Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Monday, June 30, 2025 | Time: 8:00 PM ET

Stock Region Market Briefing Newsletter - Monday, June 30, 2025 | Time: 8:00 PM ET

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always consult with a licensed financial advisor before making investment decisions. Stock markets are inherently risky, and past performance is not indicative of future results.

Market Recap: A Record-Setting Day

The S&P 500 and Nasdaq Composite continued their meteoric rise, setting new record highs today. The S&P 500 closed above 6,200, marking a 10.6% gain for Q2, while the Nasdaq surged 17.8% for the quarter. From their April lows, these indices have climbed an impressive 28% and 38%, respectively.

Apple (AAPL, $205.17, +2.03%) stole the spotlight with a 2% rally after reports surfaced that the company is exploring external AI partnerships to enhance Siri. This news not only boosted Apple but also lifted the broader tech sector, which gained 1% today.

The Senate's progress on the "One Big, Beautiful Bill" provided a sense of political stability, further fueling market optimism. The bill includes permanent tax cuts and increased debt ceiling limits, which the market interpreted as a green light for continued economic growth.

Key Corporate Updates

1. Tutor Perini (TPC, $46.78, -0.07%)

Tutor Perini secured a massive $1.87 billion contract for the Midtown Bus Terminal Redevelopment in NYC. This project will add significant backlog to TPC's Q2 earnings and is expected to drive revenue growth through 2028.

2. IREN Limited (IREN, $14.57, +0.57%)

IREN hit its mid-year target of 50 EH/s, supported by its 750MW Childress site. With plans for a 50MW AI data center by Q4 2025, IREN is positioning itself as a leader in AI-driven infrastructure.

3. Rayonier (RYN, $22.18, +0.06%)

Rayonier completed the sale of its New Zealand joint venture for $710 million. The company plans to use 50% of the proceeds for debt reduction and shareholder returns, including a special dividend of $1.00–$1.40 per share.

4. SkyWater Technology (SKYT, $9.84, -0.05%)

SkyWater finalized its acquisition of Infineon Technologies' semiconductor fab, adding 400,000 wafer starts per year. This move strengthens U.S. semiconductor manufacturing and aligns with national onshoring efforts.

5. Progress Software (PRGS, $63.84, +0.08%)

Progress Software raised its FY25 guidance and announced the acquisition of Nuclia, a leader in Retrieval-Augmented Generation (RAG) AI solutions. This acquisition enhances Progress' data platform and positions it for future growth in AI-driven analytics.

Growth Stocks to Watch

Super Micro Computer (SMCI, $49.01, +1.43%)

SMCI's immersion cooling certification for Intel processors positions it as a key player in the high-performance computing market. With AI and data center demand surging, SMCI is a stock to keep on your radar.AeroVironment (AVAV, $284.95, +6.88%)

AVAV announced a $750 million common stock offering and $600 million convertible notes offering to expand manufacturing capacity. With its focus on defense and drone technology, AVAV is poised for long-term growth.IREN Limited (IREN, $14.57, +0.57%)

As mentioned earlier, IREN's focus on AI data centers and infrastructure makes it a compelling growth story in the tech sector.SkyWater Technology (SKYT, $9.84, -0.05%)

With its recent acquisition, SKYT is now the largest U.S.-based pure-play semiconductor foundry. This aligns with government initiatives to bolster domestic chip production.Progress Software (PRGS, $63.84, +0.08%)

PRGS' acquisition of Nuclia and raised guidance signal strong growth potential in the AI and data analytics space.

Market Forecast

The stock market's momentum shows no signs of slowing down. With the S&P 500 and Nasdaq up significantly for the quarter, the outlook remains bullish. However, investors should remain cautious as valuations in the tech sector are reaching frothy levels.

The Federal Reserve's stress test results for major banks and the Senate's progress on the "One Big, Beautiful Bill" add to the market's positive sentiment. That said, geopolitical risks and inflationary pressures could create headwinds in the second half of the year.

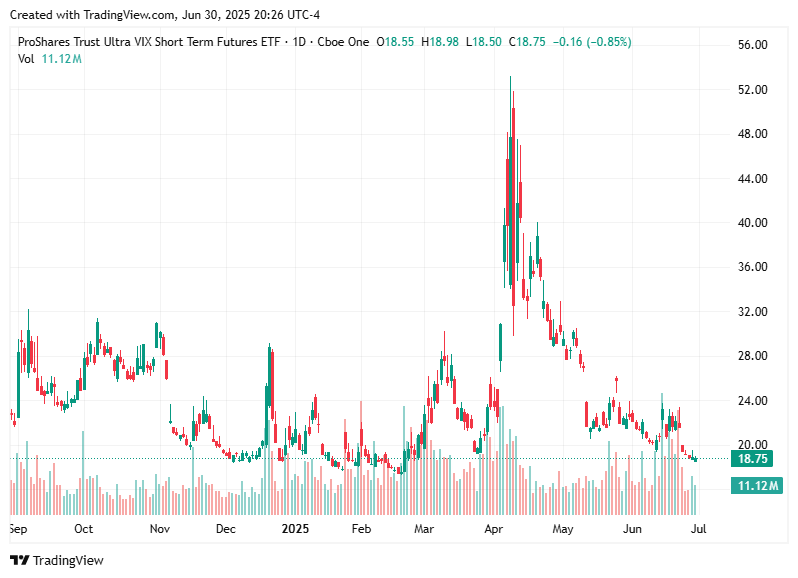

As we head into the second half of 2025, the market is riding high on optimism. Growth stocks in AI, semiconductors, and renewable energy are leading the charge. However, it's essential to stay diversified and prepared for potential volatility.

The S&P 500 and Nasdaq closed at record highs last week, fueled by optimism in tech innovation, geopolitical developments, and corporate earnings. However, the US dollar's worst start to a year since 1973 has raised concerns about long-term economic stability. Meanwhile, Elon Musk's criticism of Congress's spending bill and his proposal for an "America Party" have added a layer of political intrigue to the financial landscape.

Top Stories and Market Impacts

1. Senate Advances Trump’s Bill Amid Ceasefire Optimism

The Senate narrowly advanced President Trump’s flagship tax bill, signaling potential economic shifts. Trump also expressed optimism for a ceasefire between Israel and Hamas, which could stabilize geopolitical tensions in the Middle East.

Market Impact:

Defense stocks like Lockheed Martin (LMT) and Raytheon Technologies (RTX) could see increased activity as the US approves a $510M arms deal with Israel.

Energy stocks may benefit if Middle Eastern stability improves, potentially easing oil price volatility.

2. Tech Highlights: AI Innovations and Investments

Tech giants are making waves:

Tencent (TCEHY) unveiled Hunyuan-A13B, an AI model with ultra-long context capabilities.

Alibaba (BABA) introduced Ovis-U1, a multimodal AI for image editing.

Nvidia (NVDA) launched Radial Attention tech, boosting video processing speeds by 1.9x.

Growth Stocks to Watch:

Nvidia (NVDA): A leader in AI hardware and software, Nvidia continues to dominate with groundbreaking innovations.

Alphabet (GOOGL): Google’s focus on fusion energy and AI research positions it as a long-term growth play.

Meta Platforms (META): With its aggressive AI recruitment and restructuring under "Superintelligence Labs," Meta is doubling down on AI dominance.

3. Apple’s AR/VR Roadmap and Affordable MacBook

Apple’s (AAPL) roadmap for seven head-mounted devices, starting in 2025, signals a deeper push into AR/VR. Additionally, rumors of a budget-friendly MacBook powered by an iPhone processor could disrupt the education and entry-level laptop markets.

Why It Matters:

AR/VR Growth: Apple’s Vision Pro and upcoming devices could solidify its leadership in immersive tech.

Market Expansion: A cheaper MacBook could capture price-sensitive markets, boosting Apple’s global reach.

Growth Stocks to Watch:

Apple (AAPL): A consistent innovator, Apple’s AR/VR and education-focused products could drive long-term growth.

Unity Software (U): As a key player in AR/VR development, Unity stands to benefit from Apple’s ecosystem expansion.

4. Crypto Highlights: Solana Leads the Pack

Solana ($SOL) continues to dominate, leading in network revenue for 14 weeks. Bybit’s launch of tokenized U.S. stocks and the upcoming Solana Staking ETF hint at growing institutional interest in blockchain innovation.

Growth Stocks to Watch:

Coinbase (COIN): As regulatory clarity improves, Coinbase could see increased trading volumes and institutional adoption.

Block (SQ): With its focus on blockchain and crypto services, Block remains a strong contender in the fintech space.

5. Google’s Fusion Energy Deal

Google (GOOGL) has partnered with Commonwealth Fusion Systems (CFS) to secure its first fusion power agreement, marking a significant leap toward clean, sustainable energy.

Why It Matters:

Fusion energy could revolutionize industries by providing virtually limitless, emission-free power.

Google’s investment underscores its commitment to long-term innovation and sustainability.

Growth Stocks to Watch:

Alphabet (GOOGL): A pioneer in clean energy and AI, Google’s diversified portfolio makes it a solid growth stock.

NextEra Energy (NEE): A leader in renewable energy, NextEra could benefit from advancements in fusion technology.

The market is riding high on tech innovation and geopolitical optimism, but risks remain. The US dollar’s decline and inflation concerns could weigh on investor sentiment. However, sectors like AI, AR/VR, and renewable energy are poised for significant growth, making them attractive for long-term investors.

Bullish Sectors:

Technology: AI, AR/VR, and clean energy are driving innovation and investor interest.

Defense: Geopolitical tensions and arms deals are boosting defense stocks.

Crypto: Regulatory clarity and institutional adoption are fueling growth in blockchain and digital assets.

Bearish Risks:

Currency Volatility: The US dollar’s decline could impact global trade and investment flows.

Inflation: Persistent inflation may lead to tighter monetary policies, affecting market liquidity.

That’s your Stock Region Market Briefing for today! Stay informed, stay invested, and let’s navigate the markets together. Have questions or need insights? We’re here to help!

Disclaimer: This newsletter is not a recommendation to buy or sell any securities. All investments carry risks, including the risk of losing principal. Please consult a financial advisor for personalized advice.