Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Monday, July 14, 2025 | Time: 8:00 PM ET

Stock Region Market Briefing Newsletter - Monday, July 14, 2025 | Time: 8:00 PM ET

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making investment decisions. Stock markets are inherently risky, and past performance is not indicative of future results.

Market Recap: Resilience Amid Tariff Tensions

The stock market showcased its trademark resilience today, shaking off early losses triggered by tariff concerns. A proposed 30% tariff on the EU and Mexico, set to begin August 1, initially weighed on sentiment. However, optimism surrounding potential trade negotiations helped the major indices recover.

The Nasdaq hit a new record high, buoyed by strength in mega-cap tech stocks like Alphabet (GOOG, +0.8%) and Meta Platforms (META, +0.5%). Meanwhile, the S&P 500 eked out a modest gain of +0.1%, and the Russell 2000 outperformed with a +0.5% rise.

Energy stocks were the day’s laggards, with the sector falling -1.2% as oil prices dropped 2.3% to $66.90 per barrel. On the flip side, financials (+0.7%) and communication services (+0.7%) led the charge, with Netflix (NFLX, +1.26%) gaining ahead of its earnings report later this week.

Key Corporate Updates

Equity Bancshares (EQBK, +2.52%)

Equity Bancshares reported Q2 net income of $15.3M, or $0.86 per diluted share. Adjusted earnings came in at $0.94 per share, reflecting strong performance despite merger-related expenses. The stock closed at $44.00, up $1.08.

Opinion: EQBK’s focus on expanding its net interest margin is a positive sign for long-term growth. Investors seeking exposure to regional banks may want to keep an eye on this one.

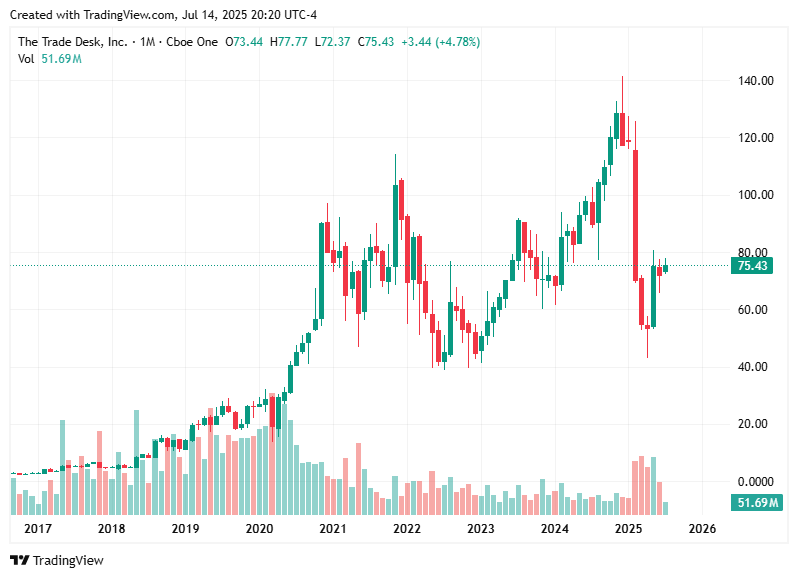

The Trade Desk (TTD, +1.45%)

Big news for The Trade Desk as it prepares to join the S&P 500, replacing ANSYS (ANSS). This milestone reflects TTD’s growing influence in the digital advertising space.

Opinion: TTD’s inclusion in the S&P 500 could attract institutional investors, potentially driving further upside. With its innovative programmatic advertising platform, TTD remains a growth stock to watch.

Magnite (MGNI, +2.39%)

Magnite announced a partnership with Paramount (PARA) Australia to provide programmatic access to Paramount+’s premium streaming inventory. This move positions Magnite as a key player in the ad-supported streaming revolution.

Opinion: As streaming platforms increasingly adopt ad-supported models, Magnite’s technology could see significant demand. Growth-oriented investors should monitor MGNI closely.

Cavco Industries (CVCO, +0.59%)

Cavco Industries is acquiring American Homestar Corporation for $190M in cash. The deal will add 1,676 homes to Cavco’s portfolio and is expected to close in FY 2026.

Opinion: With the housing market showing signs of stabilization, CVCO’s strategic acquisition could bolster its market share. This is a solid pick for those bullish on the manufactured housing sector.

Darden Restaurants (DRI, +0.07%)

Darden announced a partnership with Recipe to expand Olive Garden across Canada. This move underscores Darden’s commitment to international growth.

Opinion: Olive Garden’s family-friendly appeal could resonate well in Canadian markets. DRI’s steady dividend and growth potential make it a compelling choice for long-term investors.

Growth Stocks to Watch

The Trade Desk (TTD): With its S&P 500 inclusion and strong fundamentals, TTD is a standout in the digital advertising space.

Magnite (MGNI): Positioned to benefit from the shift to ad-supported streaming.

Netflix (NFLX): Earnings this week could provide insights into its ad-supported tier’s performance.

Cavco Industries (CVCO): A play on the affordable housing trend.

Neurocrine Biosciences (NBIX): Promising Phase 3 data for its CAHtalyst studies could drive further gains.

Market Forecast

The stock market’s resilience in the face of tariff concerns is a testament to its underlying strength. However, this week’s economic data—June CPI, PPI, and Retail Sales—will be critical in shaping investor sentiment.

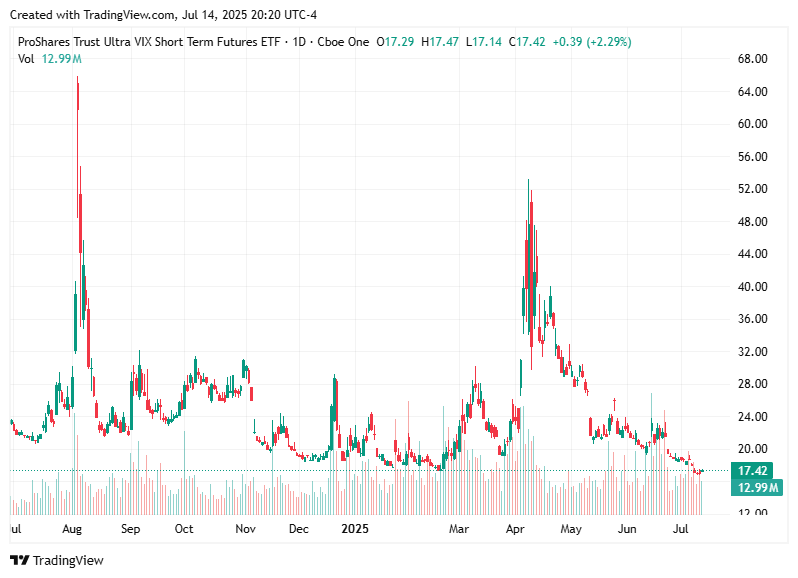

Short-Term Outlook: Expect volatility as markets digest inflation data and earnings reports from major banks like JPMorgan (JPM) and Wells Fargo (WFC).

Long-Term Outlook: The tech sector remains a bright spot, with mega-cap stocks leading the charge. However, rising geopolitical tensions and potential rate hikes could pose challenges.

🚀 Top Headlines in Focus

Bitcoin Smashes Past $121,000 as AI and Crypto Take Center Stage

Bitcoin (BTC-USD) has reached a remarkable milestone, trading at $122,000 and boasting a market cap that just surpassed Amazon (AMZN). This surge was accompanied by $615M in liquidated crypto short positions in the last 24 hours. EMJ Capital’s Eric Jackson predicts Ethereum (ETH-USD) could touch $1.5M, reflecting newfound bullish sentiments across the crypto universe.

Key developments driving interest include Coinbase’s (COIN) upcoming Base update, Sonic’s anticipated AI product launch, and Wormhole’s $60B+ cross-chain volume milestone. Wormhole’s momentum, backed by major investors like Jump and Coinbase Ventures, signals a critical turning point in institutional crypto adoption.

Our Take

This historic Bitcoin run isn’t just about the cryptocurrency itself but also about its growing entwinement with cutting-edge technologies like AI. SpaceX’s $2B investment in Elon Musk’s xAI further cements this dynamic. For investors looking to ride the wave, companies like Coinbase, Nvidia (NVDA), and MicroStrategy (MSTR), heavily tied to crypto and AI, deserve a closer look.

Growth Stock to Watch: Nvidia (NVDA) – With its crucial role in both AI and blockchain solutions, Nvidia continues to be a dominant force across two disruptive industries.

Global Geopolitical and Economic Shifts

Middle East Escalations: Iranian and Israeli conflicts have hit the global stage with accusations of bombings and retaliatory strikes. This geopolitical tension already impacts oil markets, with renewed volatility expected in the near term.

China-US Trade Tensions Ease: China’s export surge in June highlights a potential thaw in the trade war. Simultaneously, China approved a $35B deal with Synopsys (SNPS) for chip software, signaling a reprieve in supply chain struggles that could benefit companies like Intel (INTC) and AMD (AMD).

European Concerns: EU stocks dipped amid renewed tariff fears from former President Trump, adding a layer of uncertainty for the Eurozone economy. Germany’s export-heavy sectors, including automakers like Volkswagen (VWAGY), face mounting challenges.

Thoughts: The easing of the US-China trade war offers relief but is no cure-all. Investors may find opportunities in companies likely to benefit directly, such as Tesla (TSLA), which relies on Chinese supply chains, and chip leaders like ASML (ASML).

Growth Stock to Watch: ASML Holding (ASML) – A key maker of semiconductor equipment, ASML is poised to benefit from renewed chip trade between the US and China.

Super Drones Revolutionizing Industry

From high-speed, camouflaged military drones to swarm-capable industrial models, these new “Super Drones” are propelling us into a sci-fi-like reality. Key players like Lockheed Martin (LMT) and startups specializing in autonomous tech stand to dominate this evolving space.

Why It Matters

Autonomous systems have applications far beyond warfare. They’re proving to be essential for sectors such as agriculture, logistics, and construction. Rising R&D in this field could spur groundbreaking partnerships, making companies like Boeing (BA) or General Motors (GM), which actively explore drone technologies, potential winners.

Growth Stock to Watch: Lockheed Martin (LMT) – Already an innovator in defense technologies, Lockheed’s progress in autonomous systems places it ahead of the curve.

A Mixed Outlook with Hidden Opportunities

The S&P 500 is expected to face unease as geopolitical and economic uncertainties weigh on global markets. European equities may continue to lag as tariff threats and bureaucratic red tape stifle growth. Meanwhile, American markets could find a rallying point in tech-related sectors driven by advancements in AI and blockchain.

Cryptocurrencies are setting the tone for speculative investments. A potential Bitcoin rally to $200K, as hypothesized by market analysts, might invigorate blockchain stocks. Similarly, AI-focused corporations like Alphabet (GOOGL), Meta (META), and Palantir Technologies (PLTR) are poised to lead because of their cutting-edge innovations and demand for automation.

Our Take

Stay nimble. While the broader market might seem uncertain, focusing on innovation-heavy industries can be a winning strategy. Keep an eye on high-growth opportunities in tech, AI, and clean energy, which are expected to outperform traditional sectors in the coming months.

📌 Upcoming Dates to Watch

July 14: Huma Finance 2.0 Deposits

July 15: Trader Joe’s Token Mill V2 Release

July 16: Coinbase’s Base Update and Sonic AI Launch

July 18: $868M TRUMP Crypto Unlock

💡 Have thoughts or questions? Respond to this email or connect with us on social media!

Stay Ahead. Stay Invested.

Stock Region

Disclaimer: This newsletter is not a recommendation to buy or sell any securities. Always conduct your own research or consult a financial advisor.