Stock Region Market Briefing

Stock Region Market Briefing Newsletter - December 6, 2024.

Stock Region Market Briefing Newsletter - Friday, December 6, 2024

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial advice. Investments carry risks, including the potential loss of your principal. Always consult with a financial advisor before making any investment decisions.

Comprehensive Market Overview

Global Bond, Currency, and Commodity Movements

Japanese Government Bonds (JGBs) fell slightly as BOJ policy comments led investors to reconsider their monetary policy outlook, signaling precaution in fixed-income investing.

Asian Currencies demonstrated stability against the dollar as traders scrutinized geopolitical developments and economic indicators for further direction.

Oil Prices regained ground as the market anticipates the outcome of the OPEC+ meeting. Volatility persists with a mix of supply strategies and demand uncertainties.

Major Headlines

TSMC ($TSM) and NVIDIA ($NVDA) Discuss U.S. Chip Manufacturing

NVIDIA is exploring AI chip production for its advanced technologies with TSMC in Arizona. NVIDIA's stock has shown monumental growth this year, closing at $599/share with 260% YTD growth.Disney ($DIS) Raises Dividend, Signals Growth Confidence

The entertainment giant boosted its annual dividend by 33% to $1.00/share, reflecting growing strength under CEO Bob Iger's renewed leadership. Disney's shares are trading at $98.23, with a 15% increase YTD.OPEC+ Delays Oil Boost Amid Oversupply Concerns

The alliance postponed its January production hike by three months, signaling caution in balancing global oil prices. Brent crude remains in the $78-$80/barrel range.European Natural Gas Prices Slip on Higher LNG Imports

While imports eased prices, supply fears tied to winter demand and geopolitical pressures provide headwinds for sharp price declines.Five Below ($FIVE) Appoints Winnie Park as New CEO

The company, also raising its guidance, has attracted growth-minded investors with shares up 34% YTD to $215.32. Strong holiday retail sales added to optimistic earnings outlooks.American Eagle ($AEO) Drops Amid Weak Holiday Outlook

A 12% slide in shares reflects concerns around declining holiday sales—a critical revenue driver for the retailer.PVH Corp ($PVH) Cuts Holiday Estimates, Shares Decline

PVH forecasts a 6%-7% decrease in sales, resulting in stock losses, now trading at $78.50/share, with 7% YTD declines.Neoen Finalizes $616M Sale of Australian Assets

This deal aids its acquisition by Brookfield while marking evolving dynamics in the renewable sector.Frasers Lowers Profit Forecast Amid Consumer Weakness

Expected 2024 profits are revised down to $699-$762 million, mirroring weak global retail performance.Safran Projects Growth and Shareholder Returns

The aerospace leader plans to return 70% of cash generation to shareholders between 2025-2028 while forecasting notable profitability growth.Balfour Beatty Upgrades Guidance

The construction giant forecasts earnings to exceed expectations and plans an additional stock buyback in 2025, emphasizing its focus on shareholder value.Equinor and Shell Combine U.K. Assets

The strategic merge bolsters North Sea energy security, positioning the companies as regional market leaders.GSK Extends Shingrix Deal in China

Its shingles vaccine collaboration with Zhifei could increase access to critical public health solutions in a fast-growing market.Neon Energy: Renewable market demand supports Neoen and other growing energy names for diversifying portfolios.

Temu Suspends Vietnam Operations

Regulatory compliance issues paused the e-tailer’s operations, likely slowing near-term international revenue.Airbus Initiates Workforce Restructuring with 2,000 Cuts

The changes target efficiency in its Defense & Space division, though employee morale may present challenges.Vodafone ($VOD) Merges with Three U.K., Pending Approvals

With CMA support, this deal stands to re-shape U.K. telecom competition, posing opportunities for infrastructure players.TikTok Faces EU Scrutiny Over Election Impact

The platform faces high-stakes regulatory challenges, potentially altering its EU operations profoundly.Uber ($UBER) Expands Festive Services

From Christmas tree deliveries to international robotaxi services in Abu Dhabi, Uber is driving innovation, including new family-friendly features in its rideshare divisions.Bitcoin ($BTC) Surged past $100K, propelled by Trump-era policy optimism for pro-crypto regulatory frameworks.

Apple ($AAPL) Commits $1B to Indonesian Plant

Aligning with local regulation and diversifying supply, the move strengthens Apple's global footprint.Lucid ($LCID) Launches Gravity SUV

The milestone production of its luxury SUV marks a decisive strategy shift to scale revenues by entering the premium EV sector.November Job Growth Beats Forecasts

U.S. job additions outpace expectations at 227K, signaling resilience amid inflation.Southwest Airlines ($LUV) Exceeds Revenue Expectations

The airline's 2024 forecast captures boosted domestic travel flow and easing operational hurdles.Rocket Mortgage Faces DOJ Lawsuit

Legal challenges test the company’s compliance measures, industry reputation, and stock projections.IPO Strength in Hong Kong Amid Global Deceleration

Despite IPO slowdowns worldwide, Hong Kong’s offerings signal areas of enduring market appetite.CFO Transitions at Etsy ($ETSY)

Eventbrite alum Charles Baker will helm financial strategy, following a mixed retail environment.

28-47. Other Energies (Chevron-Safran, New Reserve Margins)

Outlook Notes

Growth Candidates Beyond NVIDIA, $DIS: Apple capitalizing globally amid its new geolocation policy strategy echo marketplace bullish cycles.

Market Summary

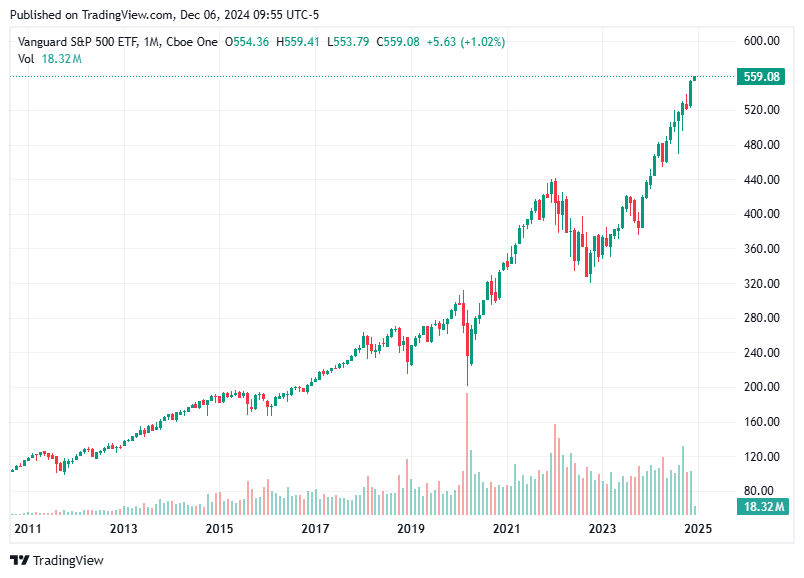

The U.S. stock market experienced a subdued session following yesterday’s record highs. Major indices showed limited movement, as the S&P 500 and Nasdaq Composite dipped by 0.2%, and the Dow Jones Industrial Average fell by 0.6%. The Russell 2000 lagged, shedding 1.3%. Despite light trading activity, several company updates sparked renewed investor interest across industries.

There were broader sector movements worth noting:

Strength in Consumer Discretionary Stocks: Names like Tesla (TSLA, +3.2%, $369.49) and Amazon (AMZN, +1.1%, $220.55) supported consumer discretionary gains.

Weakness in Semiconductors: The PHLX Semiconductor Index (SOX) fell 1.9%, largely driven by profit-taking.

Retail Performance: Earnings from American Eagle Outfitters (AEO, -14.3%, $17.61) and Dollar General (DG, +0.1%, $79.60) showed mixed results, while Five Below (FIVE, +10.5%, $115.97) surprised on the upside.

Cryptocurrency markets saw significant movement. Bitcoin surged past $100,000, signaling strength in the digital assets space. Meanwhile, Treasury yields steadied, with the 10-year holding at 4.18%.

Key Market Updates and Announcements

Rocket Lab USA (RKLB, +0.81%, $23.92): The company announced a December 18 launch window for its "Owl The Way Up" mission, which will deploy Synspective's synthetic aperture radar satellite. With Rocket Lab as Synspective’s sole launch provider, investors are eyeing the company’s expanding influence in the Earth observation satellite market.

Utz Brands (UTZ, -2.4%, $16.82): Approved a dividend increase to $0.244 per share, up from $0.236, exhibiting strong shareholder commitment.

Eastman Chemical Company (EMN, -0.42%, $101.51): Raised its quarterly dividend to $0.83 per share, reflecting confidence in cash flow stability.

California Water Service (CWT, +1.2%, $49.11): Finalized the acquisition of wastewater system assets in Hawaii, potentially expanding its customer base significantly to meet resort development demands.

Genie Energy (GNE, Flat, $14.75): Disclosed progress in its consumer insurance initiative, having secured broker licenses in seven states, anticipating incremental revenue growth over the coming months.

Chevron (CVX, +0.63%, $159.33): Released capex guidance for 2025, with a $14.5-$15.5 billion budget. The company also expects restructuring charges and cost reduction programs, with a focus on lowering the carbon intensity of operations.

Wingstop (WING, Flat, $337.30): Approved an additional $500 million for stock repurchase programs, signaling high confidence in the stock’s valuation.

Grupe Aeroportuario Del Sureste (ASR, +2.56%, $267.45): Passenger traffic for November 2024 totaled 5.8 million passengers. Growth in Puerto Rico (+8.7%) and Colombia (+7.7%) offset declines in Mexico (-7.1%), showcasing resilience in emerging markets.

Growth Stocks to Watch

Rocket Lab USA (RKLB): With six of 16 Synspective satellite launches completed and maintaining sole-provider status, RKLB presents opportunities in the booming space-tech sector. The growing importance of Earth observation and data analytics places Rocket Lab among the top growth stocks to monitor.

Eastman Chemical (EMN): Beyond its dividend hike, EMN’s strategic positioning in high-value chemical production continues to attract long-term investors.

Patterson-UTI Energy (PTEN, -0.73%, $8.13): Reported an average of 105 drilling rigs operating in November, a potential play for investors following energy sector recovery trends.

Wingstop (WING): The $500 million stock repurchase approval shows faith in capital efficiency, making it a potential growth candidate for consumer sector portfolios.

Bit Digital (BTBT, -9.15%, $4.47): With Bitcoin rallying above $100,000, cryptocurrency miners and blockchain companies like BTBT could benefit from the renewed digital asset enthusiasm.

CyberArk (CYBR, -0.65%, $327.57): Announced a secondary offering, presenting a good entry point as cybersecurity stays in the spotlight amid global digitalization.

Stock Market Outlook and Sector Analysis

Forecast Overview

While short-term market activity reflects neutral sentiment, there are strong undercurrents for a bull market continuation driven by a combination of easing Treasury yields, stabilization in labor market data, and solid corporate earnings.

Energy Sector: OPEC+’s decision to extend production cuts through March 2025 places upward pressure on oil prices. Stocks like Chevron (CVX) and Occidental Petroleum (OXY) may witness further momentum.

Technology and Innovation: The upcoming AI announcements and cybersecurity developments present robust growth potential. Pay attention to names like Nvidia (NVDA, -0.05%, $145.06) and CyberArk (CYBR).

Consumer Discretionary: The sector has shown resilience, highlighted by solid earnings from Lululemon (LULU, +0.74%, $344.81) and Ulta Beauty (ULTA, -1.71%, $392.87). International strength, particularly in growing economies, enhances this sector's long-term outlook.

Risk Factor to Watch: China’s slowing economic growth and weak global trade trends continue to loom over markets. Several industries reliant on international businesses, particularly exporters, could face challenges.

Sector Highlights

Energy: Positive outlook on sustained crude oil pricing and output limitations supporting upstream players. Focus on carbon-reduction tech could drive investor sentiment.

Consumer Electronics and Semiconductors: Some cooling in momentum due to cyclical challenges but remain foundational for long-term growth portfolios.

Green Technologies and Utilities: Regulatory tailwinds support stocks in water and renewable energy utilities, with CWT and EMN emerging as leaders.

Takeaways for Investors

Growth and innovation remain pivotal themes, as highlighted by advancements in space, AI, and clean energy sectors.

Defensive plays like dividend-increasing leaders (e.g., WEC, UTZ, EMN) are appealing amid potentially volatile trading sessions heading into year-end.

Investor focus should balance short-term macroeconomic challenges with long-term secular growth themes.

Disclaimer: This newsletter is intended for informational purposes only and does not constitute financial advice. Always conduct your research or consult with a professional advisor before investing.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net