1, 2025

The tariff deadline could impact global trade dynamics, particularly for companies reliant on imports. Retailers like Walmart (WMT) and Target (TGT) may face cost pressures.

Global Business Updates

Daimler Truck Job Cuts: Daimler Truck’s plan to cut 5,000 jobs reflects challenges in Germany’s auto industry. This could ripple through suppliers like Bosch and Continental AG (CON.DE).

Tencent’s 3D Breakthrough: Tencent’s Hunyuan3D-PolyGen innovation could disrupt the 3D content creation market. Keep an eye on Tencent Holdings (0700.HK).

Alibaba’s Autonomous Push: Alibaba’s partnership with STO Express to deploy 2,000 autonomous vehicles by 2025 could revolutionize logistics. Watch Alibaba Group (BABA) and JD.com (JD).

Breaking News: Trump Calls for Powell’s Resignation

President Trump’s call for Federal Reserve Chair Jerome Powell’s resignation adds uncertainty to monetary policy. This could lead to market volatility, particularly in interest rate-sensitive sectors like real estate and utilities.

U.S. Bans Chinese Investors from Buying Farmland

The ban on Chinese investors purchasing farmland is a significant move to protect national security. This could benefit U.S. agricultural companies like Deere & Company (DE) and Corteva (CTVA).

Apple Leadership Change and Bezos Stock Sale

Apple (AAPL): COO Jeff Williams’ departure and Sabih Khan’s promotion could signal a strategic shift.

Amazon (AMZN): Jeff Bezos’ $665 million stock sale raises questions about his future involvement with the company.

Watch These Stocks:

NVIDIA (NVDA): With AI and semiconductor demand surging, NVIDIA remains a top pick.

Meta Platforms (META): Meta’s aggressive AI talent acquisition could drive innovation.

Tesla (TSLA): As the EV market grows, Tesla’s dominance continues to attract investors.

Palantir Technologies (PLTR): Palantir’s focus on AI and defense makes it a strong contender in volatile times.

Alibaba Group (BABA): Alibaba’s autonomous vehicle initiative positions it as a leader in logistics innovation.

The market is expected to remain volatile in the short term due to geopolitical tensions, tariff deadlines, and Federal Reserve uncertainty. However, growth sectors like AI, defense, and renewable energy offer promising opportunities for long-term investors. As always, diversification and a focus on quality stocks are key to navigating these turbulent times.

The opinions expressed in this newsletter are those of the author and do not necessarily reflect the views of Stock Region. Past performance is not indicative of future results. Always conduct your own research before making investment decisions.

That’s your Stock Region Market Briefing for today! Stay informed, stay invested, and let’s navigate the markets together.

Disclaimer: This newsletter is not a solicitation to buy or sell any securities. All opinions expressed are those of the author and do not constitute investment advice. Please consult a financial advisor for personalized guidance.