Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Sunday, January 12, 2025.

Stock Region Market Briefing Newsletter - Sunday, January 12, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Stock Region is not responsible for any investment decisions made based on this report. Please consult with a professional financial advisor before making any investment decisions.

Global Market Overview

Bonds

Japanese Bonds Hold Steady as U.S. Labor Data Looms

Japanese Government Bonds (JGBs) traded flat during Tokyo’s morning session as investors adopted a cautious stance ahead of the U.S. nonfarm payrolls data release. This labor report is critical to gauging U.S. economic resilience and shaping expectations on global interest rates. Stability in JGBs indicates a market hesitant to take significant positions amid macroeconomic uncertainty. Watch iShares JP Morgan USD Emerging Markets Bond ETF (EMB) as a potential growth play in bond markets influenced by U.S. monetary policy shifts.

Commodities

Gold Prices Solid Amid Inflation and Geopolitical Risks

Gold prices remained stable at $1,925 per ounce during Asian trading. Continued demand for safe-haven assets amid rising inflation concerns tied to the incoming U.S. presidency highlights the metal’s appeal. SPDR Gold Shares (GLD) and Barrick Gold Corporation (GOLD, $17.86) could gain traction as inflationary hedges.Oil Prices Lifted by Strong U.S. Jobs Data

Oil markets rallied with Brent crude trading at $82.34 per barrel due to positive U.S. labor data, signaling strong energy demand. This optimistic outlook could benefit Exxon Mobil (XOM, $117.18) and Chevron (CVX, $155.03) while highlighting the potential of midstream players like Kinder Morgan (KMI, $17.58).Natural Gas Prices Extend Climbs

Natural gas futures rose for a third session as colder-than-normal January weather drove demand higher. Key players like Cheniere Energy (LNG, $168.11) are positioned to benefit from increased export demand in international markets.

Currencies

Asian and Global Exchange Rates Steady on Robust U.S. Payroll Data

Asian currencies stayed roughly unchanged against the U.S. dollar following a strong labor market report. This tempered hopes for Federal Reserve rate cuts in the near term. Meanwhile, China pledged interventions to stabilize the yuan amid trade tariff concerns. Investors may look at WisdomTree Emerging Currency Strategy Fund (CEW) and VanEck Vectors ChinaAMC SME-ChiNext ETF (CNXT) for exposure to foreign currency plays.

Equities

Corporate Mergers and Highlights

Constellation Energy (CEG) Acquires Calpine in a Historic $26.6 Billion Deal

This merger unites two powerhouses in U.S. energy production, preparing them to meet surging electricity demand. CEG’s 3-year revenue growth of 13% highlights its strong market position. The deal reinforces investment opportunities in renewable energy infrastructure, with NextEra Energy (NEE, $79.12) positioned as a competitor to watch.Synopsys (SNPS) and Ansys (ANSS) $35 Billion Merger Approved

The European Union granted conditional approval for this major tech merger, requiring the divestiture of overlapping software businesses. Synopsys’ EPS growth of 18% YOY underscores its solid profitability, while Ansys has seen double-digit strategic growth. These players could shape the future of semiconductor innovations, making them strong picks for long-term portfolios.Tesla (TSLA, $255.36) Reinvents Model Y for Chinese EV Market

Tesla revealed the Model Y "Juniper" edition, designed to cater to Asia-Pacific consumers. With a delivery date in March 2025, this move is part of Tesla’s broader strategy to dominate the Chinese EV market, which saw EV sales grow by 50% YOY. Other manufacturers, like BYD (BYDDY, $56.48), will note their increasing challenge in market share competition.

Additional Company Updates

Meta Platforms (META, $315.74) dissolves its DEI programs amid legal landscape changes, showcasing shifting priorities in corporate America. Despite this, its focus on AI and metaverse projects remains a central growth opportunity.

Ubisoft (UBSFY, $4.30) slipped as game delays and weaker-than-expected net bookings hampered the stock, reminding investors of the volatility tied to entertainment innovation.

Notable Declines

Mercedes-Benz reported a 3% decline in global sales (1.98 million units), exacerbated by subdued Chinese demand and EV competition. Still, the stock remains a buy signal for those confident in high-end autofocusing companies’ eventual recovery.

Geopolitical Developments

Technology and Cybersecurity

A major cyber breach by Chinese hackers, targeting the U.S. Treasury’s Committee on Foreign Investment (CFIUS), underscores national security vulnerabilities. CrowdStrike (CRWD, $147.50) and Palo Alto Networks (PANW, $504.67) are well-placed as leaders in cybersecurity solutions.

Wildfires and Emergency Management

California wildfires, destroying over 37,000 acres, have highlighted infrastructure concerns. First Solar (FSLR, $187.21) may see near-term strength, as renewable energy and fire prevention efforts position the stock favorably within sustainability and recovery narratives.

Geopolitics and Commodities

With the U.S. offering a $25 million reward for Venezuelan President Nicolás Maduro, oil sanctions could further escalate. This geopolitical tension might benefit domestic-focused oil companies like Pioneer Natural Resources (PXD, $218.43).

Growth Stocks to Watch

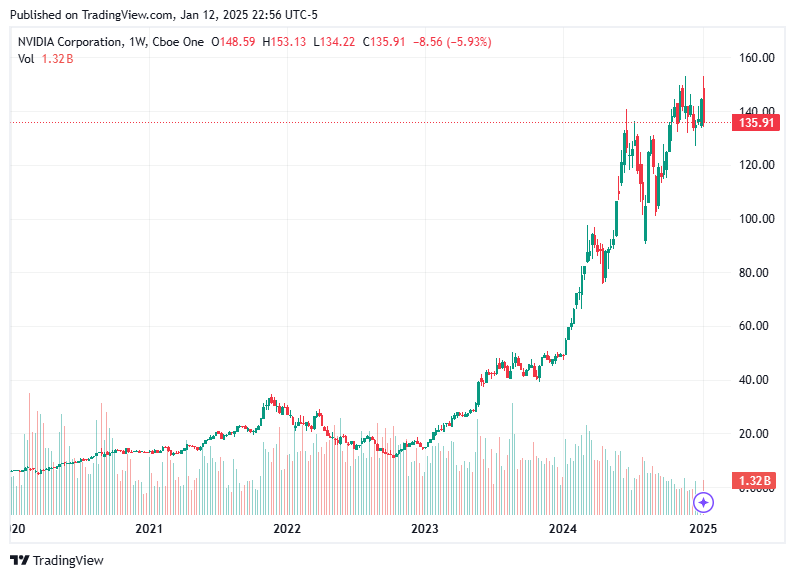

NVidia (NVDA, $390.56): Thriving on AI advancements tied to software and hardware integration.

Adobe (ADBE, $559.10): Well-positioned following its Figma acquisition and strong digital content demands.

ChargePoint Holdings (CHPT, $9.78): A standout as EV infrastructure opportunities expand with federal initiatives.

Stock Market Outlook

The market finds itself at a critical juncture, balancing optimism on U.S. job growth with inflation concerns linked to proposed fiscal measures under President-elect Trump. While bonds and safe-haven commodities signal caution, equities exhibit resilience in select sectors like energy, AI, and renewables. Investors should expect a mixed quarter, with tech and sustainability initiatives remaining top outperformers.

Weekly Performance Recap

Top Percentage Gainers (by sector)

Healthcare

DBV Technologies (DBVT): $4.99 (+48.4%) - Strong performance driven by positive trial results.

Unity Biotechnology (UBX): $1.78 (+39.06%)

AngioDynamics (ANGO): $12.28 (+35.24%)

Industrials

FTAI Aviation (FTAI): $174.60 (+15.34%)

Delta Air Lines (DAL): $66.80 (+13.22%) - Boosted by strong earnings.

Consumer Discretionary

Capri Holdings (CPRI): $23.74 (+17.06%)

Information Technology

TD SYNNEX (SNX): $133.82 (+13.47%)

Adtran (ADTN): $10.13 (+12%)

Energy

Frontline (FRO): $17.28 (+21.23%) - Continued rally aligned with higher crude prices.

Financials

Grupo Supervielle (SUPV): $19.09 (+11.77%)

Top Percentage Losers (by sector)

Healthcare

Radius Health (RDUS): $10.97 (-25.22%)

uniQure NV (QURE): $13.93 (-22.35%)

Industrials

Apogee Enterprises (APOG): $51.04 (-29.01%)

Financials

Mercury General (MCY): $47.35 (-27.97%)

Consumer Staples

Hain Celestial Group (HAIN): $4.99 (-19.39%)

Utilities

Edison International (EIX): $65.24 (-18.25%)

These shifts were influenced by economic pressures, including labor market strength and inflation concerns.

More Growth Stocks to Watch

Delta Air Lines (DAL) [$66.80]

Delta's latest strong earnings and rising passenger volumes signal potential for long-term growth. The company also announced plans to expand its flight offerings across key markets. As the economy steadies, consumer travel demand continues to fuel this industry leader.

Frontline (FRO) [$17.28]

Energy stocks surged this week, and Frontline benefited from rising crude oil prices. Continued geopolitical tensions might push fuel costs higher, making this a sector to monitor closely.

Capri Holdings (CPRI) [$23.74]

Capri’s rebound highlights growing demand for luxury brands. Watch closely for sustained trends in this high-margin segment.

UBX (Unity Biotechnology) [$1.78]

Unity Biotechnology made a solid leap, possibly driven by developments in their pipeline. While speculative, it could be worth keeping an eye on for long-term investors interested in small-cap biotech.

TD SYNNEX (SNX) [$133.82]

After reporting impressive earnings growth, SNX is positioned well for exposure to trends in cloud computing and enterprise technology solutions.

Stock Market Forecast and Analysis

This week's labor market numbers painted a complex picture for the market. Employment remains robust, with a December addition of 256,000 jobs, outpacing expectations. While this strong hiring momentum shows economic resilience, it also underscores inflationary pressures, which led to a market-wide decline as investors recalibrated expectations about Federal Reserve policy.

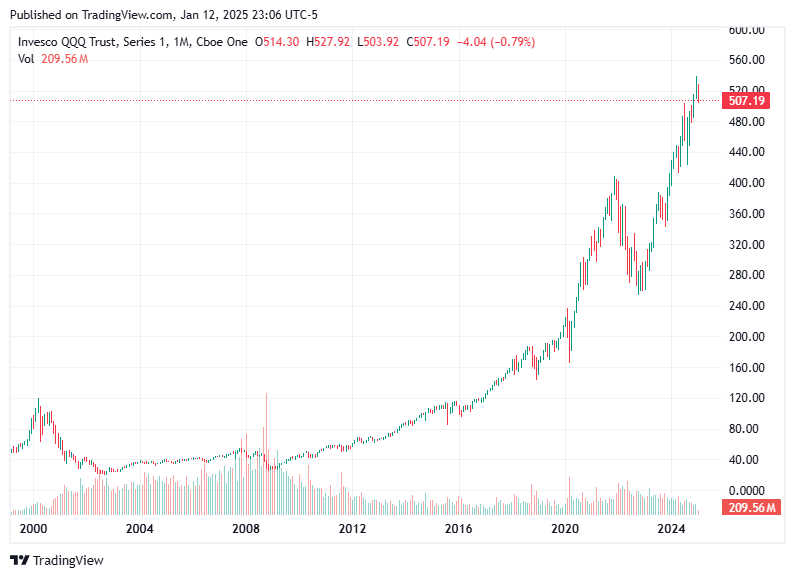

Looking ahead, market volatility is likely as uncertainties persist regarding inflation and interest rates. The rising 10-year Treasury yield, now at 4.78%, adds to this cautious outlook, making defensive sectors like healthcare and utilities attractive for risk-averse investors. Technology and growth-oriented sectors may face near-term pressure but could rebound strongly if inflationary concerns subside.

Key indices are in the red YTD (e.g., S&P 500 down -0.9%, Nasdaq -0.8%), reflecting these broader challenges. The ongoing earnings season will play a critical role in dictating short-term movements, so keep an eye on reports from key tech and industrial giants.

Long-term, growth opportunities remain promising, particularly in sectors like cybersecurity, AI, and renewable energy. Companies like Taiwan Semiconductor Manufacturing Company (TSM), which just reported record quarterly revenues, embody the resilience of innovation-oriented stocks.

Major Company Updates

Boot Barn (BOOT)

BOOT issued an upbeat Q3 earnings and revenue guidance, forecasting $2.43 EPS and an 8.6% same-store sales growth. The retailer continues to post robust e-commerce sales, up 11.1%.

UnitedHealth Group (UNH)

UNH and its peers rallied on positive news regarding Medicare Advantage reimbursement. Watch for long-term implementation impacts on the healthcare sector.

Nordstrom (JWN)

Nordstrom raised its full-year sales and comp guidance after posting a 5.8% holiday growth in comparable sales. Its store and online mix continues to drive sustained performance.

UMB Financial (UMBF) and Heartland Financial (HTLF)

These financial institutions received regulatory approval to finalize their acquisition. The deal, closing January 31, will enhance their service capacity.

Kohl’s (KSS)

Plans to shutter 27 underperforming locations and rationalize its e-commerce operations were announced to improve profitability. Execution will be key for the retail giant as it balances evolving consumer needs.

Hershey (HSY)

CEO Michele Buck announced her planned retirement by 2026. Hershey is beginning a leadership transition search, potentially affecting its long-term strategy.

Other Notables

Victory Capital (VCTR) and Franklin Resources (BEN) reported asset under management (AUM) declines, reflecting broader market pressures.

Photronics (PLAB) welcomed George Macricostas as Executive Chairman, signaling leadership strength to tackle growing opportunities in semiconductor technology.

Upcoming Economic Events

December Treasury Budget (January 13, 2025) at 2 PM ET.

Q4 Earnings Reports from major firms expected over the next weeks.

Stay tuned for inflation data and any updates on Federal Reserve policy.

Thank you for choosing Stock Region as your trusted market resource!

Closing Disclaimer: The information provided in this newsletter is not investment advice. Past performance is not indicative of future returns. Readers are encouraged to conduct their own research or consult financial professionals before making investment decisions. Stock Region is not responsible for any financial losses incurred based on this report.