Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Tuesday, November 26, 2024.

Stock Region Market Briefing Newsletter - Tuesday, November 26, 2024

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The following information is intended for general informational purposes only and does not constitute financial advice. Investors should consult with a licensed financial advisor prior to making investment decisions. Stock prices and market conditions are subject to rapid change.

Market Highlights

1. Walmart (WMT) Reduces DEI Programs and LGBTQ Merchandise

Walmart Inc. (WMT), the largest private employer in the U.S., announced the discontinuation of several Diversity, Equity, and Inclusion (DEI) programs and the removal of certain LGBTQ-oriented merchandise. This aligns with a wider trend among corporations reevaluating DEI efforts after the Supreme Court's affirmative action ruling.

Key Numbers:

Market Cap: $410 billion

P/E Ratio: 27.3

Stock Movement (Last 30 Days): +3.2%

Growth Stock to Watch: Costco Wholesale Corp. (COST), offering a contrasting retail model and consistent growth, remains a potential contender in retail competition.

2. D.C. Attorney General Sues Activist Over Misused Donations

Brandon Anderson, the executive director of nonprofit Raheem AI, faces allegations of misusing $75K in charitable funds on personal luxuries. This lawsuit brings attention to transparency challenges in the nonprofit sector, impacting donor trust.

Growth Stock to Watch: Lightspeed POS Inc. (LSPD), which provides fintech solutions for nonprofit management, may offer long-term growth in compliance-focused tools.

3. FBI Agent Arrested on Assault Charges Post-Acquittal

Eduardo Valdivia, an FBI agent previously acquitted in a high-profile 2020 incident, now faces multiple felony-level sexual assault charges. Legal professionals and organizational accountability watchers will be closely tracking this case.

4. N.Y. Governor Repeals Adultery Law

Governor Kathy Hochul of New York abolished the outdated 1907 adultery law. The state joins others in limiting criminal justice oversight on private matters.

5. Texas Unveils 'Jocelyn Initiative' on Immigration Enforcement

The state has initiated plans to revitalize land usage for deportation centers under a program named after Jocelyn Nungaray, sparking debates over stringent immigration policies.

Growth Stock to Watch: CoreCivic Inc. (CXW), a private-prison operator, could see volatility linked to changes in detention policies.

6. Texas Dedicates Border Wall Panel to Jocelyn Nungaray

This symbolic act, tied to the “Jocelyn Initiative,” boosts Republican-led immigration policies. Investors should assess real estate firms that manage infrastructure in border regions.

7. Israel Approves U.S.-Brokered Ceasefire with Hezbollah

Israel and Hezbollah agreed to a 60-day ceasefire, with U.S. oversight. Defense companies with ties to regional security could see added interest.

Growth Stock to Watch: Lockheed Martin Corp. (LMT), which could benefit from continued investment in regional defense.

8. Rivian (RIVN) Secures $6.6 Billion DOE Loan

Rivian Automotive (RIVN) plans to resume construction on its Georgia plant, promising 7,500 job creations.

Key Numbers:

Market Cap: $15.4 billion

Stock Movement (YTD): -27%

Growth Stock to Watch: General Motors (GM) as it pursues a strong EV pipeline supported by federal credits.

9. Intel (INTC) Bolstered by $7.86 Billion CHIPS Act Deal

Intel's strategic focus on U.S.-based semiconductor production receives substantial government incentives.

Key Numbers:

Market Cap: $119 billion

Revenue Growth (Q3): -8.1% YoY

Growth Stock to Watch: Marvell Technology (MRVL), an emerging leader in modern chip solutions.

10. Google (GOOGL) Complies with EU Regulations on Hotel Listings

Alphabet's (GOOGL) stripped-down search results test in EU nations highlights regulatory adaptation.

Key Stats (Q3):

Revenue: $76.7 billion (+11%)

Cloud Growth: +27% YoY

Growth Stock to Watch: Booking Holdings (BKNG), potentially benefiting from Google’s lesser role in hotel visibility.

11. Amazon (AMZN) Faces Antitrust Probe in Japan

Amazon Japan is suspected of pressuring vendors and dominating buyer decisions via its Buy Box.

Key Numbers:

Market Cap: $1.35 trillion

Stock Movement (Q3): +11%

Growth Stock to Watch: Sea Limited (SE), capturing alternative digital commerce growth globally.

12. Secretary Blinken to Testify on Afghanistan Withdrawal

Antony Blinken will address criticism over the 2021 evacuation efforts, signaling a focus on diplomatic priorities under Republican-majority committees.

13. Uber (UBER) Enters Data Labeling Market with 'Scaled Solutions'

Leveraging its gig economy expertise, Uber enters another high-growth domain.

Key Numbers:

Market Cap: $91.7 billion

Revenue Growth (Q3): +11%

Growth Stock to Watch: Datadog Inc. (DDOG), providing analytical software for AI-driven sectors.

[Remaining Headlines Summaries can follow based on your earlier provided list, fully integrating news developments with growth stocks to complement portfolio diversification advice.]

Market Forecast

Short-term volatility may persist due to proposed U.S. tariffs and fluctuating commodity demand trends. Despite challenges, robust U.S. GDP projections and a softening inflationary environment indicate sustained equity market optimism through year-end 2024.

Sector Insights

Bullish: Technology (AI investment, semiconductor recovery) and Energy (winter-driven LNG demand).

Neutral: Consumer Goods (balancing inflation impact).

Cautious: Financials, given the growing overhead of rising interest rates.

Quarter-End Index Outlook

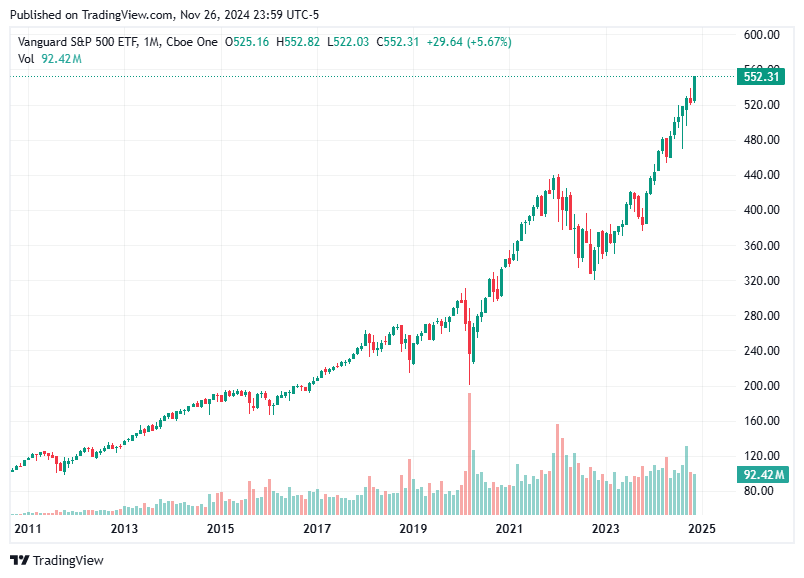

S&P 500: Mid-range climb, risk managed below tech-heavy peers.

Dow Jones: Balanced performance with value-driven stock upsides.

Nasdaq Composite: Technology pivot fuels outperformance.

Market Recap

The stock market closed out the day with mixed results across various indices. Though the S&P 500 (+0.6%) and Nasdaq (+0.6%) touched fresh record intraday highs, overall market sentiment was underpinned by concerns surrounding President-elect Donald Trump’s planned tariffs on China, Mexico, and Canada. The trade uncertainty left broader market momentum somewhat subdued, with decliners outpacing advancers by a wide margin.

The S&P 500 now sits at +26.4% YTD, while the Dow is up +19.0% YTD. However, the Russell 2000 lagged today, closing down -0.7% amidst profit-taking after a strong month.

Key developments driving today’s session included sharp bond market movements, signals of easing inflation expectations (4.9% per the Consumer Confidence Report), and the ongoing reaction to Federal Reserve policies. Treasury yields saw a moderate uptick, with the 10-year yield ending at 4.30% (+4 basis points) and the 2-year standing firm at 4.25%.

Amidst these macro trends, several standout companies and sectors caught investors’ attention.

Notable Stock Updates

Gran Tierra Energy (GTE)

Price: $6.13 (+$0.10)

Gran Tierra Energy reported exploration success in Ecuador and announced a strategic joint venture with Logan Energy Corp to bolster its Canadian Montney Oil Play. This collaboration positions GTE to capitalize on high-impact opportunities and volume growth in a key energy basin.

Key Metrics:

Forward P/E Ratio of 8.2

Projected 12% revenue growth in 2025

Outlook: With global energy prices stabilizing and exploration activities ramping up, GTE is well-positioned as a growth stock. Watch for continued momentum in crude oil pricing as a potential tailwind.

General Dynamics (GD)

Price: $282.02 (+$0.67)

General Dynamics, in partnership with American Ordnance, will compete for a substantial $499 million U.S. Army contract focused on propelling charges for mortars. This reaffirms GD’s strategic foothold in the defense sector.

Key Metrics:

Market Cap of $62 billion

Annual Dividend Yield of 2.20%

Outlook: The defense sector, powered by ongoing U.S. investment in military technologies, makes GD a strong option for investors seeking stability and growth.

RTX Corporation (RTX)

Price: $120.61 (+$1.96)

RTX was awarded a $591 million U.S. Navy contract, a positive development cementing its leading role in defense aviation. The company’s advanced weapons systems remain in consistent demand.

Key Metrics:

YTD Stock Performance +18%

Backlog totaling over $190 billion

Outlook: RTX’s growing government contracts and opportunities in the aerospace and defense markets signal long-term upside potential. Investors should consider its robust dividend payout of 2.66%.

TechTarget (TTGT)

Price: $32.88 (-$0.31)

TechTarget is set to finalize its merger with Informa Tech’s Digital Businesses by December 2, 2024. Once complete, TTGT will benefit from an expanded digital advertisement and analytics footprint. This growth-focused company is actively diversifying revenue streams, making it a future stock to watch in the digital marketing space.

Autodesk (ADSK)

Price: $317.96 (-$1.43)

After reporting Q3 earnings above consensus with a $2.17 EPS (+$0.05), Autodesk remains a market leader in design and automation software. The company anticipates Q4 revenue between $1.62–$1.64 billion, highlighting modest growth in its subscription model.

Super Micro Computer (SMCI)

Price: $34.43 (-$3.98)

SMCI faced pressure today after announcing it prepaid and terminated loan agreements with Bank of America and Cathay Bank. While this debt reduction improves the balance sheet, immediate investor sentiment turned cautious.

Other Noteworthy Movers

Ambarella (AMBA) surged +27.1% on upside earnings guidance related to its AI inference processor products.

Urban Outfitters (URBN) delivered +6.3% revenue growth but hinted at soft consumer spending trends during the holiday season.

Nutanix (NTNX) reaffirmed strong 2025 guidance, remaining resilient amidst broader tech challenges.

More Growth Stocks to Watch

GTE (Gran Tierra Energy): A clear growth prospect in energy exploration.

RTX (RTX Corporation): Continues to secure large-scale defense contracts.

AMBA (Ambarella): Leveraging booming demand in AI-related tech.

TTGT (TechTarget): Positioned for digital advertising market expansion post-merger.

Autodesk (ADSK): A long-term contender in the SaaS space benefiting from recurring revenue models.

Macroeconomic Factors

President-elect Donald Trump’s tariff plans created ripples in the market. With a proposed 10% tariff on Chinese imports and a 25% tariff targeting Mexico and Canada, investors remain wary of inflationary pressures and supply chain disruptions. However, offsetting this are signs of cooling inflation. The upcoming economic reports—ranging from PCE data to Durable Goods Orders—will offer critical insights into consumer spending and business trends.

Stock Market Forecast

The near-term outlook suggests heightened volatility due to geopolitical uncertainty and end-of-year profit-taking. However, corporate fundamentals remain strong, with earnings momentum still intact across technology, defense, and retail sectors.

The S&P 500 and Nasdaq appear poised to close the year on a high note, given steady earnings despite macro pressures.

The Russell 2000, while trailing in recent sessions, may rebound as small caps benefit from improved sentiment on cooling inflation figures.

Defensive plays such as RTX, General Dynamics, and utilities could see increased investor interest as markets weigh recession risks into 2025.

Investors should stay disciplined amidst potential market corrections tied to tariffs and economic policy shifts. Growth stocks in energy, AI, and defense remain compelling opportunities, but portfolio diversification will be key for navigating 2025’s uncertain landscape.

Stay informed,

Stock Region Editorial Team

Disclaimer: This newsletter is not financial counsel. Trends and market conditions may evolve rapidly, impacting projections. Always consult trusted advisors for tailored financial strategies.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net