Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Wednesday, December 4, 2024.

Stock Region Market Briefing Newsletter - Wednesday, December 4, 2024

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The content in this newsletter is provided for informational purposes only and should not be considered financial or investment advice. Always consult with a certified financial advisor before making investment decisions.

Headlines and Market Drama

1. UnitedHealth Group Faces CEO Tragedy

UnitedHealth Group (UNH), the largest private health insurer, canceled its investor day after insurance division CEO Brian Thompson was tragically killed in Manhattan. This unexpected event introduces leadership uncertainty at a time when UNH has been performing strongly, with a market cap of $540 billion and consistent revenue growth of over 12% year-over-year.

Impact on Stock: Short-term volatility expected. Long-term growth tied to Medicare and expanding healthcare markets remains intact.

2. Amazon Lawsuit Over Prime Delivery

Amazon (AMZN) is under fire from Washington D.C.’s Attorney General over claims that it excluded two ZIP codes from Prime’s expedited delivery service. With 48,000 customers allegedly affected, this lawsuit could dent Amazon’s reputation for equal service access.

Impact on Stock: Amazon recently reported YoY revenue growth of 11% and should weather this potential fine.

Growth Stock to Watch: Check related logistics stocks like FedEx (FDX) or UPS (UPS) that could benefit from external delivery demand.

3. Private Payrolls Growth Slows, Wages Rise

Data from ADP shows private-sector job growth slowed to 146,000 in November, while wages increased 4.8%, marking the first uptick in over two years.

Market Impact: Wage growth pressures could elevate inflation concerns, potentially influencing Federal Reserve policy.

Sector Winners: Healthcare and education were the strongest job creators. Look at opportunities in Tenet Healthcare (THC) and Chegg (CHGG).

4. Foot Locker Shares Tumble Amid Weak Holiday Demand

Foot Locker (FL) shares fell 15% after reporting weaker-than-expected holiday sales and lowered guidance. The sneaker retailer faces steep promotional activity and heightened competition.

Impact on Stock: Foot Locker is down 42% YTD. Long-term investors may focus on structural business changes.

Growth Stocks to Watch: Nike (NKE), as an industry leader, holds resilience and may attract value-driven consumers in lean periods.

5. GM and EVgo Celebrate EV Charging Milestone

General Motors (GM) and EVgo (EVGO) announced the completion of 2,000 EV charging stalls as part of their nationwide rollout. With installation progress in metro markets like California and Texas, this partnership reinforces the push for clean transportation.

Growth Potential: EVgo aims to expand services while GM evolves its EV strategy for mainstream adoption.

6. Nuclear Energy Gains Momentum with Meta's Plans

Meta Platforms (META) has unveiled plans to partner with nuclear energy firms to address its energy-intensive AI ambitions. This aligns with tech peers like Alphabet (GOOGL) and Microsoft (MSFT).

Growth Stocks to Watch: Look into NuScale Power (SMR), a leader in small modular reactor technologies, and uranium miners like Cameco (CCJ).

7. Bitcoin Hits $100,000 Milestone

Bitcoin reached a historic $100,000 per unit, boosted by market confidence in Trump’s incoming administration and his pro-crypto regulatory stance.

Sector Impact: Blockchain-related stocks like Marathon Digital (MARA) and Coinbase (COIN) could see increased investor interest.

8. Tesla Faces Pressure in China

Tesla (TSLA) reported a 4.3% drop in China-made car sales for November due to surging competition from domestic players.

Market Impact: This decline may spur Tesla to refine pricing strategies or innovate further. Investors eye EV sector leaders like XPeng (XPEV) and BYD (BYDDF) for regional advantage.

9. JetBlue Raises Revenue Outlook

JetBlue (JBLU) increased its full-year guidance, citing stronger post-election travel demand and consumer confidence.

Growth Opportunity: The airline’s adaptability highlights a renewed optimism in travel stocks, with Southwest Airlines (LUV) and Delta Air Lines (DAL) also well-positioned for growth.

10. Chipotle’s Price Hike Amid Inflation

Chipotle (CMG) raised prices by 2%, citing increased input costs. Despite inflationary pressure, the chain’s customer loyalty remains strong.

Growth Insight: Chipotle’s focus on digital sales and exclusive menu offerings reinforces its leadership in the fast-casual market. Watch comparable players like Wingstop (WING) and Shake Shack (SHAK).

Stock Market Forecast

The S&P 500 and Nasdaq are expected to experience sectoral rotation as inflation-sensitive industries like consumer discretionary and utilities react to wage data and Federal Reserve decisions. Tech stocks show continued promise due to advancements in AI and renewable energy initiatives. Look for increased volatility in the energy sector amid OPEC+ deliberations on output adjustments.

Growth Sectors to Watch:

Artificial Intelligence: Companies like NVIDIA (NVDA) and Palantir (PLTR) are still front-runners, given the strategic investments across industries.

Clean Energy: Renewable firms such as NextEra Energy (NEE) and battery players like QuantumScape (QS) align with global sustainability trends.

Cryptocurrency and Blockchain: With Bitcoin setting records, miners like Riot Platforms (RIOT) and exchanges like Coinbase (COIN) look attractive.

Geopolitical Risks: Investors should monitor global political standoffs and their influence on bond markets and currency stability, as seen with Japanese bonds and gold's recent moves.

Market Summary for December 4, 2024

The Market on Fire

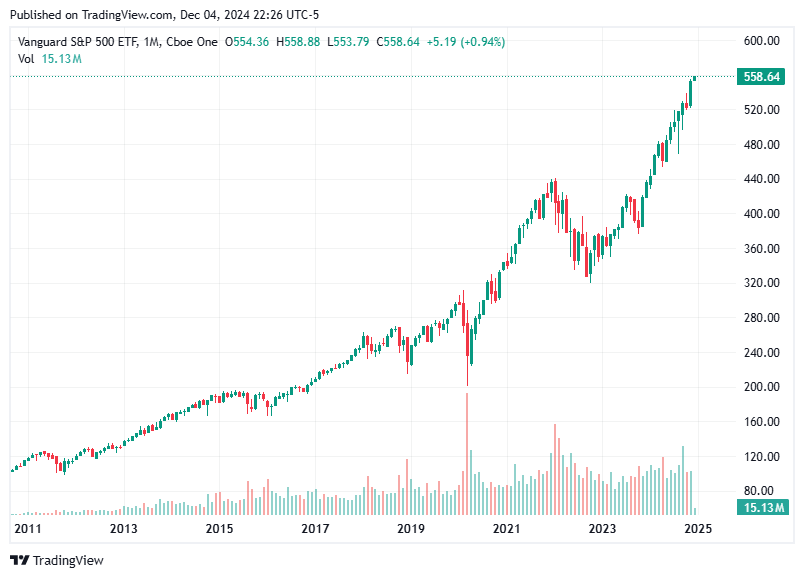

Wall Street delivered a stellar performance today as major benchmarks reached new milestones. The S&P 500 ($SPX) rallied +36 points (+0.8%) to a fresh record high. The Nasdaq Composite jumped +1.3%, hitting an all-time high, while the Dow Jones Industrial Average cracked the 45,000-point ceiling for the first time in history.

Indexes Highlight Performance

Nasdaq Composite: +31.5% YTD

S&P 500: +27.6% YTD

Russell 2000: +19.7% YTD

Dow Jones Industrial Average: +19.4% YTD

Mega-cap tech companies and semiconductor stocks fueled the rally, while AI-focused growth remained top-of-mind for investors. The Vanguard Mega Cap Growth ETF (MGK) surged +1.6%, while the PHLX Semiconductor Index (SOX) added +1.7%, reflecting strong enthusiasm.

Sector performance saw technology climbing to dominance with +1.8% gains, while the energy sector lagged, down -2.5%, amid declining oil prices, now at $68.60/bbl (-2.0%).

Treasury yields also dropped, with the 10-year note falling to 4.18% and adding to optimistic sentiment. Weaker-than-expected data on employment and services further fueled market expectations for a rate cut by the Fed at the December meeting.

Key Corporate Updates

Dividends in Focus

ArrowMark Financial ($BANX): Declared a $0.20/share special cash distribution and will maintain a regular $0.45/share distribution. Closing price 20.78 (-0.03).

Franklin Resources ($BEN): Increased its dividend to $0.32/share from $0.31/share, closing at 22.67 (+0.27).

Whitestone REIT ($WSR): Boosted its quarterly dividend by +9% to $0.045/share.

Earnings Action

Salesforce ($CRM): Propelled the Dow with a massive +11.0% jump, closing at 367.87 (+36.44), following upbeat earnings and glowing reviews for its Agentforce AI platform.

Marvell Technology ($MRVL): Astonished with a 23.2% spike to 118.15 (+22.24) on strong guidance and semiconductor traction.

Pure Storage ($PSTG): Reported stellar results, gaining +22.1% to close at 65.35 (+11.81).

Growth Story Highlights

ChargePoint ($CHPT): Despite missing EPS by $0.01, revenue growth of $99.6M beat expectations. Closed at 1.22 (+0.06). CHPT is positioning itself for a future growth rebound as it aims for profitability by fiscal year 2026.

Sprinklr ($CXM): Impressive earnings showed 7.7% revenue growth YOY, closing at 8.64 (+0.39). Strong RPO and subscription demand signal continued growth.

Noteworthy Developments

Jazz Pharmaceuticals ($JAZZ): Shares closed at 123.45 (+1.81) as the company plans to hold an investor webcast for Ziihera (zanidatamab-hrii), its newly approved HER2-targeted therapy for biliary tract cancer.

Grupo Aeroportuario ($PAC): Passenger traffic grew 1.8% in November, with strong regional gains from Tijuana (+5.3%) and Guadalajara (+5.0%). Stock climbed to 185.41 (+2.01).

Major Projects and Appointments

ONEOK ($OKE): Celebrated a key milestone by expanding its natural gas liquids fractionation capacity to over 1 million barrels per day. Finished the session at 108.74 (-1.77).

Walt Disney ($DIS): Declared a $1.00/share dividend, representing a 33% increase YOY. Shares rose to 116.99 (+0.54) as Disney continues to expand its shareholder-focused initiatives.

Growth Stocks to Watch

Marvell Technology ($MRVL): Backed by a strong AI demand cycle and semiconductors, MRVL’s +23.2% rise hints at a bullish outlook.

Pure Storage ($PSTG): A darling for data infrastructure with its cloud-scale flash storage solutions, the recent +22.1% surge adds credibility.

Grupo Aeroportuario ($PAC): Continued growth in Mexican airport passenger traffic makes PAC an infrastructure stock to monitor.

Other players like Salesforce ($CRM), Sprinklr ($CXM), and ChargePoint ($CHPT) also deserve attention for their long-term growth potential across tech and green energy spaces.

Economic Dissection and Outlook

November’s ADP Employment Change came in at 146K, below consensus expectations (170K), reflecting a slower pace in hiring. Similarly, the ISM Non-Manufacturing Index dropped to 52.1%, indicating tempered growth in the services sector. Both datasets have strengthened the sentiment that the Federal Reserve will likely cut rates by 25 basis points later this month.

With inflation moderating and the labor market cooling, 2024’s final stretch could usher in a mixed sentiment for Q1 2025. Tech and AI spaces appear ripe for continued gains, while the energy sector’s sluggish outlook may persist due to macroeconomic headwinds.

The short-term forecast remains moderately bullish for equities, with growth stocks leading the way. However, potential risks, including lingering uncertainties in global commodity markets and softening consumer demand, warrant investor caution.

Thank you for choosing Stock Region for your market insights. Stay informed, invest wisely, and we’ll see you in tomorrow’s edition!

Disclaimer: This market briefing is for educational purposes only. Stock Region does not provide investment advice, and past performance does not guarantee future results. Consult a professional advisor prior to acting on any information provided herein.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net