Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Tuesday, December 17, 2024.

Stock Region Market Briefing Newsletter - Tuesday, December 17, 2024

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Stock investments are inherently risky and may result in financial loss. Always consult a financial advisor before making investment decisions.

Market Headlines and Insights

Tech Sector Developments

Meta Platforms (META)

Meta has agreed to a $50 million settlement in Australia related to the misuse of Facebook data during the 2018 Cambridge Analytica scandal. This is the largest privacy settlement in Australian history. The company was also fined $263 million by Ireland’s Data Protection Commission (DPC) for a 2018 security breach affecting 3 million EU users.

Growth Stock Watch: Despite these challenges, Meta (META) continues investing in AI and metaverse technologies, which could fuel long-term growth. Its forward P/E ratio of 22.5 highlights investor expectations for future profitability.

Nvidia (NVDA)

Nvidia launched an affordable $249 AI device targeting small businesses and hobbyists. This is part of its effort to make AI more accessible and expand its customer base.

Growth Stock Watch: Nvidia’s commitment to democratizing AI makes it a strong growth prospect. NVDA’s revenue growth (+101% YoY) underscores its leadership in the AI chip market.

Google (GOOGL)

Google has pumped $90 million into Cassava Technologies to improve Africa's digital infrastructure. Alongside improving connectivity, this enhances Google's foothold in emerging markets.

Growth Stock Watch: Google’s strategic investment aligns with its $1 billion commitment to Africa’s digital future. Its diversified revenue streams and 20% annualized growth in cloud computing make it a standout.

Salesforce (CRM)

Salesforce plans to hire 2,000 new sales representatives as it prepares to expand its generative AI product lineup in February 2025.

Growth Stock Watch: With CRM’s forward revenue guidance targeting 11% growth and its expanding ecosystem of AI tools, Salesforce remains a top technology pick.

Global Economic Developments

TikTok (BYTEDANCE)

The European Union launched an investigation into TikTok over its alleged role in influencing Romania’s recent elections. TikTok faces potential penalties of up to 6% of global revenue if found in violation of EU regulations.

Asian Markets

Japanese Government Bonds saw slight declines as investors cautiously awaited the Bank of Japan’s policy meeting. Meanwhile, Asian currencies held steady, reflecting mixed global economic signals.

Energy and Commodities

Oil futures dipped slightly ahead of the Federal Reserve’s meeting amid expectations of an interest rate cut. On the other hand, European natural gas prices inched higher due to concerns over Russian supply disruptions through Ukraine.

Gold Market

Gold prices held steady as investors awaited the Federal Reserve’s interest rate decision, highlighting gold’s role as a safe-haven asset amidst economic uncertainty.

Corporate Updates

Alibaba (BABA)

Alibaba anticipates a $1.28 billion loss due to restructuring aimed at refocusing on its e-commerce core. The shift underscores the company’s strategy to compete more effectively with Chinese rivals.

Amazon (AMZN)

Amazon workers authorized a third strike, calling for better working conditions and aligning themselves with larger union movements across the U.S.

Volkswagen (VWAGY)

Volkswagen extended labor talks focused on cost-cutting measures as negotiations enter their second day without resolution.

Honda (HMC)

Honda’s shares dropped 2% following speculation over a potential merger with Nissan. The rumors have fueled market uncertainty about consolidation in the auto sector.

Carlsberg (CARLB.CO)

Carlsberg received approval for its $4.2 billion acquisition of Britvic, aimed at expanding its bottling operations across Western Europe.

Equinor (EQNR)

Equinor announced another promising oil and gas discovery in the North Sea, signaling its plans to continue exploration in the region.

Pharmaceutical Sector News

Pfizer (PFE)

Pfizer projected 2025 revenues in line with Wall Street’s expectations, signaling steady performance despite federal drug benefit challenges.

Bayer (BAYRY)

Bayer’s aflibercept drug showed positive results in a late-stage trial, which could lead to improved vision therapies for patients with retinal diseases.

Teva Pharmaceuticals (TEVA) and Sanofi (SNY)

New trial results for their IBD drug, Duvakitug, revealed it was well tolerated across diverse patient groups, bolstering hopes for regulatory approval and eventual market success.

Policy and Infrastructure

PG&E Corporation (PCG)

The federal government approved a historic $15 billion loan to PG&E to modernize California’s power grid and cut emissions.

SoftBank (SFTBY)

SoftBank announced a $100 billion U.S. investment in emerging technologies, potentially generating 100,000 jobs.

Consumer and Retail Updates

Walmart (WMT)

Walmart teamed up with China’s Meituan (3690.HK) to expand its e-commerce presence, aiming to capture a larger share of China’s competitive consumer market.

Bunzl (BNZL.L)

The U.K.-based distribution group warned investors of prolonged deflationary impacts on its earnings, reflecting broader economic pressures.

Guinness Shortage

British pubs are grappling with a Guinness shortage as its popularity reaches new heights. Supply chain challenges and soaring demand are contributing to these issues.

Other Major Headlines

Meta’s Growing Risks

The regulatory scrutiny around Meta expanded as the EU fined the company $263 million for past privacy flaws, underscoring long-term governance risks.

Corporate Scandals

Former Ozy Media CEO Carlos Watson was sentenced to nearly 10 years for investor fraud, stoking broader concerns around transparency in startups.

Geopolitical Tensions

The assassination of Igor Kirillov in a Moscow bombing allegedly involving Ukraine has added further strain to global security concerns.

Political Updates

AOC lost her bid for a top Democrat position on the House Oversight Committee, with Gerry Connolly taking the role in a closely contested vote.

Market Forecast

The global stock market remains delicate, reflecting mixed economic trends. Central bank decisions, particularly those of the Federal Reserve and the Bank of Japan, are set to influence equity market trajectory. Growth stocks in technology, green energy, and healthcare may continue to shine, especially with the renewed focus on artificial intelligence and infrastructure modernization.

Emerging challenges, such as geopolitical risks, regulatory scrutiny, and labor disputes, add layers of complexity to this market. However, sectors leveraging innovation—like Nvidia and Salesforce—offer robust opportunities for investors willing to manage volatility.

Growth Stocks to Watch

Nvidia (NVDA) for AI dominance.

Google (GOOGL) for its expansion in emerging markets.

Meta (META) for its metaverse and AI initiatives.

Pfizer (PFE) and Teva-Sanofi (TEVA, SNY) for emerging treatment pipelines.

Market Wrap-Up

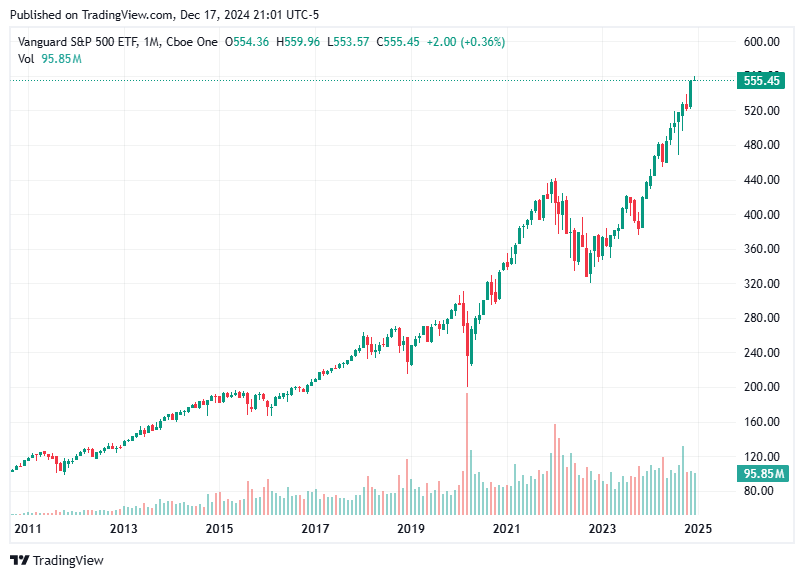

The U.S. stock market ended the day lower, with mixed performances across sectors and indices. The S&P 500 declined 0.4%, while the Nasdaq Composite dropped 0.3%. The Dow Jones Industrial Average fell 0.6%, and the Russell 2000, which tracks small-cap stocks, underperformed with a 1.2% decline. Despite today’s weakness, year-to-date performances remain robust, with the Nasdaq Composite leading at +34.0% YTD and the S&P 500 close behind at +26.9% YTD.

Chipmakers faced headwinds as the PHLX Semiconductor Index fell 1.6%, pressured by names like Broadcom (AVGO), which declined nearly 4%. However, Apple (AAPL) rose 1.0% to $253.48, and Tesla (TSLA) jumped 3.6% to $479.86, providing some support to the indices.

On the economic front, soft November retail sales and a dip in industrial production painted a cautious picture of consumer spending, especially as these figures were driven more by pricing increases than true demand. The 10-year Treasury yield dropped slightly to 4.38%, reflecting mild risk aversion in the bond markets.

Top News Stories

Alaska Air Introduces New Route

Alaska Air (ALK) [Price: $63.20 | -0.20] announced a new nonstop service between San Diego International and Washington D.C.'s Reagan National Airport. Alaska Air is now the only carrier to offer this direct route, boosting connectivity to the nation's capital.Cigna Secures Defense Health Agency Contract

Cigna (CI) [Price: $265.59 | -7.67] reported that its subsidiary Express Scripts was awarded a $670 million contract by the U.S. Defense Health Agency. This move may strengthen Cigna's foothold in the federal healthcare space, although the stock slid 2.8% amidst broader sector weakness.NVIDIA Unveils Affordable AI Supercomputer

NVIDIA (NVDA) [Price: $130.39 | -1.61] launched the Jetson Orin Nano Super, a cost-effective generative AI supercomputer aimed at disrupting the AI and automation space. Despite this innovative product, NVIDIA shares faltered today alongside broader semiconductor weakness.Seadrill Bags Lucrative Petrobras Contracts

Seadrill (SDRL) [Price: $37.31 | -0.31] announced two major drilling contracts in Brazil with Petrobras (PBR) worth nearly $1 billion. The contracts, starting in 2026, will deploy ultra-deepwater drillships for fields in the Santos Basin.Tesla Powers Ahead

Tesla (TSLA) [Price: $479.86 | +16.84] became a bright spot today, rallying 3.6% after reaffirming production targets for next year, driven by robust EV demand in Europe and North America—solidifying its growth stock credentials.HEICO Anticipates Growth in FY25

HEICO (HEI) [Price: $259.80 | -3.00] reported modest earnings growth, with fourth-quarter EPS topping estimates by $0.01. The company forecasts broader organic growth next fiscal year driven by strong demand for aviation and technology products.Enersys Adjusts EPS Guidance Upward

Enersys (ENS) [Price: $91.53 | -1.25] raised its fiscal 2025 adjusted EPS guidance to $9.65-$9.95, buoyed by tax credits from the Inflation Reduction Act. This represents optimism for renewable battery solutions despite broader market softness.Transocean Wins Indian Drilling Contract

Transocean (RIG) [Price: $3.67 | -0.06] gained a $111 million contract with Reliance Industries to drill in ultra-deepwater off India, adding to its growing international backlog.Vistra Expands Solar Operations

Vistra (VST) [Price: $138.77 | -5.56] connected new solar systems to the grid while extending operations at its Baldwin Power Plant to meet rising electricity reliability concerns.Mastercard Share Buyback Program

Mastercard (MA) [Price: $531.01 | +0.70] approved a $12 billion share repurchase program and announced a 15% dividend increase, signaling confidence in its financial health.

More Growth Stocks to Watch

NVIDIA (NVDA) continues to lead in the AI and semiconductor revolution with its latest affordable generative AI supercomputer product. Despite recent pressure on chipmakers, its innovative edge makes NVDA a long-term growth contender.

Tesla (TSLA) surges ahead with strong EV demand, robust production plans, and leadership in the clean-energy revolution. The company remains a top pick for those seeking exposure to sustainable tech.

Microsoft (MSFT) [Price: $454.46 | +0.6%] and Apple (AAPL) are worth monitoring due to their dominance in the cloud and consumer tech markets. Microsoft, particularly, stands out for its aggressive AI integrations, including cloud partnerships with OpenAI.

Enersys (ENS) deserves consideration for its role in powering clean energy infrastructure, supported by favorable government incentives under the Inflation Reduction Act.

Applied Digital (APLD) [Price: $9.69 | -0.32] is pioneering high-performance computing centers, aligning well with the rise of data-intensive AI solutions.

Economic Data Review

The market digested several key economic reports today, providing a snapshot of current conditions:

Retail Sales (November): Up 0.7% overall and just 0.2% ex-auto, reflecting weak volume-based demand.

Industrial Production: Contracted again at -0.1%, missing expectations of a modest rebound.

Capacity Utilization: Dropped to 76.8%, indicating continued softness in industrial activity.

Looking ahead, all eyes will be on tomorrow’s November Housing Starts, Building Permits, and the trajectory of Oil Inventories for any signs of stability.

Stock Market Forecast

The market appears poised for an uncertain near-term trajectory as it navigates mixed economic signals, geopolitical concerns, and pockets of sector-level volatility. While tech stocks like NVIDIA and Tesla offer robust growth opportunities, industrials and small caps face potential headwinds as interest rate uncertainties linger.

Investors should also watch for central bank commentary and inflation updates heading into 2025. Volatility may persist amid lukewarm retail spending and tepid industrial output. However, the broader S&P 500 is expected to hold its uptrend into the new year, supported by sectoral leadership in technology and renewable energy.

Long-term investors should remain patient and focus on high-quality names with solid earnings growth and innovative product offerings, particularly in technology, energy, and healthcare.

Disclaimer: All data and opinions shared in this newsletter are for educational and informational purposes only. Past performance does not indicate future results. Always research investments thoroughly or consult with a financial advisor before making any investment decisions.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net