Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Friday, January 31, 2024.

Stock Region Market Briefing Newsletter - Friday, January 31, 2024

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

For informational purposes only. Not financial advice.

Fed Holds Rates Steady as Inflation Gauges Meet Expectations

The Federal Reserve's personal consumption expenditures (PCE) price index showed encouraging stability, with core PCE holding at 2.8% year-over-year, matching forecasts. Meanwhile, headline PCE increased 0.3% monthly. Despite these positive trends, the Fed kept interest rates unchanged at 4.25%-4.5%, maintaining a cautious stance as inflation remains above its 2% target.

Stocks to Watch

The Financial Sector (XLF) could remain sensitive to Fed policy changes, with banks like JPMorgan Chase (JPM) and Bank of America (BAC) on investors' radar due to their exposure to interest rate dynamics.

Growth stocks like NVIDIA (NVDA) and Microsoft (MSFT) may experience increased volatility as stable rates shape tech valuations.

Apple (AAPL) Pushes Back in Google Monopoly Case

Apple has taken a proactive stance, filing for involvement in the Google search monopoly remedies trial. With its iOS ecosystem in focus, Apple's concerns about long-term deal restrictions highlight potential risks to its substantial services revenue, which reached $21.21 billion in Q4 2024. The case underscores the competitive pressures facing big tech.

Growth Pick

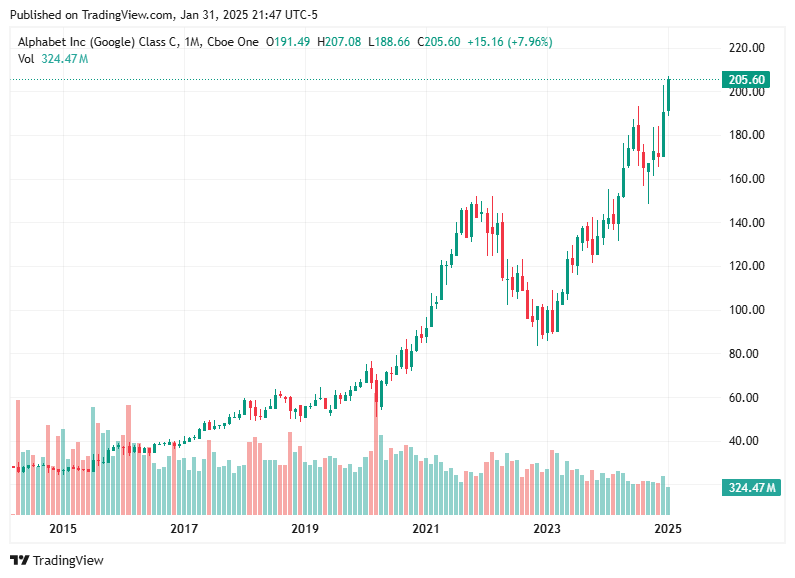

Alphabet (GOOGL) could see near-term pressure, making it a potential buying opportunity, while regulatory scrutiny could temporarily affect its search monopoly dynamics.

Microsoft (MSFT) Advances AI Research

Microsoft is doubling down on artificial intelligence with its new Advanced Planning Unit (APU), aiming to explore AI's societal and workplace impact. This initiative reaffirms the company's commitment to "model-forward" AI applications and builds on Microsoft's $10 billion OpenAI stake. With AI reshaping industries, Microsoft's forward-looking approach strengthens its position in the tech race.

AI Stocks to Watch

Competitors like Palantir (PLTR), a pure-play AI analytics company, and Adobe (ADBE), innovating in creative AI tools, remain compelling options for tech investors.

Tesla (TSLA) and Microsoft Layoffs Reflect Workforce Reshaping

Microsoft's decision to cut "underperformers" highlights the competitive landscape for tech employees. Similarly, Tesla’s performance-driven workplace culture continues to set the pace for industry standards. These changes may boost margins but could impact company culture.

Opportunities in Workforce Efficiency Plays

Companies like Workday (WDAY), providing HR cloud solutions, may benefit as firms optimize workforce strategies, positioning themselves as a leader in business planning software.

Colombian Politics and Trade Tariffs Add Unpredictability

President Trump's 25% tariffs on Canadian and Mexican goods have the potential for economic ripple effects. Trade-related stocks like Caterpillar (CAT) and Ford (F) may react sharply, given their reliance on North American supply chains. Furthermore, political challenges in Latin America, including Colombia's migrant issues, add another layer of volatility.

Meta (META) Faces Backlash Over Policy Shifts

Meta employees protesting the removal of tampon dispensers in men's restrooms reflects the broader cultural shift within tech companies. Although the policy seems minor, it showcases the resistance from employees to DEI rollbacks. Despite this internal dissent, Meta continues to focus on redefining its corporate culture.

Investor Takeaway

Meta, with its pivot toward lean operations, remains a monitorable growth play despite workplace unrest. Look for developments affecting perception and talent retention.

Stock Market Forecast

The market faces mixed signals going into February 2025. Stabilizing inflation provides a breather, while unchanged rates indicate the Fed remains watchful. Major risks lie in geopolitical tensions, new trade tariffs, and signs of slowing consumer spending amid layoffs. Growth stocks may face headwinds, but long-term investors could use this as an opportunity to identify entry points into innovation-driven firms.

Sectors like technology (XLK) and renewable energy (ICLN) remain poised for growth over the mid- to long term, while defensive plays like utilities (XLU) may protect against downside risk in the short term.

Stay diversified and vigilant for opportunities brought about by volatility. The market offers challenges, but with challenges come opportunities for investors prepared to adapt their strategies.

Weekly Market Recap

This week’s stock market saw notable activity across sectors, with gains in select industries offset by market-wide challenges. Persistent inflation, the Fed’s policy stance, and tariff uncertainty motivated investors to remain cautious as we closed out the week. Here’s a breakdown:

Dow Jones Industrial Average: -0.8% for the session, +4.7% YTD

S&P 500: -0.5% for the session, +2.7% YTD

Nasdaq Composite: -0.3% for the session, +1.6% YTD

The week began on a positive note with strong consumer spending data and steady core PCE inflation numbers. However, tariff announcements on Canada, Mexico, and China caused investor sentiment to shift on Friday, resulting in a broad market retreat. Treasury yields climbed, with the 10-year yield rising to 4.57%, underscoring the market's volatility and risk-off sentiment.

Weekly Winners and Losers

Below is a snapshot of the week's top percentage gainers and losers by sector, showcasing the breadth of both market strength and challenges:

Top Percentage Gainers

Healthcare: Surgery Partners (SGRY) +25.69%, Neuronetics (STIM) +25.41%, Corcept Therapeutics (CORT) +11.02%

Consumer Discretionary: Brinker International (EAT) +22.21%, Royal Caribbean (RCL) +15.17%, Asbury Automotive Group (ABG) +13.08%

Industrials: Oshkosh (OSK) +18.58%, Dynamic Materials (BOOM) +11.22%

Information Technology (IT): Atlassian (TEAM) +14.15%, American Software (AMSWA) +24.78%, IBM (IBM) +13.48%

Financials: New York Community Bancorp (NYCB) +24.5%, Brighthouse Financial (BHF) +22.36%

Top Percentage Losers

Healthcare: Ironwood Pharm. (IRWD) -39.76%, Allscripts (MDRX) -30.77%

Information Technology (IT): Manhattan Associates (MANH) -28.1%, MaxLinear (MXL) -23.05%

Consumer Discretionary: Modine Manufacturing (MOD) -23.40%, Beazer Homes (BZH) -19.08%

Utilities: NextEra Energy Partners (NEP) -32.55%

Energy: Nine Energy Service (NINE) -21.41%

Shifts in market dynamics and sector-specific news were important drivers of these gains and losses.

Key Corporate News

Mergers and Acquisitions

Spirit AeroSystems (SPR): Shareholders approved its acquisition by Boeing (BA), expected to close mid-2025. Spirit closed at $176.52 (-3.01%).

UMB Financial Corporation (UMBF): Announced the acquisition of Heartland Financial USA (HTLF), effective tonight.

Earnings and Announcements

Apple (AAPL): Opened the day 4% higher post-earnings but ultimately fell 0.7% to $236.00 as Friday’s market softness swept across tech.

AbbVie (ABBV): Surged 4.7% following promising earnings, closing at $183.90.

ExxonMobil (XOM) and Chevron (CVX): Dropped 2.5% and 4.6% respectively, due to soft quarterly performance.

Contract News

Lockheed Martin (LMT): Won a $383M contract modification with the U.S. Navy, lifting its stock to $462.95 (+3.30%).

KBR (KBR): Its subsidiary, LinQuest, secured a $970M U.S. Air Force contract, reinforcing its defense-sector foothold.

Industry Disruption

FutureFuel (FF): Announced biodiesel production delays and uncertainty stemming from federal tax credit policy changes.

Growth Stocks to Watch

Given this week's reports and sector trends, here are key growth stocks to keep an eye on:

Atlassian (TEAM): IT leader gaining momentum with robust earnings and product expansion.

Royal Caribbean (RCL): Benefiting from pent-up demand for cruises and strong earnings.

New York Community Bancorp (NYCB): Financial stock with significant upside after its rally this week.

Additionally, Surgery Partners (SGRY) in the healthcare sector and Oshkosh (OSK) in industrials continue to show promising trajectories.

The market’s near-term outlook remains clouded by mixed signals as persistent inflation intersects with strong consumer spending. The Fed’s current policy position remains dependent on data proving inflationary trends, and this could result in sustained volatility over the coming weeks.

Looking into February, continued attention will be on tariff developments with key trading partners and their broader implications, which could sway investor sentiment significantly. Earnings from major tech players and economic data, including the ISM manufacturing index and construction spending reports, will also influence directional trends. Expect defensive positioning until macroeconomic clarity improves.

Market Themes to Monitor:

Tariffs: U.S. trade tensions with China, Canada, and Mexico.

Yields: Rising Treasury rates confirming risk-off sentiment.

Earnings: Results from consumer-focused companies as February earnings continue.

Investors should brace for continued swings as the market processes tariff headlines, economic data, and earnings season developments. Diversifying portfolios across defensive and growth sectors might offer stability and opportunity amid uncertainty.

Thank you for tuning into this week’s Stock Region Market Briefing! Stay informed, and we’ll see you next time.

This newsletter is for informational purposes only and should not be considered financial advice. Please consult a financial advisor before making any investment decisions.

We are working endlessly to provide free insights on the stock market every day, and greatly appreciate those who are paid members supporting the development of the Stock Region mobile application. Stock Region offers daily stock and option signals, watchlists, earnings reports, technical and fundamental analysis reports, virtual meetings, learning opportunities, analyst upgrades and downgrades, catalyst reports, in-person events, and access to our private network of investors for paid members as an addition to being an early investor in Stock Region. We recommend all readers to urgently activate their membership before reaching full member capacity (500) to be eligible for the upcoming revenue distribution program. Memberships now available at https://stockregion.net