Stock Region Market Briefing

Stock Region Weekly Market Briefing - Sunday, June 8, 2025.

Stock Region Weekly Market Briefing - Sunday, June 8, 2025

The stocks featured in this report were previously delivered in our trading room in real-time. To access Stock Region’s real-time trade ideas, then be sure to purchase a membership now.

Disclaimer: This newsletter is for informational and educational purposes only. It is not financial advice. Please consult with a financial professional before making investment decisions. Stock Region is not responsible for any trading decisions made based on this information.

Market Overview

The stock market had an upbeat week, buoyed by economic data that showed resilience in U.S. labor markets and consumer spending. All major indices posted gains for the day, with significant strides in sectors like energy and communication services.

Key Indices Year-to-Date Performance:

S&P 500: +2.0%

Nasdaq: +1.1%

Dow Jones Industrial Average (DJIA): +0.5%

S&P 400 (Mid-Caps): -2.2%

Russell 2000 (Small-Caps): -4.4%

Treasury yields increased sharply after May’s Employment Situation Report exceeded expectations, with the 10-year yield rising to 4.51%. Despite optimism in equities, rate cut probabilities for July and September have been revised lower, suggesting that the Federal Reserve may hold rates steady.

Top Gainers and Losers This Week

Biggest Gainers

Healthcare

URGN (+77%)

BPMC (+26.21%)

ESPR (+46.51%)

Materials

AG (+33.47%)

CLF (+30.1%)

Consumer Discretionary

CHGG (+62.25%)

RRGB (+27.84%)

Information Technology

SPWR (+42.81%)

Biggest Losers

Healthcare

SLP (-13.91%)

NVCR (-11.25%)

Consumer Discretionary

QRTEA (-23.66%)

LULU (-16.36%)

TSLA (-14.96%)

Information Technology

UPLD (-17.13%)

DOCU (-14.96%)

Investors should monitor these volatility trends closely, particularly in light of sector-specific news and macroeconomic signals.

Key News Highlights

Corporate Changes

LiveWire Group (LVWR) CFO Tralisa Maraj will resign effective July 11, 2025.

Oceaneering International (OII) CFO Alan Curtis will step down by January 2026, with Michael Sumruld slated to succeed him.

Arcos Dorados (ARCO) has appointed Luis Raganato as CEO, effective July 1, 2025.

Stock Offerings

Bowhead Specialty Holdings (BOW) and Braze (BRZE) announced common stock offerings of $300 million and 3.9 million shares, respectively.

Economic Data Beat

The May Employment Situation Report showed nonfarm payroll growth and steady unemployment at 4.2%.

Average hourly earnings increased 0.4%, reflecting healthy wage growth.

Energy News

Energy stocks surged by 2% overall, partly driven by sector fundamentals and geopolitical stability.

Growth Stocks to Watch

Healthcare

Blueprint Medicines Corporation (BPMC) remains a standout in the biotech space with its +26.21% weekly gain. Its pipeline innovations may make it a forward-looking pick despite volatility.

Consumer Discretionary

Chegg (CHGG) saw a remarkable +62.25% rise with restructuring efforts boosting investor confidence. Keep an eye on whether this rebound can sustain.

Renewable Energy

SunPower Corporation (SPWR), up +42.81% this week, is benefiting from rising demand for solar solutions tied to federal incentives. Investors seeking eco-friendly growth should take note.

Materials

First Majestic Silver Corp. (AG) gained momentum, reflecting investor interest in metals during economic transitions.

These stocks have shown strong weekly performance in line with market catalysts. However, they carry risk due to market volatility and sector-specific headwinds. Conduct your due diligence.

Economic Data Analysis

The May Employment Report is the week’s defining economic data release. Key takeaways include a stronger-than-expected labor market with nonfarm payrolls growth, steady unemployment, and a 0.4% rise in average hourly earnings. These data reinforce consumer spending trends and suggest resilience despite Federal Reserve policy uncertainty.

Consumer credit also showed a sharp uptick in April (+$17.9 billion), signaling sustained borrowing activity across revolving and nonrevolving categories. However, broader debt levels may weigh on consumer sentiment if interest rates remain elevated.

Stock Market Forecast

Based on current economic data, the outlook for the U.S. stock market remains cautiously optimistic. Steady employment and wage growth should support consumer-oriented stocks, while technology and energy could benefit from renewed sector rotation.

However, macroeconomic risks, including Federal Reserve policy uncertainty and global trade tensions, may cap the upside in the near term. Investors should stay diversified and watch key indices and economic trends closely, particularly inflation and interest rate developments.

Today's Key Highlights

Canada and China Enhance Diplomatic Relations

Canada and China have formed an agreement to institute a regular communication framework, signaling improved diplomatic ties after a strained period marred by political disputes and trade tensions. This development could bolster trade opportunities between the two nations, potentially impacting sectors like technology and commodities.

Tesla ($TSLA) Surges Nearly 5% Premarket

Tesla shares climbed almost 5% in premarket trading after news broke of a forthcoming call between White House aides and CEO Elon Musk. Investor sentiment has been buoyed by speculation about potential policy alignment or collaboration tied to Tesla’s EV and energy sectors. Tesla's market cap currently stands at approximately $852 billion.

Growth Stock to Watch: Keep an eye on Tesla as continued policy support or collaboration could solidify its position as a leader in the EV market.

India Cuts Interest Rates Amid Cooling Inflation

The Reserve Bank of India made an unexpected 50 basis point rate cut, bringing its benchmark rate down to 5.5% while noting moderating inflation (3.16% in April). Despite the cut, GDP forecasts remain at 6.5% for the fiscal year, reflecting a slowdown from prior highs.

Growth Stock to Watch: Monitor Indian multinational IT companies like Infosys ($INFY) and Tata Consultancy Services (NSE:TCS) as potential beneficiaries of lower borrowing costs and sustained economic growth.

Court Ruling Impacts Apple ($AAPL) Revenue Model

A federal court has denied Apple’s appeal to delay implementing a significant ruling affecting its App Store payment structure. Apple may have to allow third-party payment options, which could impair App Store revenue, a key driver of its services segment growth. Apple’s revenue from its services division hit $20.9 billion in Q1 2025, up 6% year-over-year.

Growth Stock to Watch: Keep an eye on platform developers and fintech innovators like PayPal ($PYPL) poised to benefit from more open payment systems.

Omada Health Debuts on Nasdaq

Virtual chronic care provider Omada Health ($OMDA) launched its IPO with a market valuation exceeding $1 billion. The company raised $150 million, reflecting strong investor appetite in the digital health space.

Growth Stock to Watch: Consider exploring digital health innovators and virtual care providers, such as Teladoc Health ($TDOC), which could see correlated gains as the sector expands.

Russia and China Monetary Policy Moves

Russia’s central bank has reduced interest rates for the first time since 2022, paving the way for stronger economic activity.

Meanwhile, China continues to pursue AI advancements, with reports of highly accurate AI-driven torpedo systems and refinement in consumer AI tools.

Growth Stock to Watch: For investors following the AI space, Nvidia ($NVDA) and AMD ($AMD) remain strong contenders to capitalize on global advancements in cutting-edge AI development.

Microsoft ($MSFT) Innovates AI Training Efficiency

Microsoft revealed a groundbreaking update to AI training processes, reducing fine-tuning time by 65% while maintaining quality outputs. This leap forward in efficiency underlines Microsoft’s continued leadership in the AI field.

Growth Stock to Watch: Evaluate AI-centric stocks such as Alphabet ($GOOGL) and Amazon ($AMZN), particularly given their AI contributions like Amazon’s collaboration on text-to-image AI systems.

Sector Watch

Energy: Chevron ($CVX) and ExxonMobil ($XOM) remain staples amid fluctuating global energy demands. Watch for potential policy impacts in U.S.-China trade negotiations.

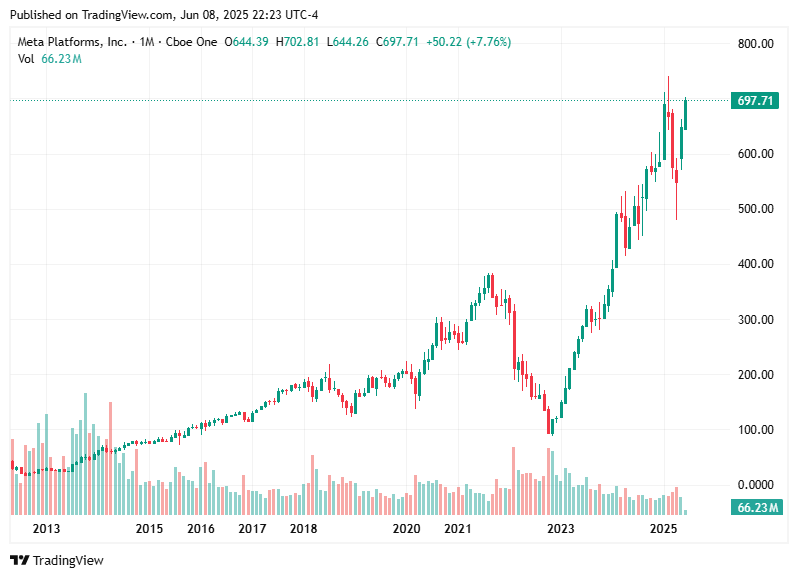

Technology: Continued emphasis on AI innovation benefits leading players like Meta ($META) and semiconductor stocks like ASML ($ASML).

Healthcare: Innovations in digital care and new IPOs spotlight growth opportunities for health-tech equities.

Despite ongoing global uncertainties, the U.S. stock market exhibits resilience, buoyed by robust payroll data and a steady unemployment rate of 4.2%. Anticipate sustained sector-driven growth in technology and healthcare, but remain cautious due to geopolitical risks and evolving central bank policies worldwide.

Key Benchmarks:

S&P 500 (SPX): 4,460.12 (as of the last close)

Nasdaq Composite (COMP): 13,880.62 (+2.63% over the past week)

Dow Jones Industrial Average (DJIA): 34,321.09 (+1.12% over five sessions)

Stock Region remains committed to bringing you timely, actionable insights into the market. Stay tuned for updates on major developments like U.S.-China trade talks and advancements in AI innovation.

Thank you for being a valued Stock Region subscriber. Follow us on [social media links] for real-time updates and insights.

Disclaimer: All material in this newsletter is for informational purposes only and does not constitute investment advice. Always consult a financial advisor before making any trading or investment decisions. All investments involve risks, including loss of principal.

Stock Region © 2025 All Rights Reserved