Stock Region Market Briefing

Stock Region Market Briefing Newsletter - Wednesday, June 19, 2025.

Stock Region Market Briefing Newsletter - Wednesday, June 19, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational purposes only and should not be considered financial advice. Always consult with a financial advisor before making investment decisions. Stock market investments involve risk, and past performance is not indicative of future results.

Market Recap: A Day of Intrigue and Restraint

The stock market closed Wednesday with a whimper rather than a bang, as the S&P 500 (SPY: $597.48, -0.05) ended flat. While the indices showed little movement, the day was anything but ordinary. Geopolitical tensions, Federal Reserve updates, and mixed economic data kept investors on their toes.

The Federal Reserve held interest rates steady at 4.25-4.50%, but the Summary of Economic Projections (SEP) painted a murky picture. Inflation estimates for 2025 were revised upward, while GDP growth expectations were trimmed. Fed Chair Jerome Powell emphasized the need for more data before making further policy moves, leaving the market in a state of cautious anticipation.

Sector Highlights

Winners: Information Technology (+0.4%) led the pack, buoyed by innovation and optimism.

Losers: Energy (-0.7%) and Communication Services (-0.7%) struggled, reflecting broader market hesitancy.

Company Spotlights

Franco-Nevada (FNV: $168.21, -0.74)

Franco-Nevada has suspended its arbitration proceedings regarding the Cobre Panama mine after engaging with the Panamanian government. While this move signals a willingness to negotiate, the uncertainty surrounding the resolution could weigh on the stock. Investors should monitor developments closely, as a favorable outcome could unlock significant value.

Lumentum (LITE: $88.46, +2.12)

Lumentum unveiled its PicoBlade Core ultrafast laser platform, a game-changer for precision manufacturing. This innovation positions Lumentum as a leader in industrial micromachining, with applications spanning electronics, solar cells, and more. Growth investors should keep an eye on LITE as it continues to push technological boundaries.

Prothena (PRTA: $5.75, +0.05)

Prothena announced a 63% workforce reduction to streamline operations and focus on its core programs. While this cost-cutting measure is a short-term pain point, the company’s pipeline, including Alzheimer’s and Parkinson’s treatments, holds long-term promise. With potential milestone payments from partners like Bristol Myers Squibb (BMY), PRTA could be a speculative play for biotech enthusiasts.

Aurora Cannabis (ACB: $4.68, -1.20)

Aurora Cannabis denied acquisition rumors involving MedLeaf Therapeutics, highlighting the challenges of misinformation in the cannabis sector. While the stock dipped, the company’s focus on organic growth and operational efficiency remains intact.

Growth Stocks to Watch

Coherent (COHR: $82.29, +2.52)

Why Watch: The launch of the LEAP 600C excimer laser positions Coherent as a leader in advanced manufacturing technologies. With applications in semiconductors and renewable energy, COHR is a compelling growth story.

AeroVironment (AVAV: $190.04, +1.31)

Why Watch: AeroVironment’s partnership with UAS Denmark Test Center enhances its capabilities in uncrewed aircraft systems. As the drone market expands, AVAV is well-positioned for long-term growth.

BrightSpring Health Services (BTSG: $22.38, +1.03)

Why Watch: Onco360’s role as a national pharmacy partner for cutting-edge cancer therapies underscores BrightSpring’s commitment to innovation in healthcare.

Lumentum (LITE: $88.46, +2.12)

Why Watch: The PicoBlade Core launch could drive significant revenue growth in the precision manufacturing sector.

Economic Data Highlights

Initial Jobless Claims: Remained steady at 245,000, signaling resilience in the labor market.

Housing Starts: Fell to a five-year low, raising concerns about the housing sector’s health.

Stock Market Forecast

The market is navigating a complex landscape of geopolitical tensions, inflationary pressures, and Federal Reserve uncertainty. While the S&P 500 is up 1.7% year-to-date, the Nasdaq (+1.2%) and Dow Jones (-0.9%) tell a mixed story.

The tech sector’s resilience and innovation could drive gains, but caution is warranted as inflation and interest rate concerns linger. Growth stocks in emerging industries like renewable energy, healthcare, and advanced manufacturing offer opportunities for long-term investors.

As we head into the Juneteenth holiday, take a moment to reflect on the progress we’ve made and the challenges that lie ahead. The stock market, much like life, is a journey of ups and downs. Stay informed, stay patient, and remember that every dip is an opportunity for growth.

Global Headlines Snapshot: Economic Shifts and Industry Challenges

The global economy is navigating turbulent waters, with geopolitical tensions, economic uncertainty, and industry-specific challenges shaping market sentiment. From China's faltering property market recovery to the UK’s inflationary pressures and industrial setbacks, the landscape is as complex as ever. Meanwhile, Brussels is cracking down on AliExpress for breaching EU digital rules, and OpenAI is stirring the pot with claims of Meta offering $100 million sign-on bonuses to poach talent.

Growth Stocks to Watch:

Alibaba (BABA): With AliExpress under scrutiny, Alibaba’s broader e-commerce strategy could face headwinds. However, its cloud expansion in South Korea signals resilience.

OpenAI (Private): While not publicly traded, keep an eye on companies like Microsoft (MSFT), a major OpenAI backer, as AI innovation continues to drive growth.

Tensions Rise: Iran, India, and U.S. in Focus

Geopolitical tensions are escalating, with the U.S. considering deploying bunker-busting bombs to target Iran’s nuclear sites. Meanwhile, India’s PM Modi denies U.S. involvement in mediating a ceasefire with Pakistan, adding to the region’s complexity.

Market Impact:

Defense stocks are likely to see increased interest as geopolitical risks rise.

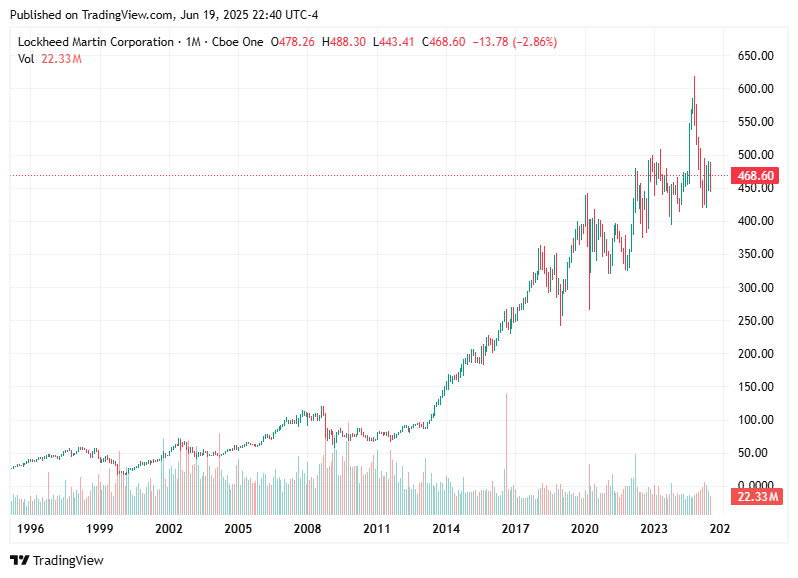

Lockheed Martin (LMT): A key player in defense innovation, poised to benefit from heightened military spending.

Anduril (Private): Partnering with Rheinmetall to develop advanced drones, signaling growth in defense tech.

Global Partnerships, Housing Slumps, and Legal Risks Shape Markets

The UK housing market is experiencing its steepest drop in four years, while banks face mounting climate-related lawsuits. On a brighter note, Anduril and Rheinmetall’s partnership highlights innovation in defense, and Welsh biotech secures funding for depression treatments.

Growth Stocks to Watch:

Rheinmetall (RHM.DE): A European defense leader, well-positioned for growth amid rising demand for advanced military technology.

Gilead Sciences (GILD): With the FDA approval of its HIV prevention drug, Gilead is making strides in healthcare innovation.

Breaking News: Honda Enters the Space Race

Honda has successfully launched and landed a reusable rocket, marking its entry into the competitive aerospace industry. This positions Honda alongside giants like SpaceX and Blue Origin, signaling a new era for the company.

Growth Stocks to Watch:

Honda (HMC): Diversifying into aerospace could unlock significant long-term value.

Nvidia (NVDA): A key supplier of AI and computing power for aerospace and defense applications.

Fed Holds Rates Steady Amid Economic Uncertainty

The Federal Reserve has decided to maintain its interest rate at 4.25%-4.5%, citing concerns over inflation and slower economic growth. With stagflationary pressures looming, the Fed’s cautious stance reflects the complexity of the current economic environment.

Market Impact:

Financials: Banks like JPMorgan Chase (JPM) and Bank of America (BAC) may face challenges as rate cuts are delayed.

Energy: Rising tensions in the Middle East could drive oil prices higher, benefiting companies like ExxonMobil (XOM) and Chevron (CVX).

Escalating Tensions: Israel-Iran Crisis Sparks Global Alarm

The Israel-Iran conflict has reached a boiling point, with missile strikes, threats, and international involvement dominating headlines. Iran’s threat to close the Strait of Hormuz, a critical oil artery, has sent shockwaves through global markets.

Growth Stocks to Watch:

Raytheon Technologies (RTX): A leader in missile defense systems, likely to see increased demand.

BP (BP): As oil prices rise, energy companies with global operations stand to benefit.

Tech Titans Drive Innovation Across Industries

From JD.com’s courier service in Saudi Arabia to Amazon’s robotaxi factory and Nvidia’s investment in nuclear power, tech giants are reshaping industries.

Growth Stocks to Watch:

Amazon (AMZN): Expanding into autonomous vehicles and logistics, Amazon continues to innovate.

Nvidia (NVDA): Its investment in TerraPower highlights its commitment to sustainable energy solutions.

Li Auto (LI): Reaching its 2,500th supercharging station, Li Auto is a key player in the EV market.

The stock market is navigating a minefield of geopolitical tensions, economic uncertainty, and industry-specific challenges. While the Fed’s decision to hold rates steady provides some stability, stagflationary pressures and global conflicts add layers of complexity.

Bullish Sectors:

Defense: Rising geopolitical risks are driving demand for advanced military technology.

Energy: Potential disruptions in the Strait of Hormuz could push oil prices higher, benefiting energy stocks.

Technology: Innovation in AI, EVs, and aerospace continues to create growth opportunities.

Bearish Sectors:

Real Estate: The UK’s housing slump and rising interest rates are weighing on the sector.

Financials: Delayed rate cuts and economic uncertainty pose challenges for banks.

Stay informed, stay invested, and as always, keep an eye on the horizon. The markets may be volatile, but opportunities abound for those who are prepared.

-Stock Region Team

Disclaimer: This newsletter is not a solicitation to buy or sell any securities. Stock Region and its affiliates are not responsible for any investment decisions made based on this content. Always do your own research.