Stock Region Market Briefing

📈 Stock Region Weekly Market Briefing - Friday, July 18, 2025 | Time: 7:00 PM ET.

📈 Stock Region Weekly Market Briefing - Friday, July 18, 2025 | Time: 7:00 PM ET

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and not financial advice. Always consult with a financial advisor before making investment decisions.

Market Wrap-Up: A Week of Highs, Lows, and Everything in Between

Hello, Stock Region family!

What a rollercoaster week it’s been! From record highs to some gut-wrenching sell-offs, the market kept us on our toes. Let’s dive into the highlights, the heartbreaks, and the hidden gems you need to know about.

🏆 This Week’s Top Gainers

Some stocks soared to new heights, leaving investors grinning ear to ear. Here are the week’s biggest winners:

Healthcare:

Mesoblast Limited (MESO): +41.22% ($15.69) – A strong clinical trial update sent this biotech darling flying.

Solid Biosciences (SLDB): +22.72% ($6.46) – Gene therapy optimism continues to fuel gains.

Industrials:

GrafTech International (EAF): +39.11% ($1.41) – A surprise earnings beat and upbeat guidance lit up this graphite electrode producer.

Consumer Discretionary:

Ethan Allen Interiors (ETH): +18.54% ($33.63) – A home décor revival is in full swing.

Baozun Inc. (BZUN): +18.39% ($3.09) – E-commerce in China is heating up again.

Information Technology:

Domo Inc. (DOMO): +19.08% ($16.36) – Cloud analytics is the gift that keeps on giving.

Financials:

B. Riley Financial (RILY): +26.53% ($5.44) – A strong quarter and strategic acquisitions are paying off.

💔 This Week’s Top Losers

Not every stock had a happy ending this week. Here are the ones that took a tumble:

Healthcare:

CareDx (CDNA): -40.71% ($11.94) – Ouch! Regulatory setbacks hit hard.

Sarepta Therapeutics (SRPT): -22.86% ($14.02) – A disappointing FDA update sent shares spiraling.

Energy:

PBF Energy (PBF): -14.69% ($24.44) – Falling oil prices weighed heavily.

Consumer Discretionary:

International Game Technology (IGT): -20.45% ($14.43) – A weaker-than-expected earnings report spooked investors.

📊 Market Recap: A Flat Finish to a Wild Week

The major indices flirted with record highs early in the week, only to end on a flat note. The S&P 500 closed unchanged, while the Nasdaq eked out a modest 0.1% gain. The Dow Jones Industrial Average (DJIA) lagged slightly, down 0.2%.

Key Drivers:

Earnings Season: Companies like Netflix (NFLX, -5.1%) and American Express (AXP, -2.4%) reported solid results but faced “sell the news” pressure.

Housing Data: June housing starts and permits beat expectations, but single-unit starts declined, highlighting ongoing affordability issues.

Consumer Sentiment: The University of Michigan Consumer Sentiment Index hit a five-month high, signaling cautious optimism.

Sector Performance:

Winners: Consumer Discretionary (+1.0%), Utilities (+1.7%)

Losers: Energy (-1.0%), Healthcare (-0.6%)

📈 Growth Stocks to Watch

Looking for the next big thing? Here are some growth stocks that caught our eye this week:

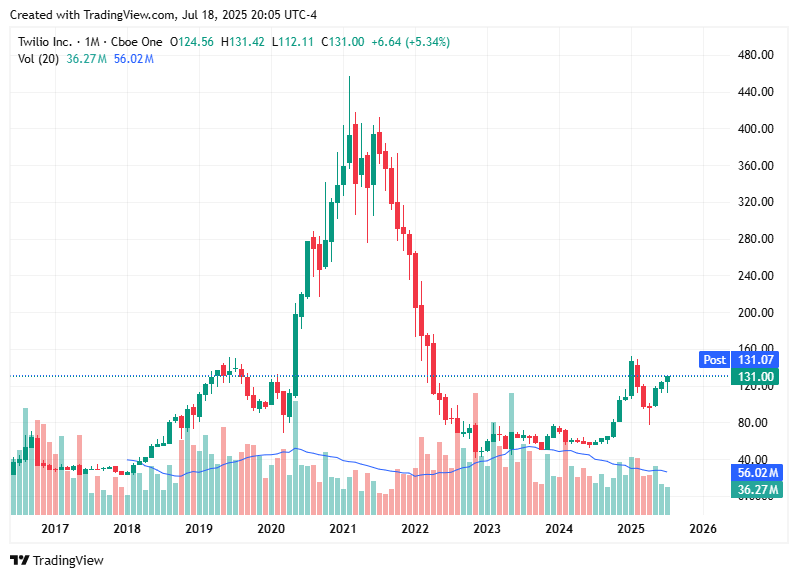

Twilio (TWLO) – Up 15.61% this week, this cloud communications platform is riding the wave of digital transformation.

Brookfield Renewable Partners (BEP) – With a $1 billion investment in Isagen, BEP is doubling down on renewable energy.

Domo Inc. (DOMO) – A leader in cloud analytics, Domo is well-positioned for long-term growth.

🔮 Stock Market Forecast

The market’s mood is cautiously optimistic as we head into next week. Here’s what to watch:

Earnings Season Continues: Heavyweights like Tesla (TSLA) and Microsoft (MSFT) are set to report.

Fed Watch: All eyes are on the July FOMC meeting. While a rate cut seems unlikely, any dovish signals could spark a rally.

Economic Data: Key reports on jobless claims and consumer spending will provide more clues about the economy’s health.

Our Take: The market is in a “wait and see” mode. While the S&P 500 and Nasdaq are near record highs, the Russell 2000’s underperformance suggests caution. Stick to quality names and keep some cash on hand for buying opportunities.

This week reminded us of the market’s unpredictability. Whether you’re celebrating gains or licking your wounds, remember: investing is a marathon, not a sprint. Stay informed, stay diversified, and stay the course.

What do you think of this week’s market action? Let us know your thoughts, and don’t forget to share this newsletter with your fellow investors!

📈 This Week's Top Market Updates

Sarepta Therapeutics' Turmoil - Ticker: SRPT

Sarepta Therapeutics (SRPT) took a massive hit on Friday, with shares plummeting over 30% amid reports linking its gene therapy treatment, Elevidys, to three patient deaths. The FDA is likely to request a halt on shipments, casting a shadow over the company's long-term prospects.

Market Insight: Volatility like this can be brutal, especially for biotech firms where one regulatory hiccup can snowball. While risk-averse investors might sidestep SRPT for the time being, speculative investors could watch closely for potential buy-back opportunities following any meaningful resolution with the FDA.

Netflix's AI Leap - Ticker: NFLX

Netflix (NFLX) continues evolving, integrating generative AI into its production workflows. The company anticipates substantial revenue growth, fueled by strong subscriber retention amidst a weakened dollar.

Key Stats:

Q2 revenue (2025): $8.1 billion (up 4% YoY)

Subscriber base now exceeds 250 million globally

On Our Radar: Netflix may surprise the market by pioneering AI-driven content recommendations that could set a new industry standard. For investors, this strategic use of AI positions them as a leader, particularly as media competition intensifies.

AI Start-up Valuation - Perplexity Hits $18 Billion

AI start-up Perplexity is the latest unicorn to shatter expectations, achieving a stellar valuation of $18 billion in its most recent funding round, led by marquee investors.

Opinion Corner: It’s fascinating to see start-ups like Perplexity gain traction while even giants like Meta (META) face mounting AI R&D expenses. Keep an eye on late-stage investments in AI-focused firms or diversified ETFs with significant AI exposure.

NVIDIA (NVDA)

Closing Price (7/18): $510.89

The company remains a juggernaut in AI and recently signaled its expansion in robotics during commentary by CEO Jensen Huang.

Takeaway: NVIDIA isn’t just enabling the future of AI; they’re shaping it. With novel applications like humanoid robots breaking onto the scene, expect NVDA to keep pushing boundaries.

Google (GOOG)

Recent $25B investment into U.S. data centers is a firm statement about AI dominance. This push towards AI-enhanced hydropower innovation showcases Alphabet's commitment to sustainable and scalable solutions.

ServiceNow (NOW)

Current Headlines? Sure—but keep a broader view. Despite antitrust scrutiny around its Moveworks acquisition, ServiceNow continues to enhance workflow optimization. If they emerge unscathed, expect deeper growth into corporate automation.

Trump Signs GENIUS Act

President Donald Trump’s passage of the GENIUS Act aims to innovate how stablecoins are governed in the U.S., opening massive potential for institutional crypto adoption. Wall Street and retail investors alike buzz with speculation—could this undiscovered momentum eventually match Ethereum’s (ETH-USD) disruptive moments?

Housing Drama - Will This Impact the Fed?

Jerome Powell faces criticism over a $2.5 billion headquarters project amidst a scathing accusation from U.S. Director of Federal Housing, Bill Pulte. Labeling Powell’s actions "economic warfare," Pulte’s remarks bring the Fed's decision-making philosophy under scrutiny.

How to Navigate: Rate-sensitive sectors like housing (think Lennar Homes LEN) might offer clues depending on Powell’s rebuttal. While the housing market remains complex, it’s certainly worth watching for stern moves against inflationary implications.

Short-Term View

The NASDAQ Composite and S&P 500 wrapped up the week on a flat note, oscillating between enthusiasm over tech-sector bloodlines (such as AI advancements) and ongoing recessionary concerns.

Key data to watch next week:

Q2 earnings announcements from Tesla (TSLA), Bank of America (BAC), and others.

U.S. jobs reports on Thursday—expected slight uptick in job creation that could influence Fed’s rate trajectory.

Long-Term View

Despite interim volatility, both tech resilience and speculative booms (stablecoins, AI, and green energy) suggest a recoverable medium-term trajectory. However, diversification remains key—pairing traditional stalwarts with emerging disruptors ensures both balance and growth potential.

Join our Stock Region Premium Member Community today! Get real-time market updates, personalized stock analysis, and access to webinars with top financial experts. Don’t miss out on opportunities to grow your portfolio—sign up now.

Until next time,

The Stock Region Team

Disclaimer: The information provided is for educational purposes only and should not be considered financial advice. Always do your own research or consult a professional before making investment decisions.