Stock Region Market Briefing

📈 Stock Region Market Briefing - Tuesday, June 17, 2025.

📈 Stock Region Market Briefing - Tuesday, June 17, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: The content provided herein is for informational purposes only and not financial advice. Always do your own research before making investment decisions.

📰 Daily Recap & Key Updates

The markets hit a rough note yesterday, as geopolitical uncertainty and troubling economic data dominated headlines. With all major indexes ending in the red, save a rally in energy stocks, investors were left grappling with risk-averse markets. Let's break it all down so you're in the loop:

🏨 Hyatt Hotels Bolsters Its All-Inclusive Empire (H)

Hyatt (H, $133.96, -0.71) officially completed its acquisition of Playa Hotels & Resorts (PLYA), adding 15 all-inclusive beachfront resorts across the Dominican Republic, Jamaica, and Mexico. This move positions Hyatt as a major player in the hospitality industry’s growing all-inclusive space.

Opinion: This acquisition could be a phenomenal growth engine for Hyatt, especially as post-pandemic travel surges. Keep an eye on their Q2 earnings call for financial details on this deal.

💳 Fiserv (FI) and Early Warning Services Partner for Paze Digital Wallet

Fiserv (FI, $163.44, -1.44) has teamed up with Early Warning Services to bring "Paze" to financial institutions, enhancing convenience for online shoppers via trusted banks.

Investor Insight: With the fintech sector growing rapidly, this partnership may improve Fiserv's standing in digital payments. Paze’s potential could spell long-term competitive advantage against fintech giants like PayPal (PYPL).

🤝 Shyft Group (SHYF) Merger Update

Shyft Group (SHYF, $12.09, +0.09) shareholders approved the merger with Aebi Schmidt Group. The combined company, set to trade under the ticker "AEBI" in July, promises operational efficiencies in fleet manufacturing and management.

Growth Potential: Mergers like this often spark interest in the small-cap space. Watch how AEBI builds on this momentum post-merger.

💡 Amazon Ads and Disney Ads Team Up for Smarter Targeting (AMZN)

Amazon (AMZN, $214.82, -1.28) announced a partnership with Disney Advertising. By combining Amazon’s ad technology with Disney’s premium inventory on platforms like Hulu and ESPN, the collaboration is expected to redefine digital advertising.

Why It Matters: This innovation could give AMZN an edge in ad-tech wars. With consumer spending faltering, better-targeted ads may revitalize revenue streams.

🌱 Growth Stock to Watch: Leidos (LDOS)

Leidos (LDOS, $149.39, +1.14) won a $35-million contract to enhance secure DoD data sharing. This consistent performance in government contracts speaks to their strategic focus. With shares up +15% YTD, LDOS looks poised for steady gains in a turbulent market.

📉 The Market’s Pulse

Geopolitical turmoil shook the major indices Tuesday. President Trump’s urgent G-7 departure and alarming rhetoric about Iran pushed investors into safe havens like Treasuries and the U.S. dollar. Meanwhile, weak May retail sales (-0.9%) and industrial production numbers (-0.2%) painted a dour economic picture.

S&P 500: 5,984.24 (-1.1%)

Nasdaq: 13,201.22 (-1.3%)

Dow Jones: 32,997 (-0.9%)

Oil kept energy stocks afloat, with WTI crude bouncing 2% to $73.27.

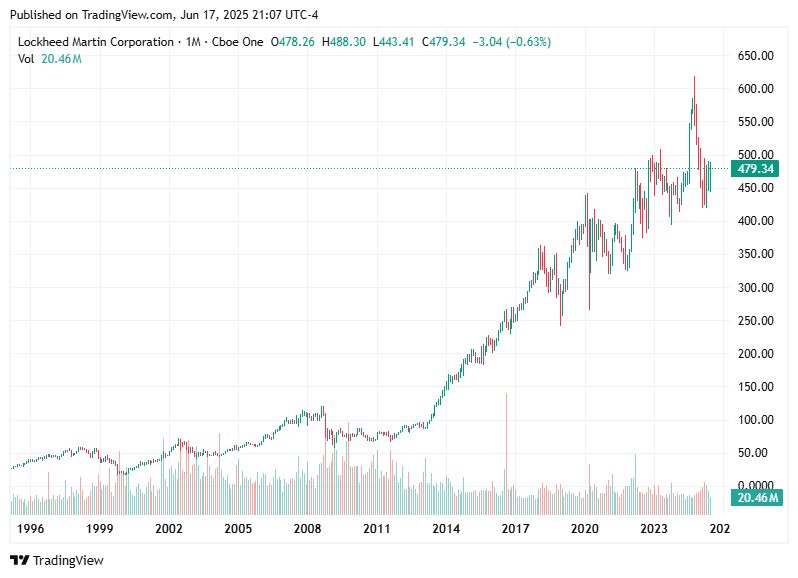

Our Take: Buckle up, volatility is here to stay. Persistent inflation and geopolitical tensions are likely to keep markets on edge through the summer. Energy and defense stocks may outperform as they traditionally shine in uncertain times.

🔎 Growth Stocks to Watch

Eli Lilly (LLY, $791.27, -2.02%)

Despite taking a hit, Eli Lilly’s acquisition of Verve Therapeutics positions it well in next-gen therapies for genetic diseases. Long-term investors may see these dips as an opportunity.Plains All American (PAA, $17.74, -0.12)

Plans to divest its Canadian NGL business for $3.75 billion provide hands-on liquidity for operational improvements. This cash-rich deal could fuel substantial growth.Talos Energy (TALO, $9.51, +0.19)

With an enhanced strategy to dominate offshore energy production, Talos is a smaller player with outsized potential, particularly as energy markets heat up.Fiserv (FI)

New fintech products like Paze give this established giant room for upward momentum.

🗓️ Stock Region’s Forecast

Brace for cautious trading as the week progresses. Markets may remain choppy given geopolitical tensions, weak economic data, and uncertainty around the Fed’s next move. Defensive sectors like energy and utilities, along with undervalued high-growth tech players, may deserve a closer look.

Pro Tip: Stay focused on the long-term. Times like these separate the patient investors from the panicked.

📈 Morning Market Snapshot

Markets are sailing through choppy waters this week, shaped by a mix of innovation, economic shifts, and geopolitical tension. The S&P 500 closed down 0.6% yesterday, while the Nasdaq held steady, gaining just 0.2%. Keep your seatbelts fastened as volatility persists in an uncertain global landscape.

S&P 500: 4,372 (-0.6%)

Nasdaq Composite: 13,643 (+0.2%)

Dow Jones: 33,478 (-0.8%)

Now, on to what’s moving the needle this week!

🔍 Key Headlines

1. Google (GOOGL) Intensifies AI Defense in India

Alphabet's Google is upping its artificial intelligence game in India to combat surging cybercrime. The company plans to deploy next-gen AI models to detect and prevent fraudulent activity.

Our Take

This push aligns with the $4 billion Alphabet committed to expanding its global AI footprint. Cybersecurity remains a lucrative industry, and Google's innovative approach could cement its influence in emerging markets like India. This is a long-term bullish signal for Alphabet stock ($GOOGL).

Growth Stocks to Watch

Palo Alto Networks (PANW)

CrowdStrike (CRWD)

Both trailblazers in digital security, poised to ride the industry wave.

2. Retail Sales Slump, But There’s a Silver Lining

May retail sales dipped 0.9%, deeper than analysts’ 0.6% forecast. However, specific categories picked up pace with online retail and furniture showing gains, suggesting selective consumer optimism.

Market Pulse

High interest rates and inflation are reshaping buyer behavior. Companies like Wayfair (W) and Amazon (AMZN) could see sustained demand in online sales, even while economic pressures linger.

3. JetBlue Airways (JBLU) Grounded by Financial Struggles

JetBlue is enacting cost-cutting measures, including flight reductions and leadership shifts, as weak travel demand hampers profitability. CEO Joanna Geraghty admits profitability may remain elusive in 2025.

Our Perspective

While painful in the short term, these cost-saving moves could stabilize JetBlue. Long-term travel bulls might consider Delta Airlines (DAL) or Southwest (LUV), which boast healthier margins and consumer bases.

4. Honda (HMC) Ventures Into Last-Mile Mobility

Honda's playground expands into micromobility for cargo delivery. By introducing eco-friendly solutions, Honda’s targeting the growing demand for sustainable urban transport.

Opinion

Smart move amid slow auto sales. Don’t be surprised if Honda partners with players like DoorDash (DASH) or Uber (UBER) to scale this new tech. Hold your positions on Honda as it diversifies streams.

5. Adobe (ADBE) Brings Firefly’s AI Magic to Mobile

Adobe has launched Firefly’s AI tools for iOS and Android, redefining on-the-go creativity. This inclusion signals the democratization of advanced design technology.

Stock Region Insight

Analysts remain bullish on Adobe, as its SaaS growth story gains momentum. Creativity pays dividends—not just in ideas but in recurrent revenue models.

6. Intel (INTC) Shrinks Workforce by 20%

Responding to shrinking demand and stiff competition from Taiwan's Semiconductor Manufacturing Co. (TSM) and Samsung, Intel is making tough calls.

Our Take

Intel remains a riskier play in semiconductors, but if you're looking for stable alternatives, NVIDIA (NVDA) continues to dominate the GPU field, with robust AI utilization flowing through industries.

🛢 Global Turmoil Adds Pressure

The Middle East remains a hotbed of geopolitical tension. Escalations between Iran and Israel threaten to ripple across global markets. Oil prices, surprisingly, are trending lower amid forecasts of oversupply, but traders should tread lightly as volatility here is inevitable.

Energy Stocks to Monitor

ExxonMobil (XOM) for stability.

First Solar (FSLR), taking advantage of green-energy momentum.

Here’s where opportunity lies for the bold investor.

Google (GOOGL) – Buckle up. AI-driven innovation remains its crown jewel.

Tesla (TSLA) – Electric vehicles are here to stay, and Tesla’s expansions solidify its first-mover advantage.

Amazon (AMZN) - Reaping growth in everything from cloud computing to online furniture sales.

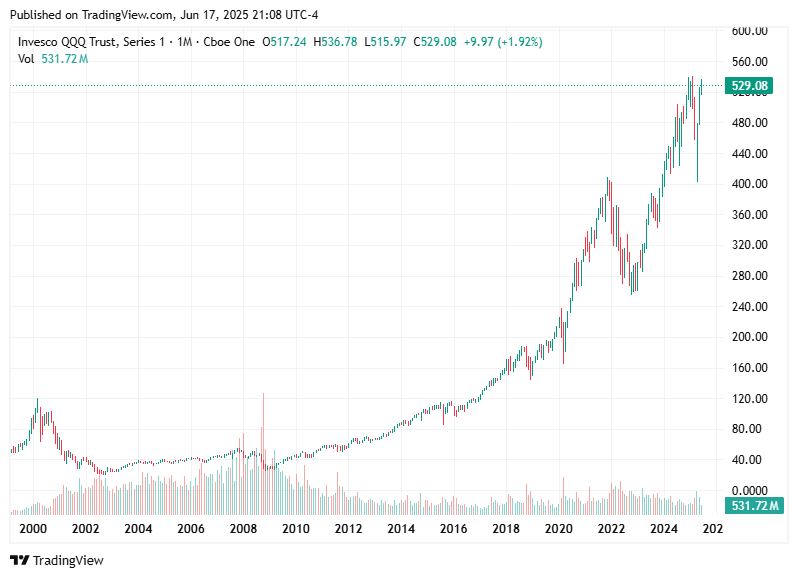

Expect a volatile but opportunistic 2025. Growth stocks tied to AI, renewable energy, and cybersecurity are well-positioned for gains. That said, keep an eye on consumer sentiment and geopolitical tensions, which may delay broader recovery.

📢 Pro Tip: We stick to a diversified mix of sectors, and brace for short-term turbulence while keeping your eyes on the long game.

That wraps today’s Stock Region Market Briefing! Have thoughts or questions? Hit reply and share your views—we love hearing from our investment community.

Till next time,

The Stock Region Team

"Invest smarter, not harder."

🔗 Want more updates like this? Head to Stock Region for the latest insights, or follow us on social media!

Disclaimer: All opinions expressed are for informational purposes only. This is not financial advice. Always consult your financial advisor for personalized guidance.